August 5, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Crypto exchange Poloniex will support Ethereum Proof of Work fork.

- One crypto developer in Solana deceived the entire ecosystem.

- Meta expands NFT support across Instagram in 100 countries.

- Tiffany NFTs are already being sold for a profit.

- Uniswap will go through a governance proposal to launch the Uniswap Foundation with a $74 million budget.

- Frax Finance’s cofounder proposed that the project’s stablecoin could only be redeemed in Ethereum PoS chain.

Today in Crypto Adoption…

- Binance and Mastercard partnered to launch a prepaid card in Argentina.

- Paraguay wants to charge higher electricity prices to crypto miners.

- Deel, a payroll software company, reported that cross-border payments in crypto are increasing rapidly.

The $$$ Corner…

- VC firm Lattice Capital raised $60 million for its second fund.

- Stride, a liquid staking protocol on Cosmos, raised $6.7 million.

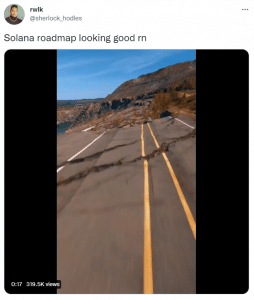

What Do You Meme?

What’s Poppin’?

BlackRock Partners With Coinbase to Bring Institutional Investors to Crypto

BlackRock, the world’s largest asset manager with $10 trillion in assets under management, is going to start offering crypto investments to institutions through Coinbase Prime.

The news was announced by Coinbase on Twitter, linking to a more detailed post on its blog. According to the company, it will give direct access to crypto to the clients of BlackRock’s investment platform Aladdin.

Coinbase stock (COIN) soared after the announcement. Yesterday, it peaked at $116.30 and it closed at $88.90, accounting for a 10% increase. Trading in COIN was temporarily halted after surging 35% in minutes.

Just last week, Cathie Wood’s fund disclosed that it had sold Coinbase shares. Ever since then, COIN has experienced a major pump. “Oof, that’s dirty,” said Hsaka.

“After years of hype, today’s announcement offers a ray of hope that institutional money actually *is* coming to crypto, and after today’s announcement, Coinbase is poised to be a beneficiary of that trend,” Matt Weller, global head of market research at forex.com, told The Block.

Is this good for the crypto industry? On the one hand, institutional investments are positive because that’s where the big money always comes from, which could mean higher prices and more money available for developments. However, it could also be seen as negative news. BlackRock, having such a large amount of assets under its management, could become a major holder of BTC and other crypto assets, making them much more centralized, which of course goes against the ethos of crypto. “Soon Blackrock will control crypto just like they already control the stock market,” said one person on Twitter.

It is not the first time that Coinbase hit the news this week. On Monday, it announced that it would start offering Ethereum staking to institutional investors in the United States. It looks like institutions are finally having the tools to invest in crypto.

Recommended Reads

- Magik Labs on under-collateralized loans in DeFi

- Maker DAO on its current dynamics

- Delphi Digital on the future of crypto gaming

On The Pod…

Kevin Zhou, cofounder of Galois Capital, comes to talk about the possibility of a Proof of Work chain on Ethereum after the Merge, the LUNA death spiral, how he plans to play the Merge, and much more… Show highlights:

- how Kevin got started in crypto

- what Galois Capital is and what its investment thesis is

- why Kevin was more vocal than most about the possibility of the LUNA death spiral

- whether Kevin made money out of the Terra collapse and what was his strategy

- what the difficulty bomb in Ethereum is

- the potential scenarios that could arise after the Merge

- whether the public is not considering the risks of the Merge

- how the fact that everybody was telling the same narrative about ETH made Kevin suspicious

- how Chandler’s statement about forking Ethereum made it a lot more likely that it would happen

- the groups behind the encouragement of a proof-of-work Ethereum chain

- whether there is a value proposition for a Proof of Work chain

- how Kevin used The Cryptopians to remember how the DAO fork went

- what replay protection is and why it is important when forking a chain

- why anyone would want to keep the difficulty bomb in a potential proof of work chain

- Kevin’s predictions about the market cap of the potential Ethereum forks

- how a proof of work chain of Ethereum would function without the biggest stablecoins like USDT and USDC

- whether Tether is going to support Ethereum 2

- why Kevin writes using metaphors related to history and gaming and how those analogies relate to Ethereum

- how Kevin wanted to “stick it” to the Ethereum Foundation by offering his services

- whether Vitalik trolled Kevin on Twitter

- whether Kevin will apply the same strategy he used with ETC after the DAO fork

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians