BlackRock and the partnership of ARK Invest and 21Shares lowered the annual fees for their respective spot bitcoin exchange-traded funds (ETF) early on Wednesday as competition continues to heat up ahead of the expected approval of such funds this week. The ongoing race to the bottom in fee prices could make the funds, which offer indirect exposure to bitcoin, cheaper than investing in BTC through a crypto exchange.

The competitive landscape has led to ETF issuers offering waivers that last for either six months or a year, or until a certain level of assets under management is reached, and also lowering their fees after those promotional periods end.

Read more: BlackRock and Others Respond After SEC Issues Additional Comments on Spot Bitcoin ETF Applications

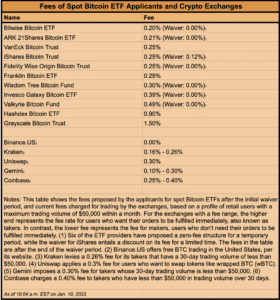

On Wednesday, BlackRock, the world’s largest asset manager, said in a filing that its iShares Bitcoin Trust has lowered its fee from 0.20% to 0.12% during its twelve-month waiver period, and from 0.30% to 0.25% afterwards, lower than many had expected. That puts it among the issuers with the lowest post-waiver fees, tied with Fidelity and VanEck and only undercut by Bitwise (0.20%) and Ark/21Shares, which also reduced its post-waiver fee in a filing on Wednesday, from 0.25% to 0.21%. Ark’s offering still has no fee during its waiver period, which lasts for either six months or a billion dollars in assets has been reached.

Here’s how the various issuers stack up currently on proposed fees, compared to the commissions charged by several major crypto exchanges:

The many potential issuers are competing aggressively on price, but other key differentiating factors include distribution, brand, and liquidity.

On Tuesday, an X account belonging to the SEC sent out a false announcement that the agency had approved spot bitcoin ETFs. SEC Chair Gary Gensler quickly posted a message that the account had been compromised and the approval news wasn’t real. Crypto liquidations topped $200 million due to the mishap.

Read more: Bitcoin ETF Fee War Could Make Investing in Bitcoin Cheaper Than Using an Exchange