In the wake of the recent Curve crisis, Sam Kazemian, founder of Frax Finance, emphasized the need for greater autonomy within Decentralized Finance (DeFi). His comments come at a critical juncture as the DeFi community grapples with the fallout of the Curve attack, an incident that exposed systemic risks and raised questions about the resilience of the DeFi ecosystem.

The Curve attack, triggered by a vulnerability in certain Curve pools using the Viper programming language, led to a significant drop in the price of the protocol’s native token CRV. This put Curve Finance founder Michael Egorov’s large borrowing position at risk of liquidation. The situation was resolved through a series of over-the-counter (OTC) deals, where Egorov sold a portion of his CRV tokens to prominent figures in the crypto space, including Justin Sun. This allowed him to repay a significant portion of his debt and stabilize the situation.

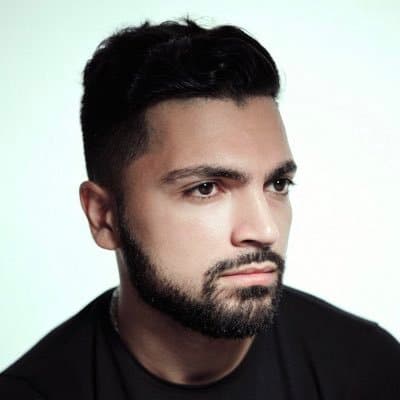

The necessity of these OTC deals underscored the limitations of the current DeFi lending systems. Kazemian argued that if these systems were more autonomous and incorporated innovations like Fraxlend’s time-dependent interest rates, such manual interventions would not be necessary. “We need more DeFi stuff that’s similar to Uniswap,” he stated, emphasizing the need for autonomous, self-regulating systems that can withstand such shocks.

Kazemian also addressed the lack of innovation in DeFi lending markets, highlighting FRAX’s efforts to introduce a new lending model with isolated elements and innovative types of interest rates. One of these innovations is dynamic restructuring, a feature that prevents bad debt. Kazemian explained, “With dynamic restructuring, there can’t be bad debt. If there’s a liquidation, it gets socialized. So no one needs to run towards whatever’s left and then kind of brick the pool for what’s remaining for everyone.”

Addressing the compiler issue that led to the Curve attack, Kazemian acknowledged its severity. He noted that such issues discourage developers from experimenting with languages other than Solidity, the dominant language for writing smart contracts in the Ethereum network. However, he expressed optimism that the Viper language, implicated in the Curve attack, could become more robust with increased security audits and attention in the aftermath of the crisis.