July 14, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Celsius filed for chapter 11 bankruptcy to stabilize its business.

- The price of stETH dropped due to fear of a Celsius selloff.

- Celsius repaid its debt to DeFi protocol Compound and reclaimed $200 million in collateral.

- Ethereum scaling solution StarkNet announced the launch of a native token for September.

- Ukrainian authorities seized the assets of crypto traders who were allegedly aiding Russia.

- The United Nations released a policy brief outlining policy options for curbing risks associated with crypto find developing countries.

- A judge denied the SEC to hide a 2018 speech which could help Ripple in its case

- Michael Barr, a former crypto adviser, will become vice chairman for supervision at the Fed.

Today in Crypto Adoption…

- South Africa is preparing to regulate crypto as a financial asset.

- Polygon was selected to be a part of the 2022 Disney Accelerator Program that focuses on NFTs, AI, and AR.

The $$$ Corner…

- Inflection Point, a crypto recruitment firm based in Miami, raised $12.6 million and acquired its competitor.

- Merkle Manufactory, a company owned by a former Coinbase executive, raised $30 million led by a16z.

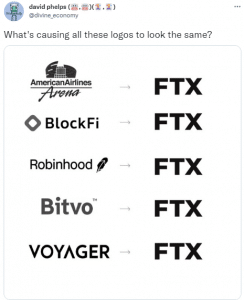

What Do You Meme?

What’s Poppin’?

US Inflation Hits 9.1%. What Does This Mean For Crypto?

By Juan Aranovich

U.S. consumer inflation reached 9.1% in June, its highest rate in 40 years. The Consumer Price Index, released yesterday, was higher than the estimates. The major contributors of this increase were gas, food and housing prices.

The Consumer Price Index measures the overall change in consumer prices over time based on a representative basket of goods and services. It’s never good for a country to have high levels of persistent inflation, especially if it is unintended. The organization responsible for the stability of prices (aka having inflation under control) is the Fed.

With CPI as high as it is, the Fed will be pressured to increase interest rates, which is the only tool they have available to fulfill its commitment. The interest rate that the Fed sets is effectively the price of money, which affects nearly everything in the economy.

But how does it affect crypto?

- Higher interest rates cause a phenomenon called “flight to safety.” This occurs when investors get out of risky assets and go to safer ones, like bonds or treasury bills. Crypto is still seen as one of the riskiest assets out there, so people might sell off, causing the prices to go down.

- When interest rates are higher, the cost to finance new projects go up. That means that there’s less money for developing new projects, especially those that require a lot of initial capital, and there are fewer jobs for people. For crypto, this might translate into less innovation, less marketing spend and less adoption.

- The higher the interest rates, the less money people have, because they can’t get credit and mortgage interests are up. If people have less disposable income, they have to spend more on their cost of living and less on investments like crypto or other financial assets.

After the news went out, crypto assets were not down badly – bitcoin and ether both dropped about 5% on the news – but that may be because the market had already priced in a high inflation number.

The market is now pricing in a 75% probability of 100bps increase (+1%) in the Fed’s rate for the next month. Whether this increase would reduce CPI is still into question. Inflation is a multi-causal phenomenon. By raising the rates, the Fed would be destroying demand (a powerful way to lower the CPI), but what if the problem of inflation is due to a lack of supply?

One of the many cases that BTC has been said to have is being an “inflation hedge.” However, it looks like BTC has not yet gained that quality. Even though the inflation rate was quite high in the past year, not only BTC wasn’t able to hedge it, but it was down considerably.

Recommended Reads

1) Crypto Thesis by Kyle:

2) Tascha Che on Tokenomics:

3) Kirill Naumov on MakerDAO:

On The Pod…

Ryan Berckmans, Ethereum investor and community member, and Alexandre Bergeron, Bitcoin investor, discuss Lido’s dominance as a liquid staking provider, whether that issue can be resolved, and how it could be a centralizing force for Ethereum. Show highlights:

- what stETH is, what the uses cases are for stETH, and why it is important

- how Lido had a first-mover advantage and how that kicked off network effects

- whether the liquid staking derivatives system is one of a “winner-take-all”

- how much of the staked ETH will be turned into a liquid staking derivative

- how Lido might have a huge MEV opportunity after the Merge

- what the proposer-builder separation is

- whether Lido’s dominance will increase over time

- whether other competitors have been competitive with Lido

- why Lido is a natural monopoly because of the incentives and MEV opportunities

- what the implication of Lido’s monopoly is for Ethereum’s censorship resistance

- whether Lido is effectively a single entity despite having multiple node operators

- whether there could be a long waiting period for becoming a validator after the Merge

- how Lido is moving its staking derivatives to other chains

- how Lido’s new dual-governance proposal works, why it might be useful to decentralize Lido and whether it reduces the power of LDO token holders

- how Lido’s centralization is the biggest threat to Ethereum in the long term and what are the possible solutions

- why Ryan believes the value of ETH comes from its credible neutrality and whether Lido’s centralization may jeopardize that

- whether finding solutions around MEV opportunities is a good way to reduce Lido’s monopoly

- whether Lido’s competitors could form an alliance and build a tokenized basket of their staking derivatives to compete with Lido

- whether Lido could airdrop the LDO token to all ETH holders to decentralize its governance token

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians