Bitcoin’s fourth halving has finally taken place, marking a new era for the world’s first cryptocurrency. On April 19 at 8:09 p.m. ET, miner ViaBTC produced the 840,000th block, triggering the protocol to cut subsidy rewards for miners in half from 6.25 BTC per block to 3.125 BTC.

THE 4TH HALVING IS HERE! 😍 THANK YOU SATOSHI 🧡🙏🏻 #BitcoinHalving2024 pic.twitter.com/mtvljMEHpu

— Remo ⚡️ (@CtrlAltFutura) April 20, 2024

The price of bitcoin slipped slightly from just under $64,000 at 8:09 p.m. ET, but was recently holding steady at around $63,590.

Satoshi Nakamoto, the anonymous creator of Bitcoin, designed the blockchain network to not be inflationary by capping the maximum supply of BTC at 21 million and implementing the periodic halving of rewards.

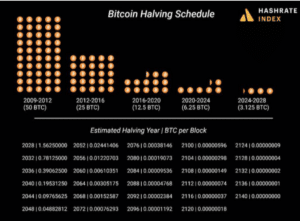

The halving occurs every 210,000 blocks, or about every four years, and reduces by 50% the rate at which newly minted bitcoins enter into the circulating supply.

Before block height number 840,000, the number of bitcoins entering the circulating supply on a daily basis via the network’s block subsidy rewards stood at 900. But with the successful trigger of the fourth halving, that number has dropped to 450 BTC, worth about $27.5 million at current prices.

Block rewards are one of two incentives for miners to use electricity and contribute their computing power to secure the 15-year-old blockchain network. The second financial incentive comes from fees paid by end users who want to have their transactions settled on Bitcoin’s ledger.

Fourth Halving Could Be an Anomaly

This latest mining cycle “could be an anomaly compared to its predecessors,” according to a March report from bitcoin mining firm Luxor Technology.

Bitcoin reaching an all-time high in price before the halving, which hasn’t occurred in any of the previous mining cycles, coupled with increased transaction fee activity, “have furnished the opportunity for many miners to stay viable after the block subsidy drops to 3.125 BTC,” Luxor’s report noted. BTC has soared over the past four years, jumping more than 600% since the last halving, which took place on May 11, 2020, when the cryptocurrency was trading at $8,600.

BTC’s more recent price appreciation can be traced to the massive capital inflows into spot bitcoin exchange-traded funds that were approved in January by the U.S. Securities Exchange Commission.

Read More: How Much Money Could Pour into Hong Kong’s New Bitcoin, Ether ETFs?

“In 2020, there weren’t any meaningful discussions about the possibility of spot bitcoin ETFs,” said Kadan Stadelmann, the chief technology officer of Komodo Platform, which supplies interoperability services. “In 2024, we have major spot bitcoin ETFs and a much more robust ecosystem that includes mainstream financial institutions.”

A dramatic cut in miners’ profitability is the immediate impact of the halving since rewards are sliced in half. Some miners in previous cycles have discontinued their mining operations because mining BTC became too unprofitable.

However, Luxor’s report said, “if Bitcoin’s price holds or increases from here, a modest amount of hashrate may come offline,” compared to previous cycles.

Rajiv Khemani, CEO of Auradine, a U.S based firm making bitcoin mining rigs, said that while it’s possible for global hashrate to drop after the latest halving, especially in the short term, he expects hash rates to eventually increase as efficient miners replace inefficient ones, and the energy previously utilized by inefficient miners is redirected to more efficient operations.

Since the supply of bitcoins coming into the market decreases by half, a pure supply-demand adherent would argue that “lower supply would potentially increase the price [of BTC]. Whether it happens immediately or [after] some period of time, nobody knows,” Auradine’s Khemani said.

Read More: Bitcoin’s Fourth Halving Is Right Around the Corner. Is It Still a Good Time to Buy?

“In terms of the price, if you talk to all kinds of analysts, what they will tell you is that everybody’s super bullish in the long-term [for BTC’s price, but] people do expect volatility to be lower as we go forward. So the swings will be a lot less [as] the returns in the long-term are expected to be less than what they were the first 10 years,” Khemani added.

New Use Cases

The 2024 halving also comes as Bitcoin as an ecosystem is experiencing a surge of new experimental innovations that have increased the amount of transaction fees, providing a stark contrast to Bitcoin in the 2020 halving. “Excitement is growing on alternative uses for the Bitcoin blockchain,” wrote Jesse Shrader, CEO of Amboss, a data analytics provider for the Bitcoin Lightning Network, to Unchained.

For example, nodes are now storing jpegs of cartoon monkeys and wizards as a result of the Ordinals protocol introducing non-fungible tokens to Bitcoin.

Memecoins have also infiltrated Bitcoin through the BRC-20 Token Standard which allows crypto users to mint and transfer fungible tokens on the Bitcoin base layer. In addition, unlike the previous mining cycle, the new one includes many more projects aiming to build layer 2 networks and sidechains to address scalability and transaction speed on Bitcoin.

The L2 space on Bitcoin during the previous mining cycle was largely composed of The Lightning Network and Stacks. However, in 2024 the L2 space has since grown substantially to include a number of other teams working on layer 2 networks. For instance, Bitcoin Layers, a risk analysis platform for Bitcoin, shows nine different projects adding layers to Bitcoin.

“This halving will highlight the growing collaboration between miners and Bitcoin L2 projects, with miners seeking additional revenue and L2s seeking to harness the security of the Bitcoin L1,” wrote Alexei Zamyatin, co-founder of BOB, a hybrid L2 solution that’s trying to to merge Bitcoin and Ethereum capabilities, in a text message. “Miners will continue to look for more revenue and will be incentivized to bootstrap new L2 Bitcoin projects, because the more successful use cases built on Bitcoin, the more miners are able to make.”

“This halving will mark the beginning of a critical phase of innovation in the Bitcoin ecosystem,” Zamyatin concluded.

UPDATE (April 19, 2024 9:00 p.m. ET): Added BTC price info.