This episode addresses the recent market crash, the Bank of Japan’s surprising rate hike, and its global impact. The team also discusses the Science of Blockchain Conference’s relocation from Stanford to New York, and the current political landscape affecting crypto, including reactions from key politicians and internal community conflicts. Highlights include Solana’s recent performance surge, opportunities in its ecosystem, and the effects of Elizabeth Warren’s letter to the CFTC on prediction markets. Tune in for an insightful overview of these significant developments!

Listen to the episode on Apple Podcasts, Spotify, Overcast, Podcast Addict, Pocket Casts, Pandora, Castbox, Google Podcasts, TuneIn, Amazon Music, or on your favorite podcast platform.

Show highlights

🔹 In-depth analysis of the recent U.S. crypto market crash caused by the Bank of Japan’s unexpected rate hike and its impact on global financial markets.

🔹 Discussion on the resilience of DeFi during market turmoil, with highlights on record on-chain volumes and DEX stability.

🔹 Examination of the rebranding of the Stanford Blockchain Conference and its implications.

🔹 Insights into the political landscape affecting crypto, including perspectives on Kamala Harris, Trump’s pro-crypto stance, and Elizabeth Warren’s opposition to political event betting contracts.

🔹 Analytical focus on the Solana ecosystem, its early investment opportunities, network reliability, UX advantages, and its influence on newer EVM chains.

🔹 Reflections on market trends and opportunities for smart investors to capitalize on new developments.

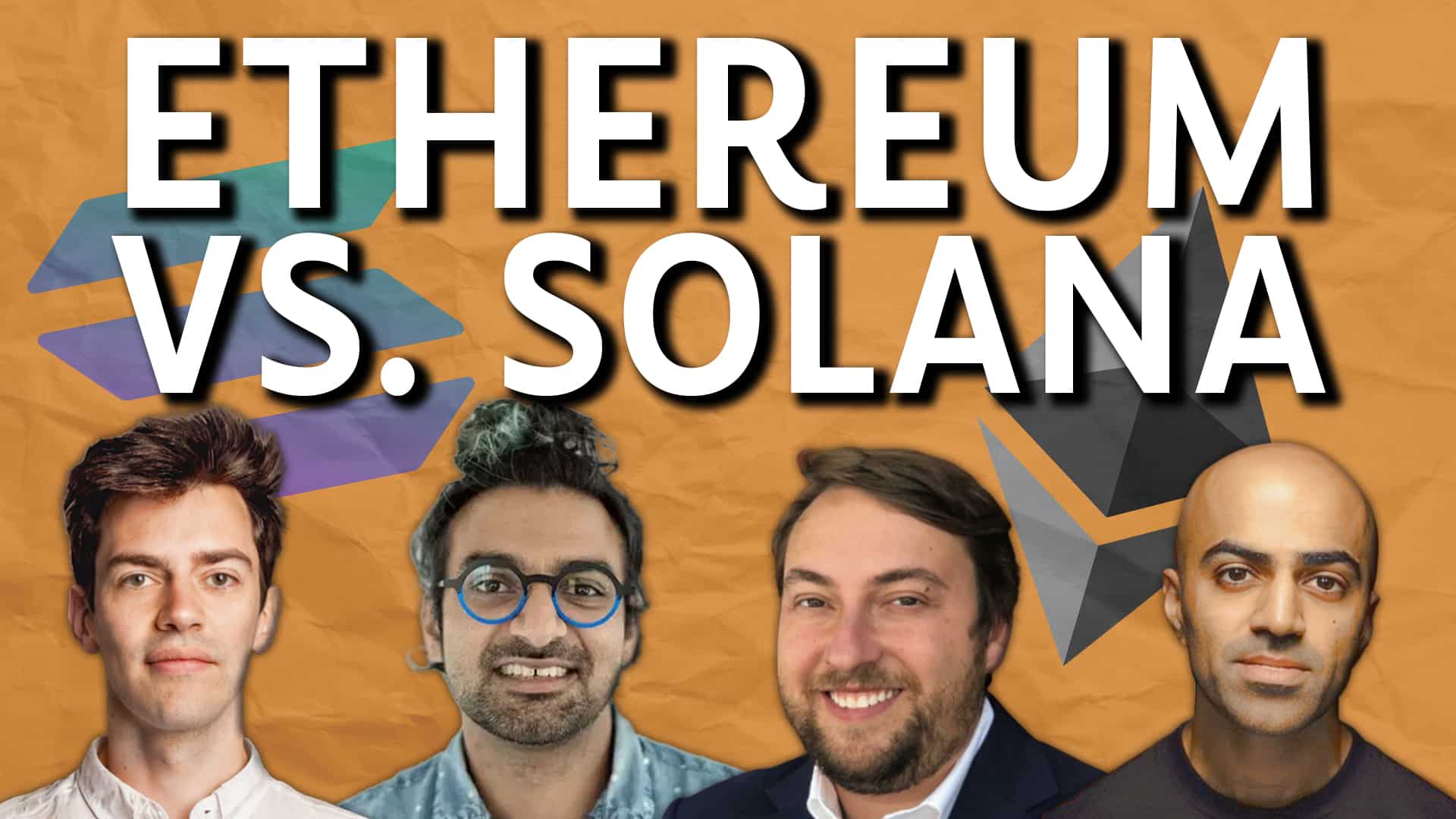

Hosts

⭐️Haseeb Qureshi, Managing Partner at Dragonfly

⭐️Tom Schmidt, General Partner at Dragonfly

⭐️Robert Leshner, CEO & Co-founder of Superstate

⭐️Tarun Chitra, Managing Partner at Robot Ventures

Disclosures

Links

What Drives Crypto Asset Prices? Adams, Austin and Ibert, Markus and Liao, Gordon, (July 30, 2024). Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4910537