January 13, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

The Energy and Commerce Committee announced a crypto mining hearing for 1/20.

-

Turks are ditching local fiat currencies for USDT and BTC.

-

Block CEO Jack Dorsey is funding a Bitcoin legal defense fund for BTC developers.

-

Ethereum’s burn rate hit a record high on January 11.

-

Coinbase acquired FairX, a CFTC-regulated derivatives exchange.

-

Xapo surrendered its BitLicense.

-

The average crypto fund returned 214% in 2021.

-

A group of US banks plans to offer a stablecoin, dubbed USDF.

-

Bank of America thinks Solana could become the Visa of crypto.

-

El Salvador has reportedly lost money on its BTC purchases.

-

TransUnion is looking to introduce credit scores to the crypto lending space.

-

Investors are seeking criminal charges against two South African crypto exchange founders who allegedly stole $3.6 billion in BTC last year.

-

Although it’s unclear why, NBA Top Shot banned a user whose username “FreeHongKong” recalls an incident when the NBA bowed to Chinese censorship pressure.

- Royal, an NFT platform backed by 3LAU, crashed during its first drop.

Today in Crypto Adoption…

-

Wikipedia is facing pressure to stop accepting crypto payments.

-

Gap, the apparel retailer, is rolling out an NFT collection on Tezos.

- According to a recent Visa survey, nearly a quarter of small business owners across nine countries plan to acceptcrypto payments in 2022.

The $$$ Corner…

-

Checkout.com brought in $1 billion in a Series D that valued that company, which has web3 aspirations, at $40 billion.

-

SEBA, a crypto bank, raised $120 million in a Series C.

- Zero Hash, a crypto startup, raised $105 million in a Series D.

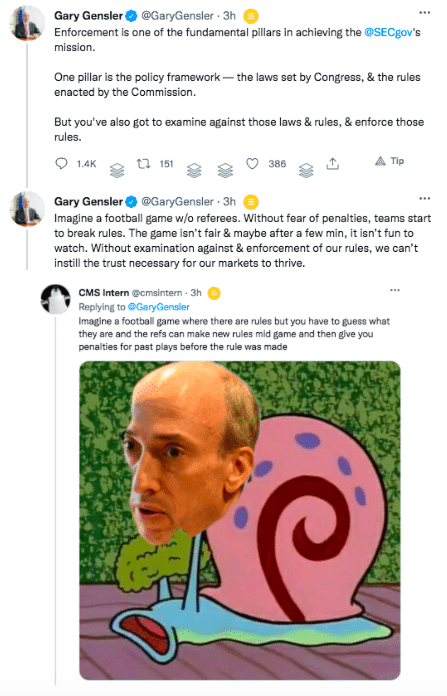

What Do You Meme?

What’s Poppin’?

CBDCs Shouldn’t Be Issued Directly to Consumers by the Fed Says Emmer

Representative Tom Emmer proposed an amendment to the Federal Reserve Act yesterday that would prohibit the Fed from issuing a central bank digital currency (CBDC) directly to individuals. The piece of legislation attempts to amend Section 13 of the Federal Reserve Act by adding a new paragraph to the end of the document:

“Except as specifically authorized under this Act, a Federal reserve bank may not offer products or services directly to an individual, maintain an account on behalf of an individual, or issue a central bank digital currency directly to an individual.”

Emmer’s move comes when CBDCs are being tested all over the world. Countries like India, Tanzania, Israel, and Mexicohave all expressed interest in issuing CBDCs. Data compiledby the Atlantic Council shows that 80 countries are developing, piloting, researching, or have already launched a CBDC. Most notably, China has ramped up its digital currency efforts and has already circulated and is testing its e-CNY, with major tech players like WeChat and Alipay integrating with the currency.

Emmer, it appears, does not want the US to follow in the footsteps of China. “As other countries, like China, develop CBDCs that fundamentally omit the benefits and protections of cash, it is more important than ever to ensure the United States’ digital currency policy protects financial privacy, maintains the dollar’s dominance, and cultivates innovation. CBDCs that fail to adhere to these three basic principles could enable an entity like the Federal Reserve to mobilize itself into a retail bank, collect personally identifiable information on users, and track their transactions indefinitely,” Emmer wrote in a press release.

He added, “Not only would this CBDC model centralize Americans’ financial information, leaving it vulnerable to attack, but it could also be used as a surveillance tool that Americans should never tolerate from their own government.” In Emmer’s view, “Requiring users to open up an account at the Fed to access a U.S. CBDC would put the Fed on an insidious path akin to China’s digital authoritarianism.”

Emmer concluded his statement, stating that the Fed should not be allowed to have control over normal bank accounts. “It is important to note that the Fed does not, and should not, have the authority to offer retail bank accounts. Regardless, any CBDC implemented by the Fed must be open, permissionless, and private. This means that any digital dollar must be accessible to all, transact on a blockchain that is transparent to all, and maintain the privacy elements of cash.”

To be clear, the Fed has not indicated any intention to implement a CBDC. However, Federal Reserve Chairman Jerome Powell did say that the Fed would be releasing a reporton CBDCs in the coming weeks.

Recommended Reads

-

@MuseumofCrypto on crypto art:

-

MetaMask’s Dan Finlay on web3 wallets (in response to Moxie):

-

Nifty Gateway’s Duncan Cock Foster on Wikipedia and NFTs:

On The Pod…

The Chopping Block: Why the Crypto Markets Have Been Down This Week

The Chopping Block is back! Crypto insiders Haseeb Qureshi, Tom Schmidt, and Tarun Chitra chop it up about the latest news in the digital asset industry. Show topics:

-

why crypto assets experienced a drawdown after last week’s FOMC meeting that hinted at accelerated rate hikes

-

which emerging assets Tarun, Haseeb, and Tom envision weathering a bear market

-

which assets could be further hurt by a continued bear market

-

the significance of Paradigm and Sequoia investing in Citadel Securities

-

what aspects of Signal CEO Moxie Marlinspike’s web3 article Haseeb, Tom, and Tarun take umbrage with

-

whether Cryptoland is crypto’s Fyre Festival or whether it’s the metaverse

-

what the heck is going on with the Pudgy Penguins community

-

the lessons from the CFTC’s fine of Polymarket (disclosure: a former sponsor of my shows)

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians