September 5, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- BlackRock, the world’s largest asset manager, will use crypto exchange Kraken’s CF Benchmarks’ bitcoin index for its new crypto offering.

- The Fed research arm published a paper warning about the risks of crypto CeFi and DeFi.

- Bankrupt crypto lender Celsius said it would have a $70 million liquidity injection from loan repayments.

- Bittrex, Poloniex, Biftinex and Tether want law firm Roche Freedman to be terminated from the class action lawsuits after the Ava Labs conspiracy.

- A bug in Coinbase allowed users in Georgia to withdraw assets worth 100 times more than the real value.

- Volume across decentralized and centralized exchanges fell in August, compared to the previous month.

- NFT Marketplace Sudoswap will release its governance token via an airdrop.

- A hacker stole $185,000 worth of crypto that was raised for charity by Bill Murray.

- KlimaDAO team members are working with politicians to provide a regulatory framework for DAOs.

- The International Organization of Security Commissions wants to create common standards for crypto.

Today in Crypto Adoption…

- FIFA announced the launch of an NFT platform for soccer-themed digital collectibles on the Algorand network.

The $$$ Corner…

- Internet Game raised $7 million in a seed funding round.

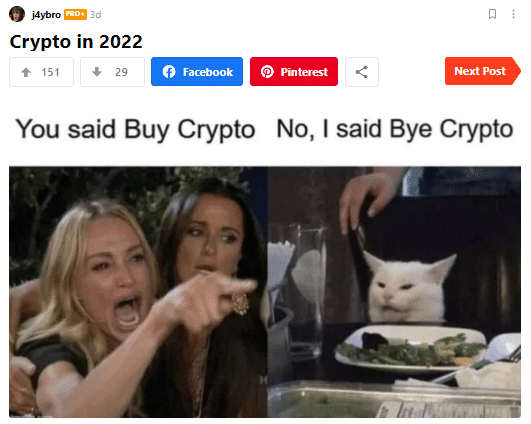

What Do You Meme?

What’s Poppin’?

Coinbase’s Chief Legal Officer Says Coinbase Will Not Censor Transactions

Paul Grewal, Coinbase’s chief legal officer, said that Coinbase’s interpretation of the sanctions on Tornado Cash is that validators are not compelled to censor transactions.

Once Ethereum moves to proof-of-stake, it is expected that Coinbase will become one of the largest validators in the ecosystem. As of now, four entities control 60% of all staked Ethereum on the Beacon Chain, with Lido having the largest portion, followed by Coinbase, Kraken and Binance.

The unprecedented sanctions against a set of smart contracts raises the question of whether, after the Merge, US-based institutions would or would not validate or attest to blocks with transactions involving blacklisted Tornado Cash addresses.

On the last episode of The Chopping Block, host Haseeb Qureshi and Espresso’s Jill Gunter had a heated discussion about it, with Jill arguing that Coinbase would not leave out Tornado Cash transactions after the Merge. Haseeb disagreed, pointing out that Coinbase, because it is a publicly traded company, would be more likely to take the strictest possible interpretation of the sanctions.

However, on Twitter, Grewal revealed at least he takes a liberal view of the sanctions. “The law says you can’t ‘transact’ with sanctioned individuals and must ‘block’ property that under the ‘possession’ or ‘control’ of US persons. But that’s just not how blocks get produced at the base layer,” explained Grewal, answering a question from Unchained host Laura Shin.

Two weeks ago, Coinbase CEO Brian Armstrong said on Twitter that he’d prefer to quit the exchange’s staking services business rather than censor transactions to comply with OFAC sanctions. But it was unclear what Coinbase would do post-Merge before OFAC clarifies which parts of the staking process would violate sanctions.

Even though Grewal’s tweets are just an opinion, it hints that Coinbase would seek legal action if it was ever charged with validating sanctioned addresses. Armstrong implied the same when he said, “a legal challenge could help reach a better outcome.”

“We can’t let fear cloud a key element of the rule of law: words in law must mean what they say, not what anyone merely wants them to say,” concluded Grewal.

Recommended Reads

- Noah Smith’s interview with Vitalik Buterin

- Steve Hanke and Caleb Hofmann on El Salvador’s Bitcoin experience

- Arcane Research on Bitcoin mining and the energy industry

On The Pod…

Andrew Hinkes, partner at K&L Gates and adjunct professor at NYU, and Martin Koeppelman, cofounder of Gnosis, talk about the sanctions on Tornado Cash, how they will impact Ethereum on the base layer, and the likelihood of having two chains. Show highlights:

- the legal meaning of the OFAC sanctions on Tornado Cash and why it is causing complications

- how legislation is built for the fiat world, and how in DeFi and crypto there’s no clarity

- whether a proof of work chain or a proof of stake chain would be more censorship resistant

- whether laws apply to validators in a PoS chain

- the different entities involved in Proof of Stake

- how a user-activated soft fork works and the conditions in which a fork could happen

- whether social slashing is enforceable considering it is not in the protocol

- the likelihood of Ethereum becoming a permissioned system

- the role of Flashbots’ relay code and what it means for Ethereum’s censorship resistance

- how DeFi’s exposure to US-based institutions can affect the likelihood of the chain complying with sanctions

- why US-based companies will choose a conservative path, considering the lack of guidance

- the importance of educating the regulators

- how cash and crypto are the only remaining private payment methods

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians