June 21, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- After freezing withdrawals, Babel Finance reached an agreement to repay some of its debt.

- Solend DAO’s controversial governance decision (covered in yesterday’s newsletter) was invalidated after a follow-up vote.

- Crypto exchange Bybit plans to reduce its workforce.

- South Korea is blocking current and former Terra developers from leaving the country.

- Iran will cut power supply to crypto miners in order to reduce electricity demand.

- A new documentary was released accusing the Bored Apes NFT collection of having a Nazi culture.

- People mock protested against NFTs at NFT.NYC, in a publicity stunt for Adam Bomb Squad.

- DeFi protocol Bancor pauses Impermanent Loss Protection due to “hostile market conditions,” putting the blame on Celsius in a Twitter Spaces.

Today in Crypto Adoption…

- The UK government reverses course; decides not to collect personal information from private wallets.

The $$$ Corner…

- Astaria, an NFT lending platform, raised $8 million.

- Admix, a gaming company, merged with LandVault and reached a $300 million valuation.

What Do You Meme?

What’s Poppin’?

ProShares Launches a Short Bitcoin ETF

By Juan Aranovich

ProShares, an investment product issuer, announced yesterday that they would be launching a new exchange traded fund that will allow investors to bet on the Bitcoin price going down or to hedge cryptocurrency exposure.

The ETF is called ProShares Short Bitcoin Strategy (Ticker: BITI) and will be listed on the NYSE starting today, Tuesday 6/20. It is meant to “avoid the significant costs and fees typically required to short bitcoin”, as said on the ProShares website.

Having an ETF to go short on Bitcoin has many advantages over the current alternatives, like buying futures and put options. The ETF will make it possible to operate it through a traditional brokerage account, so investors will not require a futures or options account. Also, it will not require the user to potentially add new funds to maintain margin levels. Lastly, as it is an ETF, there’s no chance to lose more money than what you put in.

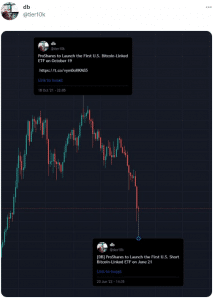

ProShares had been the first company to list a Bitcoin futures ETF in October last year, and is now the largest provider of bitcoin-linked ETFs in the United States. At that time, BTC was trading at around $60,000. The launch of that first futures ETF was very near to BTC’s all time high ($68,789). Users on social media joked that, since the long ETF seems to have marked the top, this new short ETF could potentially mark the end of the bear market.

Others did not take the news very well, and are still clamoring for the spot ETF to be approved by the SEC. “So there’s now a SHORT Bitcoin ETF, a Futures ETF, a closed end fund trading at a 30%+ discount, a 401K option for Bitcoin, but NO Spot ETF. It is clear that Gary Gensler and the SEC have an agenda against Bitcoin,” tweeted Bitcoin analyst Will Clemente.

Recommended Reads

1) Interview with Vitalik and his dad on Fortune:

2) Grant Stenger on what is the point of crypto:

3) “History is not on the side of the crypto’s grave dancers” by Simon Black:

On The Pod…

Caroline Pham, commissioner at the Commodities Futures Trading Commission, discusses how we should build a regulatory framework for crypto assets, whether the SEC and CFTC should work together, what were the consequences of the Terra collapse, and much more.

Show highlights:

- how Cmr. Pham got started in crypto and became a CFTC commissioner

- the importance of the regulatory strategy around crypto

- what crypto’s role is in the financial system

- how bitcoin is a sort of money outside of the traditional financial system

- how friendly regulators should be with the industries they regulate

- why she believes transparency is one of the greatest ideals of American democracy

- how Cmr. Pham believes in self-determination and the power of free markets

- why Cmr. Pham published an op-ed with SEC Commissioner Hester Peirce

- how the Terra collapse incentivized regulators to look deeper into the space

- whether the US approach towards regulation can improve

- the role of the regulatory agencies in making the US the financial leader of the world

- what Cmr. Pham thinks about the new Gillibrand and Lummis bill

- whether SEC Chair Gary Gensler is right about the majority of cryptos being securities

- what are the low-hanging fruit opportunities for regulators when it comes to crypto

- how Cmr. Pham believes we should have a global regulatory framework for crypto

- why she believes algorithmic stablecoins are derivatives

- why things like Terra could act as a “shadow banking 3.0”

- whether there is a way to regulate without having intermediaries

what Cmr. Pham thinks about FTX proposal to bypass futures commission merchants

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians