Bitcoin soared past the $54,000 mark and was flirting with the $55,000 threshold on Monday afternoon ET. The last time BTC was trading at this level was more than two years ago at the beginning of Dec. 2021.

The largest cryptocurrency by market cap jumped to as high as $54,924 in the past 24 hours before settling at around $54,750 at the time of publication, a 5.8% gain since yesterday, outpacing most of the major cryptocurrencies, CoinGecko data shows.

In comparison, ETH has increased 2.9% to $3,186 in the same period, while the CoinDesk Market Index, which acts as a broad benchmark for the entire crypto space, has increased 4.59%. Gold, on the other hand, was essentially flat at $2,040.70, per Yahoo Finance.

Read More: How ETF Inflows Could Shape Bitcoin’s Price Trajectory

Bitcoin’s price jump comes as “the entire #Bitcoin ETF category had its 2nd most traded day ever at $3.2 billion,” as Bloomberg analyst James Seyffart wrote on X Monday afternoon. “[The] only day larger was launch day when they traded $4.6 billion.”

Yes $IBIT had an absolutely monster day of $1.3 billion in volume. But the entire #Bitcoin ETF category had its 2nd most traded day ever at $3.2 billion. Only day larger was launch day when they traded $4.6 billion.

This is viewable on the terminal at {G #BI 124517<GO>} https://t.co/nB6UrVmPDt pic.twitter.com/sRd1TMLvee

— James Seyffart (@JSeyff) February 26, 2024

Blackrock’s iShares Bitcoin Trust (IBIT) “went wild” and broke its record by roughly 30%, Bloomberg ETF analyst Eric Balchunas shared on X. This “ranks it 11th among all ETFs (Top 0.3%) and Top 25 among stocks. Insane number for [a] newbie ETF (esp one w ten competitors). $1b/day is big boy level volume, enough for (even big) institutional consideration,” Balchunas wrote.

Read More: 5 Ways That Spot Bitcoin ETFs Have Smashed All Expectations

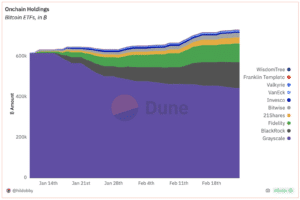

According to a Dune dashboard created by Hildebert Moulié, aka Hildobby, a data scientist at VC firm Dragonfly, Blackrock’s IBIT ETF holds 126,950 bitcoins worth about $6.9 billion, the second-most behind Grayscale’s GBTC, which holds over 450,000.