After a tumultuous few months, things could finally be looking up for crypto market proponents.

On-chain analytics platform Glassnode estimated that capital is flowing back into cryptocurrencies at a rate of $4.5 billion per month. These inflows have largely been concentrated in Bitcoin and Ethereum.

From this, we can estimate the net capital flows into the digital asset industry, considering most fiat comes in via $BTC, $ETH, or stables.

After a period of outflows since Apr-2022, capital is flowing back in at $4.5B/month, primarily into $BTC + $ETH.https://t.co/prfskVXCox pic.twitter.com/6yQpgVF5bx

— glassnode (@glassnode) February 22, 2023

Spending behaviour among investor cohorts suggests that investors expect upward swings in the market, said Glassnode analysts in the most recent edition of its newsletter. In particular, analysts noted an increase in short-term holder dormancy, which implies investors are spending older coins – typical of bullish rallies.

“Overall, this signals a reduction in sell-side pressure and a potential return of the ‘buy-the-dip’ mentality,” said the analysts.

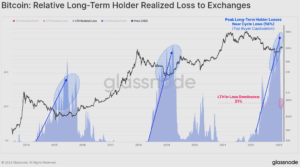

Meanwhile, the long-term holder cohort of investors, who have dominated the losses locked in by investors in the worst phase of the bear market, have been gradually increasing their dominance. Based on the realized value of coins sent to exchanges, long-term holders in loss have declined from a peak of 58% in mid-January to just 21% as of Feb. 20.

The change in investor behaviour could potentially signal that a new cycle is starting, said Glassnode. Moreover, Bitcoin’s price action around the $25,000 mark, despite increased regulatory pressure on digital assets, is a net positive for the industry, they said.

Market intelligence platform Santiment cautioned investors not to buy too much into the short-term recovery signs that have appeared in the crypto sphere. According to Santiment, markets move higher when traders are under water.

🧐 #Crypto returns are beginning to show signs of at short-term recovery the past 8 hours. But cautiousness is advised with average trading returns positive in 2023. Markets move up with the highest probability when traders' assets are under water. Currently, they're mildly over. pic.twitter.com/yihMj4HMrI

— Santiment (@santimentfeed) February 23, 2023

CryptoQuant’s Maartunn also believes that Bitcoin’s price is relatively higher than its corresponding on-chain metrics.

I'm sorry guys but #Bitcoin looks pretty heavy to me.

The price is still relatively high, while Net Taker Volume is deeply red🔴https://t.co/3R2BFFL0cD pic.twitter.com/KPVP95N4tn— Maartunn (@JA_Maartun) February 23, 2023

Based on the Bitcoin Taker Buy/Sell ratio, an indicator that measures buy volume versus sell volume, short-sellers are still largely dominating the leading digital asset’s daily trades.