February 10, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Authorities in Russia are reportedly set to recognize crypto as a form of currency.

-

CFTC Chair Rostin Behnam wants to bring crypto spot markets under the control of the CFTC based on his testimony before the Senate Agriculture Committee yesterday.

-

Bitfnex’s LEO token has been surging after the US Department of Justice announced the seizure of $3.6 billion in BTC that had been stolen from the exchange in 2016.

-

AssangeDAO won the bid for a Julian Assange x Pak NFT for $53 million.

-

A bill proposed in Tennessee would see the state invest in crypto and NFTs.

-

The issuance of El Salvador’s Bitcoin bond could come as soon as next month.

-

The managing director of the IMF thinks CBDCs are more practical than cryptocurrencies and stablecoins.

-

Wells Fargo says it’s not too late to buy crypto.

-

Blockchain analytics firm Elliptic reports that Ukraine NGOs and volunteer groups are using Bitcoin to crowdfund the fight against Russia.

-

Shiba Inu announced plans for a metaverse-land project, and its token, SHIB, jumped upwards of 40%.

Today in Crypto Adoption…

-

Zynga, the gaming company behind FarmVille and Words With Friends, plans to launch an NFT game this year.

-

The Terra DAO is partnering with the MLB’s Washington Nationals in the first-ever DAO-sports franchise deal.

-

McDonald’s and Panera filed for virtual restaurant trademarks.

- Candy Digital launched a line of NASCAR NFTs.

The $$$ Corner…

-

OpenNode raised $20 million in a Series A funding round, valuing the bitcoin-payment company at $220 million.

- Compute North, a BTC mining infrastructure firm, raised$385 million in equity and debt funding.

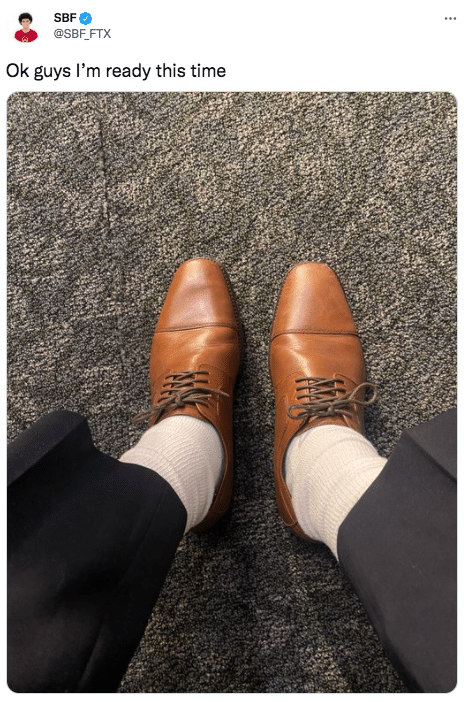

What Do You Meme?

What’s Poppin’?

The World’s Largest Asset Manager Is On the Brink of the Rabbit Hole

BlackRock, the Larry Fink-led asset manager, is gearing up to offer crypto trading services to investor clients, according to a report from CoinDesk.

CoinDesk cites three people with knowledge of BlackRock’s plans. According to CoinDesk, BlackRock will first enter the crypto space with “client support trading and then with their own credit facility,” – meaning clients could use crypto as collateral to borrow from BlackRock. From there, one of CoinDesk’s sources says clients will have the ability to trade crypto via Aladdin, BlackRock’s investment management platform.

Chris Perkins, president of CoinFund, told Unchained this was an important move for two reasons. “First, Aladdin supports many of the largest sovereign wealth, pensions, and asset managers in the world, and this connectivity will solve many of the operational challenges that have been holding these institutions back,” he wrote in a message. “Second, Aladdin typically releases new functionality based on client demand. This tells you that many of the largest institutions in the world are asking for crypto capabilities.”

In total, BlackRock currently has $10 trillion in assets under management (AUM). For context, the market capitalization of cryptocurrencies is worth $2.13 trillion. In essence, if just a slice of BlackRock’s clients decides to invest in crypto, it would be a significant boon to the crypto market writ large.

CoinDesk also reported sources saying that BlackRock is looking to “get hands-on with outright crypto” and that a working group of “20 or so” individuals is evaluating crypto in order to “start making some money from this [crypto].”

The rumor of crypto support at BlackRock is not a total surprise. Last June, the firm posted a job listing for a blockchain strategy lead at Aladdin. In addition, a BlackRock fund began trading CME bitcoin futures in 2021 and owns 16.3% of MicroStrategy’s stock.

That being said, the CoinDesk report emphasized that it is not clear when crypto will be supported.

With additional reporting from Laura Shin

Recommended Reads

-

Fais Khan on coin listings, VCs in crypto, and Coinbase vs. Binance:

-

Forbes’s Jeff Kauflin on DAOs:

-

DeFi Education on the history of DeFi:

On The Pod…

Will Every Piece of Media Enter the Internet as an NFT? Variant Fund Says Yes

Variant Fund is a venture capital firm that describes itself as “a first-check crypto fund investing in the ownership economy.” Jesse Walden and Li Jin, co-founders and general partners at Variant, join Unchained to discuss the ownership economy, issues with web2 and web3, NFTs, the future of work, and more. Highlights:

-

where Li and Jesse met and how their backgrounds as investors + founders led them to the crypto space

-

how Li’s investing niche, which she describes as the passion economy, ended up intersecting with crypto

-

why Li believes that web3 platforms will be better for creators than the current web2 ecosystem

-

why Jesse was so inspired by Bitcoin after working in the music industry for so many years

-

why Jesse believes that NFTs are the “port of entry” for the mainstream adoption of crypto

-

what other use-cases exist for NFTs outside of the JPEG or PNG meme (and why Jesse is so excited about music NFTs)

-

why Li believes that web3 tools can help fix the issues inherent to the “gig economy”

-

Li and Jesse respond to criticisms of web3 coming from Jack Dorsey and Moxie Marlinspike

-

how Variant Fund thinks about investing in crypto projects

-

what token allocation Variant Fund targets when investing in crypto projects

-

why mainstream platforms are experiencing backlash for integrating with NFTs and crypto

-

what trends in NFTs, DAOs, and the ownership economy Jesse and Li think will pop in 2022

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians