July 28, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Binance reduced the withdrawal limit for non-KYC customers from 2 BTC to .06 BTC per day.

-

Code from a Robinhood test app would override certain trades to protect investors from volatility.

-

FTX Foundation Group has launched the FTX Climate Program, which has already purchased $1M in carbon offsets.

-

Stronghold Mining, a bitcoin mining firm based in the US, is looking to raise $100M in an IPO.

-

Over 3M unique addresses have interacted with DeFi protocols, marking 10X growth since July 27, 2020.

-

1inch, a DEX aggregator, plans to airdrop 10M tokens to DeFi users to refund high gas fees.

-

“Instead of leaving our financial system at the whims of giant banks, crypto puts the system at the whims of some shadowy, faceless group of super-coders and miners, which doesn’t sound better to me.” – Senator Elizabeth Warren

What Do You Meme?

What’s Poppin’?

Crypto fundraising is poppin’.

Ten projects combined to raise over $430M, as The Block’s Frank Chaparro pointed out on Twitter yesterday:

Most of yesterday’s funding went toward Fireblocks, a digital asset custody provider, which raised $310M a Series D that values the company at $2B, adding another company to the list of crypto unicorns.

A few other firms brought in substantial funding as well:

- Eco closed a $60M round led by Activant Capital and L Catterton to accelerate its “smart money” strategy.

- Valora, a mobile wallet for the Celo network, raised $20M in a Series A led by a16z.

- Lemon Cash, an exchange based in Argentina, announced a $16.3M Series A to expand to Chile, Colombia, Ecuador, Peru, and Uruguay.

- StormX, a crypto rewards app, secured $9M in funding with plans to launch a debit card later this year.

- Saber Labs, a Solana-based exchange, raised $7.7M, with participation from Chamath Palihapitiya’s Social Capital, among others.

The rest of the money was distributed evenly across a bunch of interesting protocols, companies, and platforms: Splinterlands ($3.6M), Hedgehog Markets ($3.5M), Lyra ($3.3M), and EthSign ($650,000).

Recommended Reads

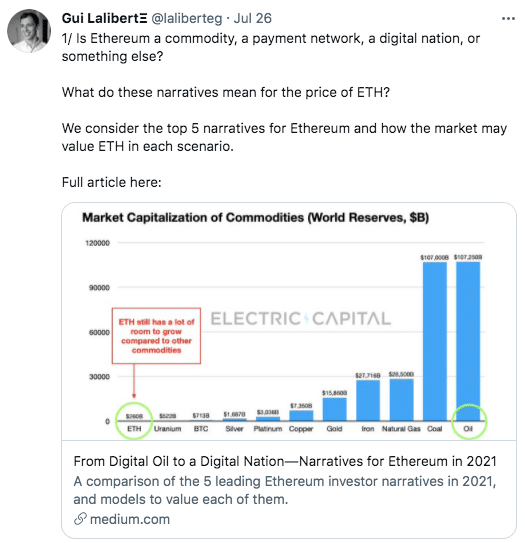

- Electric Capital’s Gui Laliberte on Ethereum:

- The Atlantic’s Talmon Joseph Smith on America’s investing boom:

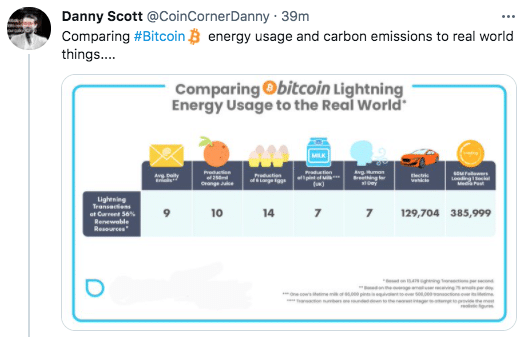

- CoinCorner released a report comparing Bitcoin’s energy usage to real-world things:

On The Pod…

Why ShapeShift’s Erik Voorhees Thinks Toxic Bitcoin Maximalism Is Bullshit

ShapeShift recently announced an intent to decentralize — a move that would transition the one-time centralized exchange to a full-on DAO. Erik Voorhees, founder and CEO of ShapeShift, comes onto the show to talk about decentralizing the exchange, along with his thoughts on Bitcoin maximalism and crypto regulation. Show highlights:

- why ShapeShift is decentralizing the company

- how ShapeShift used to work

- what needs to happen for ShapeShift to decentralize

- why user experience should not change during the transition

- how the FOX token works

- what parts of a company cannot be decentralized yet

- how ShapeShift’s forthcoming foundation will function

- how ShapeShift decided upon the allocations for the FOX token airdrop

- why ShapeShift employee and shareholder FOX tokens are locked up for three years

- what Erik’s role will be going forward

- how ShapeShift plans to attract devs

- why Erik believes FOX is not a security

- how Erik wants the SEC to handle crypto

- why he believes THORChain is one of the most critical projects in crypto

- why he is opposed to Bitcoin maximalism

- Erik’s thoughts on BitMEX’s and Binance’s regulatory issues

- what he thinks about stablecoin regulation

- Why Erik believes ShapeShift and Uniswap are not competitors

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians