May 18, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- A lawmaker from South Korea’s ruling party called for Do Kwon to attend a parliamentary hearing on the UST and LUNA collapse.

- The TFL legal team resigned shortly after the Terra crash.

- The Terra community rejected Do Kwon’s second proposal.

- Nansen acquired Ape Board, a DeFi portfolio tracker, for more than $10 million.

- Fireblocks launched a suite for developer tools and a portal to access crypto exchanges, NFT marketplaces and dapps.

Today in Crypto Adoption…

- Indian regulators propose banning public figures from advertising crypto products.

- EY launches OpsChain, a supply chain L2 rollup.

- Crypto.com (which, disclosure, is a sponsor of my shows) is now available on Shopify.

- Robinhood plans to build a web3 wallet.

The $$$ Corner…

- Certora announced a $36 million funding round.

- Coinshift raised a $15 million funding round led by Tiger Global.

What Do You Meme?

What’s Poppin’?

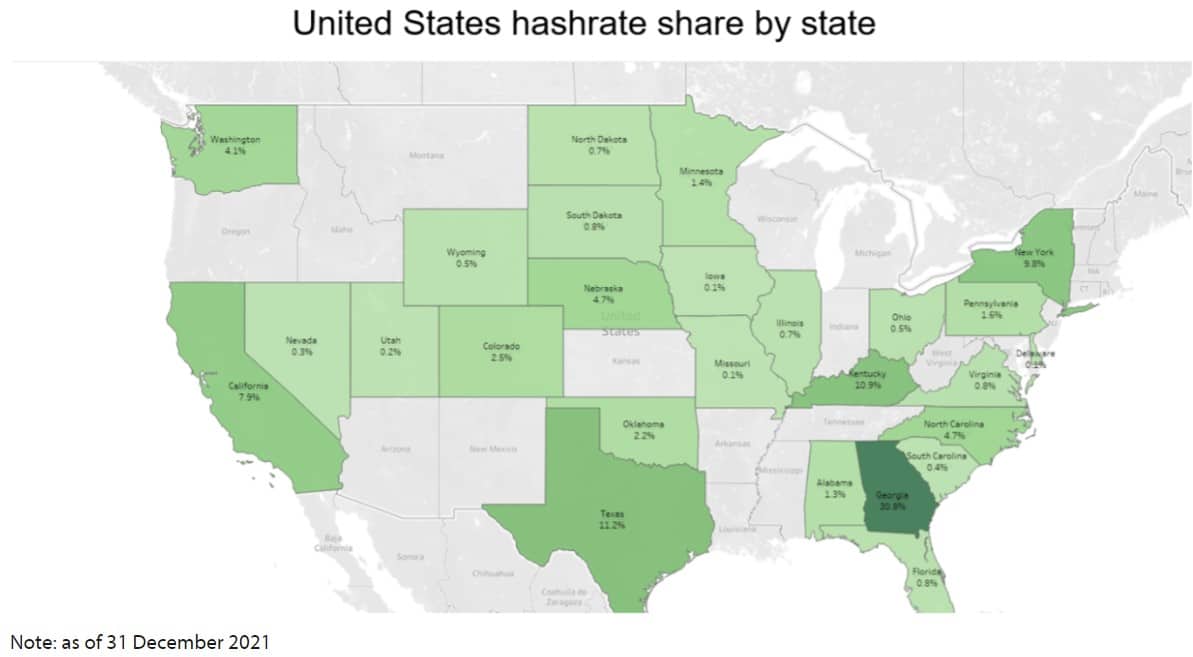

China Is Again Second in the Bitcoin Mining Ranking

According to new data from the Cambridge Centre for Alternative Finance (CCAF), China has resurged as a BTC mining world leader. China now sits as the second-largest producer of hashrate despite a ban, which prohibited crypto trading and mining, instituted last year. The United States is still the world’s leading miner of BTC.

The data from the CCAF was disclosed in the Bitcoin Electricity Consumption Index (CBECI), which maps the mining activity around the world based on the geolocational data reported by partnering pools.

China is second in the ranking, with a global hashrate of 21.1% as of December 2021. Previous data from the CBECI showed that, after the ban, China’s share of the global hashrate was 0% in July and August.

Following the crypto ban in China, the global hashrate of BTC went down significantly, hitting a multi-year low in July 2021. However, the hashrate has been growing ever since and is now at nearly all-time-high levels.

The remarkable hashrate recovery from China suggests that some miners in the country are operating underground. In a statement, the CCAF said: “Access to off-grid electricity and geographically scattered small-scale operations are among the major means used by underground miners to hide their operations from authorities and circumvent the ban.”

It seems that these miners are using foreign proxy services to escape attention and not get prosecuted by Chinese authorities. According to the CCAF, immediately after the ban, the miners decided to take their operations to nearby countries like Kazakhstan, and once they made sure that these proxy services were functioning correctly, they apparently decided to return to China, causing the big resurgence we are seeing now.

CBECI data also shows that the US has 37.84% of the global hashrate, making it the undoubted leader of the world. In addition, the US is also leading in terms of hashrate growth. Georgia has the biggest share of the hashrate in the US (30.76%), followed by Texas (11.22%) and Kentucky (10.93%). These three states together account for more than half of the country’s hashrate.

Recommended Reads

- 2022 State of Crypto Report by a16z.

- Vitalik Buterin on contradictions.

- Glassnode on unstable coins.

On The Pod…

Why Terra Collapsed and Whether an Algo Stablecoin Can Ever Succeed

Nic Carter, general partner at Castle Island Venture, Eric Wall, former Chief Investment Officer of Arcane Assets, and Erik Voorhees, founder of ShapeShift, discuss what happened with the TerraUSD (UST) and LUNA fiasco, Do Kwon’s responsibility, the impact on the crypto ecosystem, and much more. Show highlights:

- how Erik used to feel that algo stablecoins were impossible and why he changed his mind

- why Eric considers that the demand for UST was tied to a sh*tcoin

- why Nic didn’t think LUNA would work

- how a stablecoin could theoretically be decentralized

- whether Nic, Eric, and Erik think this was a deliberate attack

- why they think whether or not there was a deliberate attack is not even relevant

- how the de-peg started with a liquidity issue on Curve

- why Nic thinks that Terra’s biggest mistake was the 19.5% APY on Anchor

- whether pursuing a decentralized stablecoin is a worthy goal

- what aspects of UST were decentralized, according to Erik

- whether algo stablecoins are dead or whether in the future, death spirals of algo stablecoins can be avoided

- why Erik believes that everything in the crypto space is an experiment, even BTC

- what it says that the VCs behind Terra knew were so reputable

- why Do Kwon’s arrogance and inexperience might have caused this chaos

- whether Terra can be rebuilt

- whether this collapse imposes risks on other blockchains and other assets

- why the Luna Foundation Guard’s purchase of Bitcoin might have made the UST collapse even worse

- what Erik thinks about the global financial system and the US dollar

- how this event could trigger more regulation in the crypto space and why it might hurt the entire ecosystem

- how regulators might use the Terra case to impose CBDCs.

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians