Crypto loves a good fad. In 2017 it was ICOs. The summer of 2020 brought DeFi tokens. Then came NFTs in 2021 and memecoins over the last two years.

This year, the fad is crypto treasury companies. These firms are following the playbook launched by Strategy chairman and former CEO Michael Saylor, whose firm currently owns 580,250 bitcoin worth $60 billion, but has a market capitalization of $102.4 billion. Put another way, the firm is trading for 1.7x the value of its bitcoin.

In the last few weeks alone Twenty One, created by SoftBank and Tether, launched via a Cantor Fitzgerald SPAC with $685 million in capital to buy bitcoin. Nakamoto, founded by Bitcoin Magazine’s David Bailey, merged with a publicly traded medical firm, raising $710 million to buy bitcoin. And not to be outdone, Trump Media & Technology Group raised $2.44 billion last week for the same purpose. Now these types of companies are even expanding beyond bitcoin. Three firms have launched to focus on Solana, and just last week, another, SharpLink Gaming, announced plans to raise $1 billion to become an Ethereum holding company, while VivoPower raised $121 million to launch an XRP treasury company.

Read More: Michael Saylor Copycats Rush to Win the Solana Rat Race. Can Lightning Strike Twice?

But numerous crypto OGs are warning this is creating systemic risk for the industry.

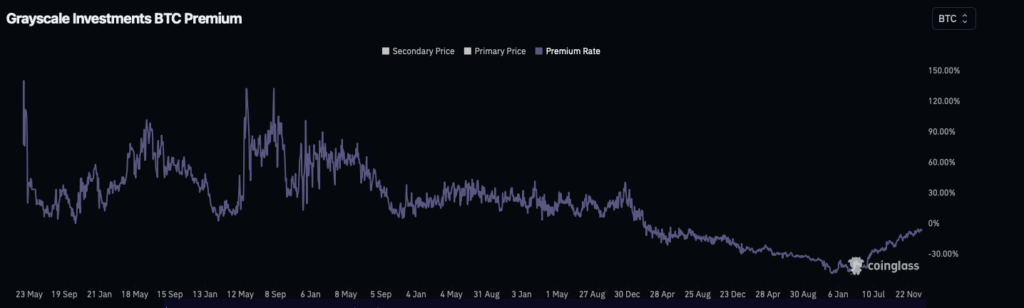

Nic Carter, partner at Castle Island Ventures, compared these publicly traded investment vehicles to GBTC, which had for years traded at a premium. The flipping of that premium to a discount precipitated the 2022 collapses of key crypto firms and projects like Terra/Luna, Three Arrows Capital, Voyager, Celsius, BlockFi, and of course FTX. Commenting on a VC firm’s blog post about investments in these treasury companies, Carter said, “It’s like writing a blog post in 2021 saying we think the GBTC trade will last forever.”

Mike Ippolito, co-founder of Blockworks, called these treasury companies “the 2025 equivalent of GBTC,” adding, “I have no idea if these vehicles will achieve that level of scale and destructive potential, but make no mistake, this is leverage getting injected into the system. To spell out the risk, it’s that these acquisition vehicles accumulate a lot of crypto at much worse terms than Saylor and eventually become forced sellers.”

Could these crypto treasury companies create the next big systemic risk in the system? If so, how would that risk and any subsequent collapses play out?

“We look for risk when we want additional returns, and right now we’re still early in the cycle,” says Noelle Acheson, editor of the Crypto is Macro Now newsletter and the former head of market insights at Genesis Trading, one of the companies that fell victim to GBTC’s collapse. “We know that will change and people will go way out on the risk curve because they can. We can say people do forget, but I don’t think it’s that. They just don’t think that it’s going to happen to them this time.”

Why Everyone’s Eyes Are on the Premiums

Why is this the trend du jour? Ever since then-presidential candidate Donald Trump embraced bitcoin back in July 2024, the asset has been on a tear. Currently priced at $104,968, it is just a hair away from its all-time high of $111,814. With now-President Trump going full orange pill — he is creating a national Strategic Bitcoin Reserve and his son Eric is the chief strategy officer for a bitcoin mining company — why wouldn’t people try to find ways to get additional exposure to bitcoin?

One reason could be that these companies are creating a house of cards or pyramid scheme on the back of retail investors. In the same post on X, Nic Carter wrote, “You can harvest retail for a bit but there’s no value creation your fundamental premise here is ‘sometimes people will buy $1 for $1.5 for no apparent reason we think this can last forever.'”

The industry claims to be more responsible today, but the eye-watering premiums already being attached to stock prices and the need for these firms to continue to find ways to outperform bitcoin’s already impressive gains this year creates a dangerous risk-taking environment. It is not hard to imagine these firms taking on excessive or dangerous levels of leverage, which could harm the entire industry.

Read More: U.S. Treasuries Are Ailing Due to Tariffs, but Tokenized Treasuries? Growing

After all, the efficient market hypothesis would dictate that at some point there would be a reversion to NAV, especially with so many companies entering the space. In fact, noted short seller Jim Chanos announced a couple of weeks ago that he is trying to effectuate this very result by shorting Strategy and going long on Bitcoin.

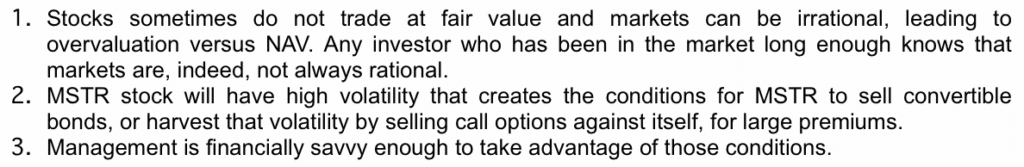

Any investor betting on one of these firms is expecting exactly the opposite to happen. Cosmo Jiang, general partner at Pantera Capital, wrote the following in an investor letter shared with Unchained in explaining his firm’s investment in companies like MSTR, DeFi Technologies Group, and others:

Put another way, investors will need to believe that the capital markets acumen of the leadership behind any of these firms, in what are irrational markets, can make the whole far larger than the sum of its parts. Saylor’s Strategy has been able to defy gravity by taking advantage of traders’ insatiable appetite for the convertible debt that it sells. “The arbitrage guys are absolutely eating it up,” said the senior vice president of trading at a prime broker who requested anonymity. “Strategy often sells their convertibles at what is equivalent to 20 to 30 volatilities lower than what the open options market is actually pricing for Bitcoin.”

But while Strategy has become a unicorn all to itself, many other firms have achieved premiums for little reason other than riding a wave of euphoria and being a first mover, especially in their home country.

According to Bitcointreasuries.net, dozens of companies now keep bitcoin on their balance sheet. Now, not all of them employ a similar approach to Strategy. Many are bitcoin miners, which produce the asset as part of their normal operations. But there are plenty of companies around the world that have fully embraced this approach, and their share prices are trading at multiples ranging anywhere from 1.118 (Semler Scientific) to 80.572 (Nexon Co. Ltd).

The three Solana-focused companies that own almost $300 million worth of the asset, which are trading at positive multiples as well, are Sol Strategies (5.25), DeFi Development Corp (2.90), and Upexi (3.74).

What will happen if or when these premiums start to slip? Will they take on additional leverage in an effort to bail themselves out? Say what you will about Strategy, but this is something that Michael Saylor has largely refused to do.

“There have been guardrails put in place [at Strategy] with regard to leverage for some time where the company is targeting leverage between 20 and 30%. And what we have seen recently is that Strategy is well below that,” says Mark Palmer, senior equities analyst at The Benchmark Company. “I think one of the big risks of some of these [companies] is that faced with competition, other crypto acquisition programs in the market, there’s going to be a temptation to use leverage as a means of driving potential upside.”

The Ghost of GBTC

Crypto watchers do not have to look very far back in history for a precedent in which a seemingly permanent premium quickly turned to a discount. In 2021, Grayscale’s Bitcoin Trust (GBTC), which was a perfect profit-making opportunity for savvy investors to dump on retail, switched from what was once a 120+% premium to a discount that reached as high as 30%.

While this reversal did not have to become a systemic problem, it is important to remember how the GBTC trade permeated the entire industry. For starters, because of bitcoin’s bullishness back at the time and the fact that newly minted shares at NAV were only available to wealthy investors, the industry saw it as an ultra-safe, durable, and highly profitable investment.

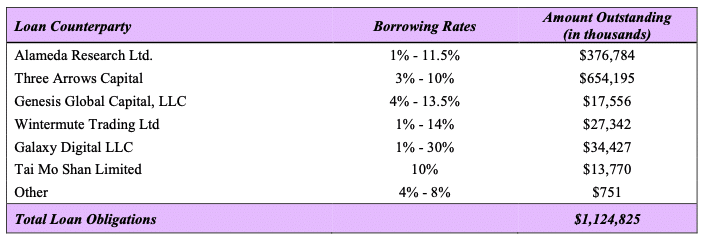

At one time, the Singaporean-based hedge fund Three Arrows Capital held as much as 5% of GBTC’s outstanding supply. It got that money from multiple places, such as pseudo banks like Voyager Digital, that were banking on the trade’s outsize profits to pay hefty interest rates to their own depositors. In fact, Voyager gave 3AC a $654 million uncollateralized loan, which it used for various investment strategies including GBTC.

At one point in time BlockFi also owned more than 5% of all outstanding GBTC shares and was also exposed to the asset by accepting it as a safe form of collateral for the loans it used to pay interest to depositors.

And these are just two of the many companies that found themselves wrong-footed when the GBTC premium flipped to a discount. Suddenly they found their books underwater and unable to meet all of their liabilities. This ultimately led them to freezing withdrawals and then declaring bankruptcy.

What Could Create Contagion

If the market reverses and premiums on these publicly traded treasury companies shrink, the industry could be impacted in a few ways. For starters, companies could be forced to liquidate crypto on their balance sheets to pay back loan obligations, assuming that they cannot refinance this debt. These massive sell walls could have a cascading effect on everyone else.

But the bigger concern is if or when trading desks and lenders begin to accept shares in these companies as collateral. Especially if it becomes unclear who owns what. After all, that is what caused the reversal in GBTC to become a systemic problem.

“The same way that during the financial crisis, it wasn’t necessarily the core housing instruments that were as much of a problem as was the fact that they were put into other instruments where the leverage was magnified and ability to understand who owned what was obscured,” says Palmer. “Until we see that landscape develop, it’s going to be difficult to really be able to gauge the extent to which the potential for contagion is there.”

Read More: DeFi Looping Comes to Apollo’s $1.3 Billion Credit Fund. What Could Go Wrong?

One advisor to a crypto treasury company who requested anonymity also pointed out that a growing trend of tokenizing equity could complicate things, especially if those tokenized treasury stocks end up being used as collateral at either centralized or decentralized lenders, even though ostensibly it should make it easier for outsiders to determine ownership. “If you start seeing more stocks trade onchain, who knows where it goes.”

The good news is that things are still early. In fact, according to the prime broker, most shops are not even accepting bitcoin ETF shares from the likes of BlackRock or Fidelity as collateral to extend margin, which are seen as much safer instruments. “My understanding is that in most cases the ETFs are not recognized as quality collateral or considered a marginable security by a lot of the primes. I’ve heard rumors that a few of the large primes are offering to their platinum TradFi clients very low margin on the ETFs, but doing it purely as a relationship trade.” The advisor to the crypto treasury company cited above also said that he has not seen crypto treasury shares being accepted as collateral.

Read More: Bitcoin ETFs Are on the Verge of Erasing Their 2025 Losses of 15%

But the prime broker also went on to say that it only takes one desk looking to make a name for itself to buck the trend, and they might see a crypto stock trading much higher than NAV as an attractive form of collateral. “If prime brokers start accepting these as marginable collateral and offering you considerable leverage on something that trades above NAV, even if there is let’s say a forward multiple reason for it, then the basis of that NAV is what puts you at risk.” Put another way, that trading desk better not be wrong about why that NAV exists and whether it is sustainable.

The crypto holding firm advisor agreed. “That’s where your contagion can happen. If shares are given to somebody as collateral and they have to start liquidating, you could put a lot of pressure on a stock to do that and therefore it can go into a discount rather than a premium.”