June 1, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Singapore’s DBS bank priced its first tokenized bond ($15 million)

-

The Reserve Bank of India clarified that banks may no longer caution customers against crypto

-

Crypto exchange volume hit an ATH in May, crossing $2 trillion

-

5 million+ ETH have been deposited to Ethereum 2.0

- BTC had its second-largest monthly percentage decline in May

What Do You Meme?

The Bitcoin 2021 Conference is this week.

What’s Poppin’?

Yesterday, Marathon Holdings, a prominent Bitcoin miner, announced in a press release that the mining firm “will be updating all our miners to the full standard Bitcoin core 0.21.1 node, including support for Taproot.”

The announcement comes about a month into CEO Fred Thiel’s arrival at the company, where he appears to be taking the miner in a slightly different direction. Previously, Marathon had described itself as an OFAC compliant pool, meaning they would only mine blocks compliant with US regulations — excluding transactions associated with sanctioned addresses from the blocks it mined. Furthermore, not all of Mara Pool’s (Marathon’s mining pool) have signaled for Taproot activation, with half of the non-signaling blocks for Taproot coming from Mara this epoch.

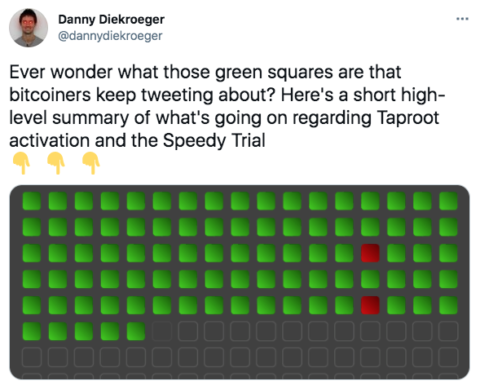

Bitcoin’s Taproot update recently began its three-month activation period. @bitcoin_DLC described Taproot rather succinctly on Twitter:

Miners who wish to adopt the update can signal support by adding a “signal bit” in blocks they mine.

At the time of publishing, miners have signaled for activation at a ratio of 97.67%, with 251 out of 257 blocks signaling readiness for taproot. However, there is a long way to go before Taproot is activated, as 1562 additional blocks are needed for the protocol to lock-in.

Recommended Reads

- Goldman Sachs on crypto as an asset class:

- If the Taproot activation section got you excited about the intricacies of Bitcoin, here is an excellent thread on all things Taproot:

- Here’s a great thread linking to a handful of guides for beginners Bitcoiners:

On The Pod…

June 14th is the 5-year anniversary of Unchained. 🎉

On Tuesday, June 15th, we’ll publish a 5-year anniversary episode with questions or messages from you listeners to me.

- record a video or audio message of 60 seconds or less stating your name, where you’re from and your question or message.

- email it to hello@unchainedpodcast.com with “anniversary” in the subject line (or just respond to this email)!

The deadline to get your submissions in is Thursday, June 10 by 5 pm ET/2 pm PT.

Thanks so much for supporting Unchained all these years! 🙏

Check out the latest episode of Unchained:

Nick Tomaino on 1confirmation’s $125 Million Fund and What Future NFTs Will Look Like

Nick Tomaino, general partner of 1confirmation, discusses his firm’s recently announced third fund of $125 million and gives his perspective on many hot crypto topics, such as NFTs, Layer 2 solutions, Polkadot, DAOs, and more. Show highlights:

- why Nick became interested in crypto and his background

- what drives 1confirmation’s investment thesis

- why Nick believes NFTs have taken off in popularity this year

- why NFTs are currently in a bubble

- what we might do with NFTs in the future

- how competition between different NFT marketplaces will shake out

- how music NFTs could work

- the feasibility of charging royalties in the secondary sale of NFTs

- why environmental concerns over crypto mining to only be a short-term issue

- why Nick is not an Ethereum maxi and how he feels about the fragmentation of Layer 2 solutions on ETH

- why Polkadot is such an exciting project

- whether, as an early Coinbase employee, he would say the fat protocols thesis is true

- what new trend Nick is keeping an eye on for 2021 and beyond

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians