May 27, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

SEC Commissioner Gary Gensler said DeFi ‘platforms raise a number of challenges for investors and the SEC staff trying to protect them”

-

Ledn, a crypto lender, raised $30 million in a Series A

-

PayPal is working on allowing customers to withdraw crypto holdings

-

Apple is seeking crypto experience for an ‘Alternative Payments’ job posting

-

Nebraska Governor signed a bill allowing for state-level crypto banks

-

The Blockchain Technology Coordination Act was re-introduced on Tuesday

-

Chia Network, a blockchain payments company, is eying an IPO; the company recently announced a $61 million Series D

-

The SEC started its review of the SkyBridge and Fidelity bitcoin ETFs

-

BlackRock CEO Larry Fink said, “The firm has monitored the evolution of crypto assets. We are studying what it means, the infrastructure, the regulatory landscape.”

-

Blockchain development platform Reach raised $12 million in seed funding

- Fidelity’s Wise Origin Bitcoin Fund raised $100 million+ from 83 investors in the first nine months

What Do You Meme?

What’s Poppin’?

A Nashville couple is suing the IRS over how their rewards for staking on the PoS blockchain Tezos were taxed.

In 2019, the couple engaged in staking, receiving 8,876 new Tezos tokens in return for validating the network. However, during 2019, the couple did not sell or exchange any of their tokens.

The couple initially reported the rewards as income in 2019, totaling $3,293, as the IRS had yet to issue specific guidance on how to report staking income.

The couple, Joshua and Jessica Jarrett, is now requesting a refund matching that $3,293.

The lawsuit is centered on the idea that newly created property is not considered income under US tax law until it is sold, with Joshua adding, “Like any property, cryptocurrency tokens can be income when they’re received as payment or compensation. But these newly-created tokens are like crops harvested by a farmer — which are not taxed until they are sold.”

With Ethereum planning to transition to proof-of-stake, this is definitely a lawsuit to keep an eye on.

Recommended Reads

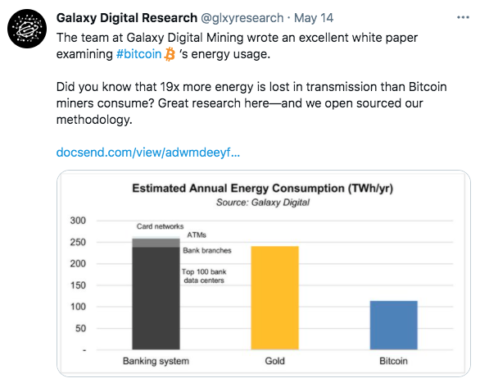

- Galaxy Digital on Bitcoin’s energy consumption:

- A few poignant insights on the current landscape of the crypto VC space:

- 5 months of Bitcoin good news in one thread:

On The Pod…

June 14th is the 5-year anniversary of Unchained. 🎉

On Tuesday, June 15th, we’ll publish a 5-year anniversary episode with questions or messages from you listeners to me.

- record a video or audio message of 60 seconds or less stating your name, where you’re from and your question or message.

- email it to hello@unchainedpodcast.com with “anniversary” in the subject line (or just respond to this email)!

The deadline to get your submissions in is Thursday, June 10 by 5 pm ET/2 pm PT.

Thanks so much for supporting Unchained all these years! 🙏

Check out the latest episode of Unchained:

How Solana and Binance Smart Chain Could Take Ethereum’s Lead

Kain Warwick, founder of Synthetix, and Kyle Samani, managing partner at Multicoin Capital, debate the merits of Ethereum, Solana, and Binance Smart Chain. In this episode, they discuss:

-

why Ethereum is losing market share to Solana and BSC

-

whether decentralization matters and at what point decentralization becomes redundant

-

why they think Solana and Binance Smart Chain need to be taken seriously as competitors to EThereum

-

whether BSC or Solana is the bigger long-term threat to Ethereum

-

the biggest obstacle to Ethereum’s success (and it’s not gas fees)

-

how Ethereum will navigate fragmented Layer 2 solutions

-

Solana and its lack of developers

-

what differentiates DeFi from CeFi

-

why Solana has an edge on Ethereum in terms of composability

-

how Ethereum will onboard new users

-

why Kain is such an ardent backer of Ethereum

-

why both Kyle and Kain think EIP 1559 and the potential for higher ETH prices is bad for Ethereum

-

if Synthetix would ever consider launching a cross-chain product

-

the viability of a multi-chain world

-

why Kyle believes the future holds a winner-take-most blockchain ecosystem

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians