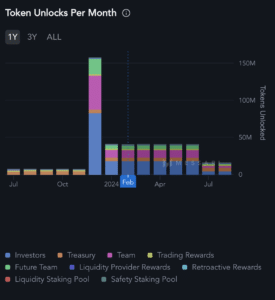

The unlocked supply of the native cryptocurrency for decentralized exchange dYdX is poised to increase by 33.33 million tokens by Friday, data from blockchain intelligence platform Messari shows. This forthcoming unlocking event is estimated to be valued at roughly $116 million.

The soon-to-be unlocked tokens will be allocated to three parties. Investors will receive 18.48 million DYDX, more than half of the entire unlocked tokens. The team is allocated 10.18 million tokens, with the remaining 4.66 million set for future employees, according to Messari and tokenomics dashboard TokenUnlocks.

Read More: DYDX Token to Become the Native Asset for dYdX Chain on Cosmos

The decentralized crypto exchange, widely known for its perpetual trading, regularly conducts token unlocks. For example, dYdX saw its unlocked supply increase in January by about 41 million tokens (worth about $142 million) and in December, roughly 158 million tokens worth about $545 million were unlocked, per Messari.

Read More: dYdX Becomes Open Source as It Transitions to Cosmos-Based Blockchain

What Is Token Locking For?

Numerous blockchain protocols use token locking or vesting mechanisms to deter substantial selling during the initial project phases, thereby averting an influx of these tokens into the open market. This is also a common practice in traditional finance as well, but instead of tokens, shares are locked or vested.

Token unlocks refer to the gradual process of releasing previously restricted tokens into circulation, granting holders such as early team members or investors the flexibility to deploy their tokens as desired. This may include selling tokens on the market or engaging in decentralized finance protocols.

While token unlocking events typically cause downward pressure on a cryptocurrency’s price, DYDX has increased 1.6% in the past 24 hours and nearly 12% in the past seven days to $3.48 at press time, according to CoinGecko.

Holders of the native token for the crypto exchange of the same name can participate in the governance process as well as stake their DYDX to contribute to the security of the network’s consensus process.