July 7, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Allied Payment Network is partnering with NYDIG to allow clients to buy, sell, and hold Bitcoin.

-

August 4th has been proposed as the date for the London hard fork.

-

Binance has suspended euro bank deposits from the Single Euro Payments Area (SEPA), the EU’s payment network.

-

Beijing office of China’s central bank shut down a company for allegedly “providing software services to crypto trading activities.”

-

FinCEN has created an advisory role for digital currency policy, which Michele Korver, a crypto advisor to several government agencies, will fill.

-

DAOs hold $838.8M in AUM — up by $241M in the past month.

-

In 2020, blockchain and crypto investments made up less than 1% of the global VC market.

What Do You Meme?

Part 1:

As we all know… 2007 was a crazy year for criminal activity on the Bitcoin network:

Part 2:

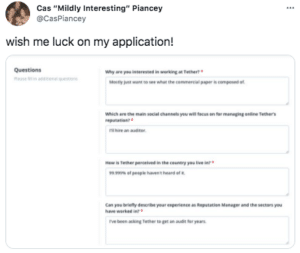

Everyone should be rooting for @CasPiancey to land a role at Tether:

What’s Poppin’?

DeFi tokens are poppin’.

DeFi protocols have seen token prices skyrocket in the past week, even as BTC and ETH lag behind, stuck in the mid $30,000s and $2,000s, respectively.

While the crypto industry is known for explosive volatility and random pumps, it appears this week’s DeFi boom holds some substance. The four DeFi protocols with the largest weekly gains each show promise of being something more than just a random uptick.

In the past week…

UNI is up 18%, perhaps riding the last Wednesday’s news of its integration with CoinMarketCap, which launched a token swap feature on its website powered by Uniswap. According to Arca’s Jeff Dorman, UNI’s growth could also stem from launching universal liquidity mining contracts on top of Uniswaps v3. This is a net positive for Uniswap, as more projects will add liquidity mining incentives, Jeff Explains.

AAVE increased by 30% after announcing its Aave Pro platform would launch later in July. Aave Pro is a permissioned version of Aave built for institutions. Through a partnership with Fireblocks, Aave Pro will require institutional investors to pass KYC verification to interact with the DeFi protocol.

COMP jumped 50% following an institutional DeFi announcement of its own. Last week, Compound Labs, the company behind COMP, announced a new company: Compound Treasury. In collaboration with Fireblocks and Circle, Compound Treasury will allow institutional investors to access juicy DeFi yields without directly interacting at a protocol level. The newly minted institutional DeFi company is offering a guaranteed interest rate of 4%.

SNX rose 60% after developers reported a record monthly trading volume on Synthetix, the derivatives liquidity protocol that SNX is native to. In just one month, the platform did roughly $1B in trading volume, nearly 15% of total volume ever. SNX’s pump also comes shortly after Kain Warwick, the founder, and self-proclaimed benevolent dictator of Synthetix, published a blog announcing his intent to run for Spartan Council, which is responsible for approving proposed changes to the protocol, after previously distancing himself from the project.

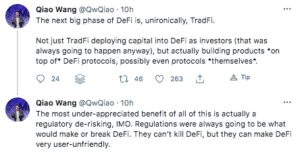

DeFi is certainly a sector to watch, especially as more projects emerge with an institutional bent.

Other DeFi weekly winners:

- MKR (+13%)

- AVAX (11%)

- SUSHI (9%)

- CAKE (8%)

Data sourced from CoinMarketCap’s Top 100 coins list.

Recommended Reads

- Messari’s Mira Christanto published a scintillating recap of the crypto industry for Q2 2021:

- Spartan Group’s Jason Choi on his investment process:

- Brady Dale on the quest for a decentralized stablecoin:

On The Pod…

The Bitcoin Hash Rate Has Dropped. How Long Will It Take to Return?

Kevin Zhang, vice president of business development at Foundry, breaks down the latest developments surrounding China and bitcoin mining. Show highlights:

- how he came across crypto and which Bitcoin OG he joined at Bitcoin.com to help start its mining operations arm

- what Foundry does and its relationship with Digital Currency Group (DCG)

- why DCG wanted to build out a mining infrastructure business

- what news from China in early March kickstarted the process of the mining ban

- how China’s Central Television broadcasting company might have brought extra scrutiny to cryptocurrencies

- what the 100th anniversary of the Chinese Communist Party has to do with its Bitcoin mining ban

- why the Inner Mongolia and Sichuan Bitcoin mining bans were especially disruptive for Chinese miners

- how much of China’s hash rate Kevin estimates has been shut down since May

- where are miners relocating to

- why Chinese mining equipment will not be allowed to turn on in the US

- whether or not China’s Bitcoin mining ban will stick

- why China banning bitcoin mining will be good for the network in the long run

- what significant risk to Bitcoin’s network is solved by China banning bitcoin mining

- how much Bitcoin’s hash rate will drop and what effect this will have on miner revenue

- why Kevin thinks that Bitcoin is good for renewable energy

- how immersion cooling technology works

- what tangible benefits miners could find by moving to North America

- if El Salvador’s volcanic bitcoin mining plan is feasible

- what Kevin predicts will happen in the Bitcoin mining industry for the latter half of 2021

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians