July 26, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bitcoin briefly hit $39,000 yesterday, marking the largest rally in six weeks.

-

FTX is cutting its leverage offering down from 100x to 20x.

-

Robinhood may soon allow customers to lend and stake crypto.

-

BlockFi is pursuing a public listing; Vermont became the fourth state to issue an order against BlockFi savings accounts.

-

Binance is eyeing an IPO, according to CEO Changepeng Zhao.

- Amazon is looking to hire a “Digital Currency and Blockchain Product Lead.”

What Do You Meme?

What’s Poppin’?

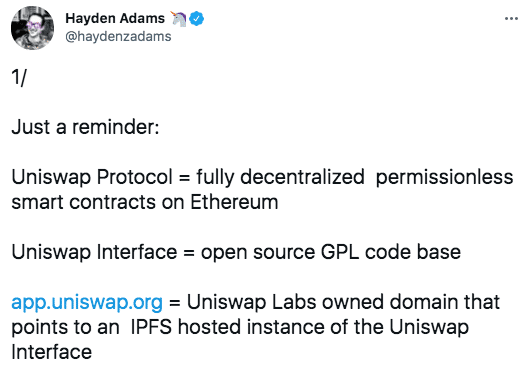

On Friday, Uniswap Labs decided to restrict access for over 100 tokens, including tokenized stocks and derivatives, through its user interface. The company cited the “evolving regulatory landscape” in its explanation of the cuts.

Uniswap Labs is not the only company to halt support for synthetic digital assets — Binance also ended its tokenized stock product last week.

However, as Uniswap is a decentralized protocol, Uniswap Labs is only restricting tokens through its own interface. Users can still interact with the protocol through different portals.

This distinction is significant. Uniswap the protocol is unaffected, as it exists as a decentralized, permissionless smart contract running on Ethereum.

Uniswap the app, however, is controlled by Uniswap Labs, which is separate from the protocol, defining itself as a “software development studio that contributes to the Uniswap Protocol.”

Notably, Uniswap Labs’s announcement comes shortly after Securities and Exchange Commission Chair Gary Gensler hinted that digital assets backed by traditional securities could fall under US securities law.

Gensler said:

“It doesn’t matter whether it’s a stock token, a stable value token backed by securities, or any other virtual product that provides synthetic exposure to underlying securities. These platforms – whether in the decentralized or centralized finance space – are implicated by the securities laws and must work within our securities regime.”

You can read the full blog from Uniswap here.

Recommended Reads

- Banning Bitcoin “would be one of the most spectacular backfires of a government ban in history,” according to Peter St. Onge:

- Arthur Hayes advises staying calm even though your portfolio is most likely in “various stages of rekt.”

- A 12-year-old made $150K+ by selling a few NFTs:

On The Pod…

MIT’s Neha Narula on Why Building DeFi on Bitcoin Is a Great Idea

Neha Narula, director of the Digital Currency Initiative at the MIT Media Lab, discusses Elon Musk’s appearance at ‘The B Word’ conference, along with a few current events in the Bitcoin world. Show highlights:

-

her main takeaway from ‘The B Word’ conference

-

why governance plays an essential role in Bitcoin’s block size arguments

-

what Neha thinks of proof-of-work mining and Bitcon’s environmental concerns

-

why Neha is skeptical of Dogecoin becoming a serious cryptocurrency

-

why Jack Dorsey’s new Bitcoin platform business is a good idea

-

what Bitcoin’s dip in hashrate due to China’s crackdown could affect network security going forward

-

what questions Neha has about Bitcoin’s adoption in El Salvador

-

why Neha thinks cryptocurrencies and CBDCs will coexist

-

what DCI has planned for the rest of 2021

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians