A recent lawsuit brought by Ethereum software giant Consensys against the U.S. Securities and Exchange Commission (SEC) suggests liquid staking protocols, such as Lido and Rocket Pool, could also come under fire from the regulatory agency.

As part of the lawsuit, which challenges the SEC’s determination that ether is a security, Consensys revealed it had received two Wells notices alleging Consensys’s MetaMask Swaps and MetaMask Staking are operating as unregistered securities brokers. MetaMask Swaps allows users to swap tokens by aggregating data from multiple providers to find the best price, while MetaMask Staking allows its users to engage in liquid staking via providers Lido and Rocket Pool.

A Wells notice is an informal document issued by the SEC notifying a company of an impending lawsuit. Companies can respond, in writing, to argue why the SEC should not pursue legal action. Earlier this week, trading platform Robinhood said it had received a Wells notice from the regulator, regarding crypto tokens on the platform.

“MetaMask staking is essentially a way of communicating with liquid staking protocols Lido and Rocket Pool,” said Laura Brookover, senior counsel and head of litigation and investigations at Consensys, recently on the Unchained podcast. “And the SEC’s theory is apparently that Lido and Rocket Pool themselves are unregistered securities and that somehow, through MetaMask staking, Consensys is distributing unregistered securities.”

An SEC spokesperson declined to comment on Consensys’ lawsuit or whether the agency had also sent Wells notices to Rocket Pool and Lido.

MetaMask staking partners — Lido and Rocket Pool, including founders and key members of the organizations — did not respond to multiple requests for comment via multiple email addresses or via their Telegram or social media accounts regarding whether the SEC had taken action or requested information from them or whether they are offering unregistered securities. Nor did anyone respond from Lido’s or Rocket Pool’s general emails, which were copied.

When reached for commentary Lido’s head of legal and general counsel Eric Hill said he was “not the right person to talk to” and he was no longer in that position. He did not confirm when he stepped down from that role or who his replacement is. A media representative for Lido also did not respond to a commentary request.

Are Liquid Staking Protocols Offering Unregistered Securities?

Staking is the process of locking up a token for a period of time to help secure a blockchain network and receiving interest in return for those locked up tokens. Liquid staking adds an additional step into this process, which is that when a user locks up the tokens, they also receive a utility token representing their share of staked tokens, which can be used elsewhere in the crypto ecosystem.

Read more: How Liquid Staking Works

“If you’re really just facilitating for the user to stake and then get a token showing that the user has staked, for that to be a security then staking itself probably has to be a securities transaction,” said Austin Campbell, founder and managing partner of Zero Knowledge Consulting and adjunct professor at Columbia Business School.

“And I have some doubts there,” he added, referring to whether staking should be considered a securities transaction.

A core test for examining whether something is a securities transaction is the Howey Test, which is a four-prong test introduced in 1946. If the asset is an “investment of money in a common enterprise, with a reasonable expectation of profits to be derived from the efforts of others,” then it is considered a security.

Read more: The ‘Howey Test’ and the Debate Over Crypto’s Legal Status

On the face of it, staking protocols meet the first three prongs, said Alex More, head of litigation at Carrington, Coleman, Sloman, and Blumenthal. It’s the final prong, the “managerial efforts of others,” which is what gets litigated most frequently, he added.

Like Campbell, More believes it would be tough to argue that a user who is staking is participating in a securities transaction.

“There’s no managerial efforts going into it, it really is just protecting the integrity of the network,” More said.

The challenge is when an entity — decentralized or centralized — aids the user in the staking process.

If the entity truly acts as a pass through, then it is no different to a user staking directly, More said. However, if the entity does something to manage those staked assets then the SEC might have a stronger case that it’s a securities offering.

The staking programs that have come under fire by the SEC are ones where staked assets were used in commingled vehicles or looked like an investment, Campbell said.

The Kraken and Coinbase Examples

One prominent staking case was the SEC’s lawsuit against crypto exchange Kraken, which was charged with failing to register the offer and sale of its staking-as-a-service program. The SEC alleged that Kraken touted benefits derived from the exchange’s efforts on behalf of investors. Kraken settled with the SEC, closing down its staking program in the US and paying $30 million in civil penalties.

On the back of this action, in February 2023, nonprofit advocacy group Proof Of Stake Alliance issued guidance on liquid staking to aid members navigating the uncertain regulatory environment.

Eric Hill is listed as Lido’s legal advisor and a member of the Alliance’s leadership on its site. A representative for the group said that while Hill is on the board, he has not been active in some time. They also said they believe Hill’s title at Lido, as listed on the site, “is no longer accurate” and have reached out for an update.

Crypto exchange Coinbase was also sued by the SEC for failing to register the offer and sale of its staking-as-a-service program, among a slew of other allegations. Coinbase pushed back and argued that its staking services do not pay rewards based on the “efforts of others” and it does not perform any “managerial efforts” in providing this service.

In March, Judge Katherine Polk Failla mostly denied Coinbase’s motion to dismiss the SEC’s lawsuit and the case is still ongoing. The court found that the SEC had “sufficiently pleaded” that Coinbase operates as a securities exchange, broker, and clearing agency and that the exchange’s staking program engaged in the unregistered offer and sale of securities.

The judge, however, did not agree with allegations that Coinbase operated an unregistered broker through its self-custodial wallet, noting that the flat fee Coinbase charges and its social media solicitation methods were not enough for the SEC to argue that it’s operating an unregistered broker. This ruling could benefit MetaMask against the claims made by the SEC in its Wells notice.

“The more [MetaMask] looks like Coinbase, the more I like their odds,” Campbell said. Unless MetaMask had a custodial relationship or was controlling the transactions, it’s hard to view them as a broker, Campbell said.

This is the challenge with the SEC’s “regulation through obfuscation approach” because now every single one of these cases needs to be looked at on a facts and circumstances basis, he added.

What About the Issuance of the Utility Tokens by Liquid Staking Protocols?

Unlike Kraken, both Coinbase — via its liquid staking service — and the liquid staking protocols issue a utility token to customers, which represent their staked holdings on the platforms.

However, the issuance of these utility tokens doesn’t change the fundamental Howey test question that needs to be answered, according to More. It still comes down to whether the issued utility token is part of a common enterprise that a group manages for the sake of a profit, he added. It’s a similar story for governance tokens issued by these protocols.

Can Decentralized Protocols Even Be Targeted?

When the SEC sued Kraken and Coinbase, the governance tokens for many liquid staking protocols surged because many believed decentralized protocols could not be targeted by regulators.

“If [the protocol] is centrally controlled by a handful of people with a multisig, one way or another, there’s the ability to issue them a Wells notice,” Campbell said. “Now, caveat, what jurisdictions are those people? And do they care about getting a Wells notice? Many people might not but there’s probably a way to serve them.”

If a project is truly decentralized and it continues operating because the code is fully automated, then serving them a Wells notice isn’t going to make a difference to how it operates, he added.

Read more: What Is a DAO and How Does It Work?

Uniswap is one decentralized protocol that recently received a Wells notice from the regulator. The decentralized exchange was also hit with a class action lawsuit back in 2022, but the court dismissed the suit, noting that the protocol did not exercise managerial control.

“You can wonder whether some of the recent adverse rulings, such as in the Uniswap case and in the Ripple case, may give the SEC some pause about pursuing these,” More said. “In general, the SEC prefers to pursue cases they believe they’re likely to win.”

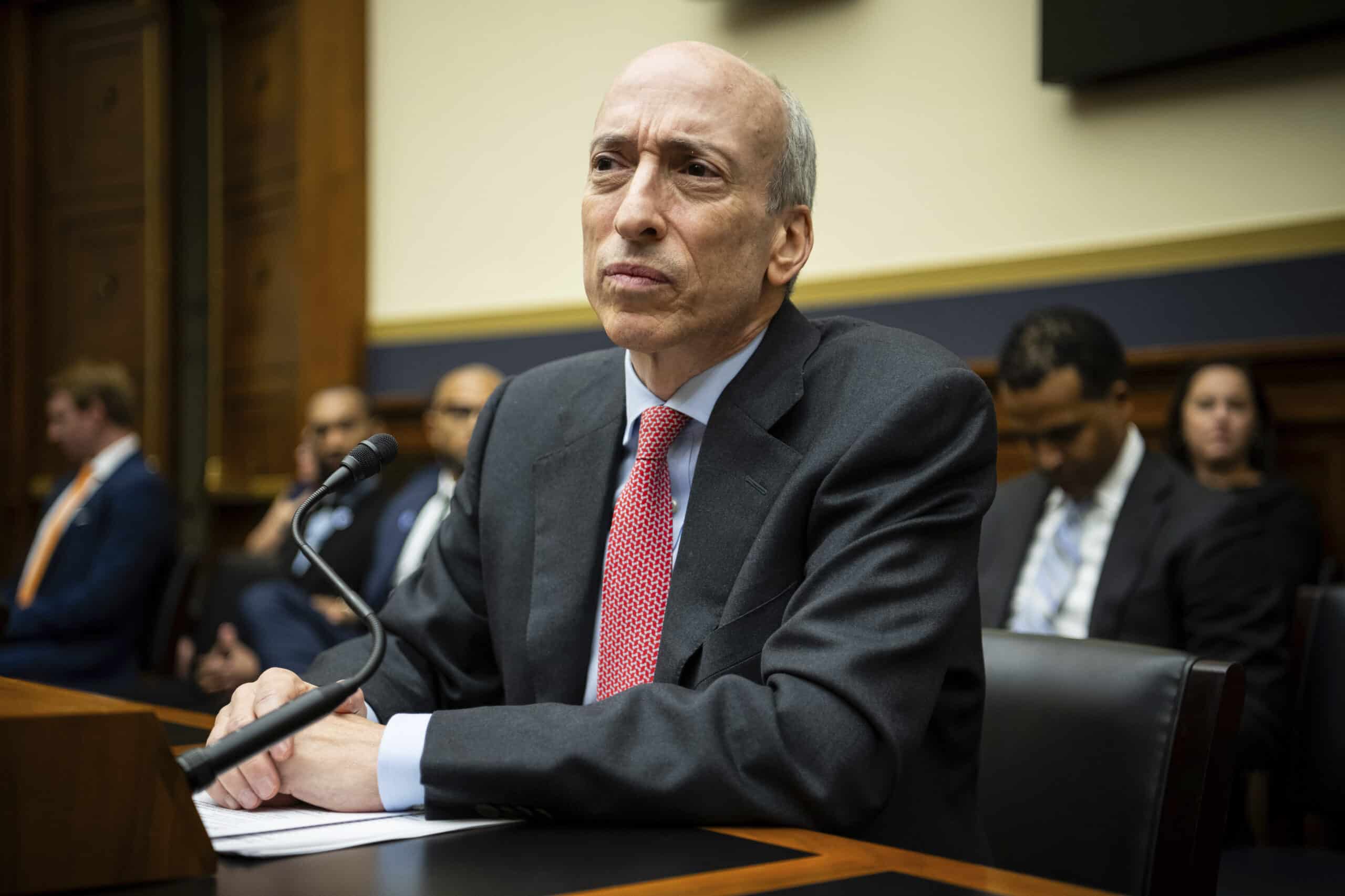

“However, it seems that it’s a policy priority of Gensler and his administration of the SEC to crack down as much as possible on what they see as a significant risk for the public in purchasing and in dealing with digital assets,” he added.