DeFi is poised to be the principal catalyst of the next bull run, outpacing non-fungible tokens (NFTs), which soared in 2021, according to a report published on Thursday by on-chain intelligence firm Flipside Crypto.

Decentralized finance (DeFi) is a distinct sub-sector within the crypto ecosystem designed to allow users to conduct financial transactions such as lending, borrowing and trading without the need for intermediaries.

Flipside’s optimism for the strength of DeFi was based on an analysis of its popularity last year. DeFi was the primary force behind the growth of the crypto space in 2023 as the majority of acquired users and super users were opting for DeFi-related activities over trading non-fungible tokens (NFTs).

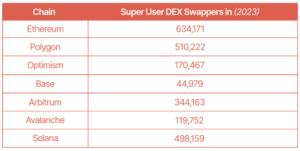

In its Onchain Crypto User Report, Flipside Crypto defined an “acquired user” as an address that has conducted a minimum of two transactions, with the second transaction occurring in 2023, and a “super user” as a 2023 acquired user who has executed over 100 total on-chain transactions over their lifetime.

Across all observed chains — Ethereum, Polygon, Optimism, Base, Arbitrum, Avalanche, and Solana — swapping on decentralized exchanges was the most frequent activity among super users in 2023, the report stated. Flipside also noted that “DeFi drives the most cross-chain activity among EVM users… Interacting with DeFi protocols across multiple chains brings with it the possibility of additional incentives.”

“As the next bull run approaches, DeFi-related activities such as DEX trading and yield farming will continue to dominate overall on-chain activity,” Flipside projects.

“My interpretation of the report overall is DeFi leads and NFTs follow,” Carlos Mercado, a data scientist at Flipside Crypto, said to Unchained in an interview. Memecoins, NFTs, decentralized autonomous organizations (DAOs), governance, and “all that culture stuff is just getting more integrated in DeFi.”

“You don’t have an NFT anymore, you have to be able to stake that NFT. It’s not just a governance token anymore, you have to stake that governance token. And it’s not just a memecoin, you have to be able to borrow and lend against the memecoin, you gotta make it a perpetual. Everything that’s culture, DeFi is absorbing,” Mercado added.

Decentralized exchange Uniswap and lending protocol Aave — two titans in the DeFi space — generated an average of about $1.9 billion and $1.1 billion in fees for the seven days from Jan. 17 to 24, respectively, according to cryptofees.info.

While less than Ethereum’s seven-day average of $7.1 million and Bitcoin’s $3.6 million, the two DeFi giants have each generated more in fees on a seven-day average than other blockchains such as BNB Chain, Arbitrum, Optimism and Polygon, data from cryptofees.info shows. The combined value of these four chains’ seven-day average fee is less than $1 billion.

Flipside is not the only crypto watcher bullish on DeFi. “Eventually blue-chip DeFi will flip L1s in fees,” wrote Aave founder Stani Kulechov on Jan. 18 in X.