Monday, August 19, marks the four-month anniversary of the 2024 Bitcoin halving, an automated event that cuts mining rewards in half every four years. Unlike previous halvings, however, the latest cut has not been followed by a rise in bitcoin’s dollar value as of this point.

Each halving makes it harder for miners to stay afloat, since BTC rewards for validating and securing the blockchain are halved. But the price of BTC in dollar terms has generally increased after a halving, with analysts often attributing price rises to decreased supply of new coins.

However, the price movement of bitcoin following the most recent halving has been worse than any previous halving events, which also took place in 2020, 2016, and 2012.

BTC’s price has dropped over 8.2% post-halving, from $63,825.87 on April 19, 2024, to $58,530.13 at the time of writing, according to data from blockchain analytics firm CryptoQuant.

In all previous halving years, bitcoin’s dollar value rose in the following four months. 2020 saw BTC’s price jump roughly 21.4% in the four months post-halving, from $8,566.77 to $10,402.66. 2016 saw BTC jump 11.12% over the comparable period, from $638.19 to $720.97. Similarly, in 2012, BTC was trading at $12.35 on the day of the halving, and four months later its price had increased nearly 600% to $86.18, per CryptoQuant.

Read More: The 2024 Bitcoin Halving – What Miners Are Doing Differently Now Compared to 2020

One reason for BTC’s weak performance after its 2024 halving stems from the net reduction in outstanding treasury bills, according to Arthur Hayes, a co-founder and former CEO of crypto exchange BitMEX.

“As a result of a net reduction in T-bills outstanding, liquidity was removed from the system,” Hayes wrote in a blog post last week. “From April to July, when T-bills were net withdrawn from the market… Bitcoin traded sideways, punctuated with a few intense dips.”

With BTC dipping in price after the latest halving, miners “are in a tough spot,” wrote the team behind Alkimiya, a blockspace marketplace protocol that allows users to trade BTC transaction fees.

“The price of $BTC is down, mining difficulty is up, and they’re selling coins to cover costs,” Alkimiya wrote on X Wednesday. “Miners are the backbone of the Bitcoin network, processing transactions and securing the blockchain. They get rewarded in BTC, but with lower prices, they need to sell more to stay profitable.”

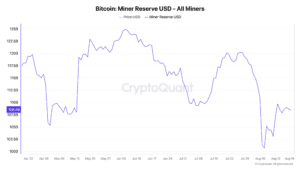

Per CryptoQuant, the amount of bitcoins held by the affiliated miners’ wallets denominated in USD has dipped by nearly $9.1 billion since the day of the 2024 halving.

This underperformance comes after Wall Street heavyweights rolled out spot bitcoin exchange-traded funds, which enabled traditional investors to gain exposure to BTC through mainstream financial marketplaces.

Read More: There Are Now 11 Spot Bitcoin ETFs. Here’s the One That’s Best for You

BTC’s 2024 post-halving movement also comes in a heated election year, with both Democrats and Republicans actively courting Bitcoin holders. Political circumstances, especially changes in who sits in the U.S. White House, are poised to substantially impact the price performance of BTC.