+ DeFi getting more love from traders than Bitcoin!

Big news this week, as the Office of the Comptroller of the Currency gave US banks the authority to custody crypto. This definitely seems it can be attributed to the fact that the currency acting Comptroller is Brian Brooks, the former chief legal officer of Coinbase. It also marks a turnaround for the crypto industry and its relationship to banks, who have long shunned the industry, making it difficult for even VC-backed firms to find and maintain banking relationships. Meanwhile, as Ethereum 2.0 gets closer, an analysis finds out what will be needed to keep it secure, and as DeFi continues to take off, traders who love Bitcoin’s volatility have been turning their sights on DeFi tokens. Plus, we get some good analyses of the rise in automated market makers such as Uniswap, Curve and Balancer, and also a dissection of how an engineered attack was behind the MakerDAO liquidations that occurred for $0 on Black Thursday. Finally, find out everything about YFI.

On the podcasts, The Defiant founder and author of the Infinite Machine Camila Russo discusses the highlights from her book, The Defiant, crypto media and more, and on Unconfirmed, Haseeb Awan talks about his dealings with the Twitter hackers.

Hi everyone, thanks for tuning in to this week’s news recap!

This Week’s Crypto News…

US Bank Regulator Grants Banks Authority to Custody Crypto

The Office of the Comptroller of the Currency (OCC) published a letter that effectively allows national banks in the US to provide cryptocurrency custody services. Acting Comptroller Brian Brooks, former chief legal officer of Coinbase who took office less than two months ago, said, “This opinion clarifies that banks can continue satisfying their customers’ needs for safeguarding their most valuable assets, which today for tens of millions of Americans includes cryptocurrency.”

The announcement marks a significant shift in the relationship between the US banking sector and the crypto industry. As Caitlin Long, Founder and CEO of Avanti Bank & Trust, said in a tweet thread, “GAME ON! The @USOCC ‘s announcement that it’s following Wyoming by allowing national banks to custody digital assets is GREAT news for crypto! Long overdue & hopefully will help U.S. regain ground it lost to other developed world countries by dilly-dallying for so long. Winners=customers & crypto VCs.” She says this will spur M&A boom as US banks acquire #digitalasset custodians, because trust co. charters and the BitLicense are now obsolete.”

Also, CoinDesk reports that Avanti Bank, which Long is founding, will be opening its doors in October and will issue a new digital asset called Avit that will likely use the Bitcoin blockchain.

Will Ethereum 2.0 Be Easier to Attack Than Ethereum 1.0?

As Ethereum moves to the Proof of Stake Incentive Model with ETH 2.0, researchers at Consensys have published a detailed review of its network economics.

In the authors’ assessment:

- Ethereum 2.0’s Proof of Stake is highly complex relative to Proof of Work

- Security of the network in Ethereum 2.0 is dependent upon three key variables: ETH staked, the price of ETH, and volatility

- Attacks on Ethereum 2.0 are easier to scale than on Ethereum

- Derivative attacks, in which attackers make money by, for instance, shorting using any of the proliferating types of ether derivatives, could become common

Stefan Coolican from Ether Capital put out a thesis which says that Staked ETH would be like a digital bond with no counterparty risk. He writes, “Staked ETH gives you yield at the protocol level and not via a counterparty. Staked ETH is therefore an intrinsic yield instrument. For the first time ever you can compound your ETH holdings organically without assuming any counterparty risk.”

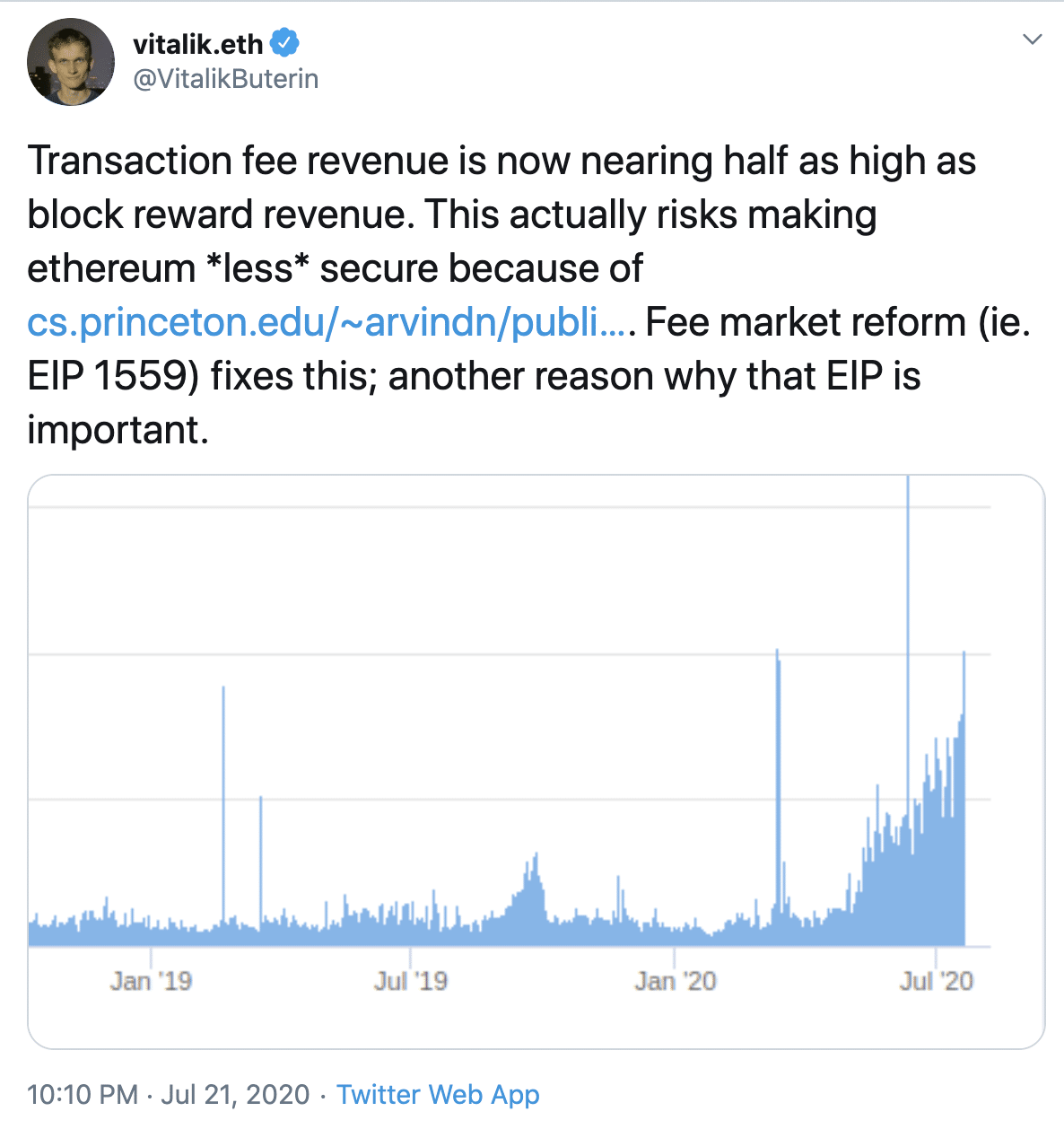

In a separate tweet, Vitalik Buterin highlighted that “Transaction fee revenue is now nearing half as high as block reward revenue. This actually risks making ethereum *less* secure”. Fee market reform (ie. EIP 1559) fixes this; another reason why that EIP is important.”

China’s State-Backed Blockchain Network Integrates with Six Public Chains

In a bid to dominate the blockchain infrastructure space globally, China has integrated its state-backed Blockchain-based Service Network (BSN) with six public chains which include Ethereum, Tezos, NEO, Nervos, EOS and IRISnet. The partnership will allow developers on these blockchains to build dapps and run nodes using data storage and bandwidth from BSN’s overseas data centers. The networks could benefit from BSN’s cost-effective services and access to Chinese enterprise blockchain networks and financial data from China UnionPay, which is usually difficult to obtain for entities outside the country.

Elsewhere in Asia, South Korea has finalized its plan to charge a 20% tax on income generated from cryptocurrency transactions for people with an annual income of more than 2.5 million won (~$2,000) from crypto trading.

Visa and Mastercard Expand Crypto Efforts

In quite a turnabout from last year when Visa and scads of other payment companies left the Libra Association, this week, the credit card giant published a new outlook on digital currency payment flows and stated that the company has been advancing and evolving its digital currency strategy for quite some time. Visa writes, “We believe that digital currencies have the potential to extend the value of digital payments to a greater number of people and places. As such, we want to help shape and support the role they play in the future of money.” Mastercard also announced “the expansion of its cryptocurrency program, making it simpler and faster for partners to bring secure, compliant payment cards to market.”

With Bitcoin Volatility Hitting Record Lows, Traders Turn to DeFi

Folks from traditional finance usually scoff at Bitcoin’s volatility. However, over the last few weeks, Bitcoin’s price has been stuck within a tight range, with its 60-day rolling volatility hitting a 15-month low last week.

Traders have now turned to DeFi tokens while reducing exposure to large-cap cryptos such as Bitcoin and Ethereum. More than a billion dollars has been locked up in lending protocol Compound, fueled by “yield farming.” Traders are also capitalizing on the derivatives market and using options to generate yield in a less volatile market.

FTX CEO Sam Bankman-Fried put things into perspective in a tweet thread where he analyzed the volume, noting that a lot of the activity is simply traders locking up, lending and trading stablecoins with each other. They’re being incentivized to do so by governance tokens, whose values go up as total locked value goes up. He said it’s similar to “transmining” or transaction fee mining, which was a fad two years ago, but decentralized. He asks whether this is smoke and mirrors or a brilliant growth strategy, and then tells the story of two exchanges — FCoin and BitMax, in which both start off with high volumes from transmining. However, he says that after they turned off their transmining, FCoin was left with nothing, whereas BitMax, he says, QUOTE “successfully combined the userbase they got with an increasingly great product.” He concludes, “Just because someone made a great marketing play doesn’t mean there isn’t substance.”

If you want to know more about yield farming, check out my Unchained podcast episode with Dan Elitzer, investor at IDEO CoLab Ventures, and Will Price, data scientist at Flipside Crypto, where we discuss this craze.

Understanding the Rise of Automated Market Makers

Dragonfly Capital’s Haseeb Qureshi wrote a great analysis of the explosion in automated market makers (AMMs), driven in part by the rise of Uniswap. He described an automated market maker as QUOTE, “a primitive robotic market maker that is always willing to quote prices between two assets according to a simple pricing algorithm … For Uniswap, it prices the two assets so that the number of units it holds of each asset, multiplied together, is always equal to a fixed constant.” The way this works, is that if the constant is 50 apples and 50 bananas is one Uniswap pool, the constant between them will be 2500. If someone wants to buy one apple, the pool will only have 49 apples, but since the constant has to remain 2500, she needs to pay with 51.02 bananas. Uniswap descendants such as Curve and Balancer are a bit different: Curve uses a mixture of constant product and constant sum while Balancer, which has pools of more than just two tokens, is defined by a multi-dimensional surface. The post goes on to explain why constant function market makers will win the stablecoin trading market and why Uniswap has been a success but why its dominance won’t last forever.

Qureshi’s post dissects Uniswap closely, but for those interested in a more complex constant function market maker such as Balancer, Placeholder Capital wrote up a blog post on its Balancer investment thesis, explaining the possibilities with pools of more than two assets, which include community governed-pools, surge pricing pools whose fees rise when demand is high, or rollover pools that issue perpetual tokens from assets that typically expire such as bonds.

Mempool Manipulation Resulted in the Theft of $8M in MakerDAO Collateral on Black Thursday

A new report by Blocknative revealed that manipulation of Ethereum’s mempools enabled attackers to steal $8.3 million from MakerDAO users on Black Thursday, March 12th, when the price of ETH fell 43% within hours, triggering liquidations of the collateral held on the MakerDAO lending platform. Some savvy traders took advantage of the congestion on Ethereum to send in bids of $0 to liquidate some collateralized debt positions on MakerDAO, thus walking away with ETH, for free. I covered this with Kyle Samani of Multicoin Capital on an episode of Unchained and with Antoine Le Calvez of Coin Metrics on Unconfirmed.

According to Blocknative’s research, the MakerDAO liquidations were an engineered event that took advantage of an issue involving evicted transactions, in which nodes, to preserve system resources, evict the transactions with the lowest fees. Blocknative writes, “When a transaction is evicted, the node does not remember any details about the transaction, such as the sending address or the transaction nonce. Therefore, when a new transaction arrives with the next nonce, the node may detect a nonce gap and will be unable to process the new transaction. Impacted transactions are then placed in the unprocessable Queued portion of the node’s mempool. These transactions become stuck regardless of their associated transaction fees (that is, gas prices).”

Blocknative discovered the use of so-called “Hammerbots,” which waited until their own transactions had been evicted from the mempool and then sent replacement transactions not with higher gas fees, but the same or lower gas fees, thus clogging the network further.

The post walks us through an example in which a zero-bid bot submitted a zero bid at 15:59:50 UTC with a gas price of 200 Gwei. This began a 10-minute countdown clock in which a Keeper bot could counter bid the transaction. One did within that window, with a gas price of 450 Gwei — two and a half times the gas price of the original bid. However, because of a nonce gap created by an earlier evicted bid, this bid was blocked, and someone walked off with some ETH they got for nothing.

What’s the Big Deal With YFI?

A new governance token called YFI is all the rage among yield famers. YFI is the governance token for Yearn.Finance, which automatically moves traders’ assets in and out of different liquidity pools in search of the best yields. Yearn’s creator, Andre Cronje, writes in a blog post, “In further efforts to give up this control (mostly because we are lazy and don’t want to do it), we have released YFI, a completely valueless 0 supply token. We re-iterate, it has 0 financial value. There is no pre-mine, there is no sale, no you cannot buy it, no, it won’t be on uniswap, no, there won’t be an auction. We don’t have any of it.” That hasn’t stopped it from trading as high as $2,374. Curve founder Michael Ogorov told CoinDesk, “Since YFI had no investors and ALL tokens are going to liquidity providers, everyone [became] very crazy about it and it all exploded.”