DWF Labs is willing to deploy capital into memecoins, a possible sign of the contagious fever the memecoin craze has brought to retail traders and institutional firms.

On Tuesday, the managing partner for investment firm and market maker DWF Labs, Andrei Grachev, wrote on X, “We are in talks with a few memecoins and willing to deploy a large amount of funds in order to let them grow faster and efficient.”

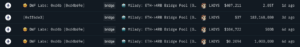

As of presstime, DWF Labs already has onchain activity connecting it to LADYS, the memecoin of the Milady NFT ecosystem. One particular wallet address belonging to DWF Labs, 0xd4b, has received six-figure-dollar sums of the Milady memecoin (LADYS) and bridged all of its received LADYS tokens worth over $500,000 to the less costly layer 2 blockchain network Arbitrum over the past six days.

Analytics firm Lookonchain also spotted earlier in the afternoon that a separate DWF wallet address (0x53c) had transferred $5 million USDT to a Milady multisig signer.

While the entire crypto market has shrunk 2% in the past 24 hours, LADYS has increased 22.7% in the same period and 90.7% in the past seven days to a market cap of $242.5 million, per CoinGecko.

Liquid Markets, DWF’s platform for over-the-counter trading, listed LADYS alongside rival memecoin FLOKI in March 2024.

Grachev’s statement on the social media platform and DWF’s onchain activity comes as memecoin ecosystems on various blockchain networks are thriving. Some Ethereum-based memecoins, such as frog-inspired PEPE, have posted all-time highs in the past week, while Solana protocols catered to memecoin enthusiasts are attracting celebrities such as hip hop artist Rich the Kid and Olympic gold medalist Caitlyn Jenner using Pump.Fun.

The willingness of DWF Labs, widely known for its market making services, to deploy funds toward memecoins in an effort to nurture growth is not the first time a financial institution has dipped its toes into the memecoin arena. For example, a non-profit for the Avalanche blockchain – Avalanche Foundation – gained exposure in March to five different memecoins native to Avalanche.

Read More: Avalanche Foundation Reveals Its 5 Initial Memecoin Holdings

DWF, which has an onchain portfolio of over $47.7 billion, per Arkham Intelligence, is one of the largest accounts on centralized exchanges. Since the beginning of 2024, DWF Labs has deposited $147.24 million into exchanges and withdrawn $211 million from them, data from blockchain analytics firm Arkham Intelligence shows.

Binance is the top exchange for deposits, accounting for $81.90 million or 56% of total DWF Labs deposits into exchanges and is the second most-used exchange for withdrawals. DWF Labs has withdrawn $90.63 million from Bitfinex and $74.67 from Binance since Dec. 31,

The Wall Street Journal reported earlier this month that a former staff member of Binance’s market-surveillance team was fired after completing an internal investigation that found evidence of DWF manipulating markets on the exchange.

DWF did not respond to Unchained’s multiple requests for comment.