Not long after bitcoin miner revenues surged thanks to transaction fees from the Runes fungible token’s launch on the halving, the profitability levels of miners has fallen to an all-time low.

At least as defined by “hashprice,” which measures projected mining earnings from a defined amount of hashrate, or computational power allotted to mine bitcoin.

On April 20, one day after the halving, hashprice reached 0.0028 BTC or $182, a two-year high, before falling nearly 72% in BTC terms to 0.000785 BTC per day as of publication. This means miners can expect 1 PH/s of hashing power to yield about 0.000785 BTC, or $47 per day, an all-time low, according to data from Hashrate Index.

Subscale Miners Suffer, While Scaled Miners Are Well-Positioned

The impact on profitability from mining is not evenly distributed, as subscale miners, which have less resource-intensive mining operations that are not efficient at scale, are in tougher waters.

“Subscale miners are no longer mining profitably, so we expect to see them go offline and network difficulty to adjust accordingly, wrote Asher Genoot, CEO of Bitcoin mining firm Hut 8, in an email to Unchained. “These post-halving conditions highlight the importance of securing low-cost energy while managing an efficient fleet.”

Read More: Bitcoin Miners Diversify Their Revenue Streams as Halving Nears

Genoot said scaled mining operators expected hashprice to decrease following the halving — and have been preparing for months. As a result, “[they] are well-positioned to not only weather this volatility but also act on opportunities for growth as distressed assets come up for sale at discounted valuations,” according to Genoot.

The Presence of Runes

The decrease in hashprice comes as interest in Runes has fallen, gleaned through a decrease in Runes transactions, per a Dune dashboard by Matt Kimmell, a CoinShares analyst.

“Runes, BTC DeFi, Ordinals, etc are all welcome innovations long-term. Who knows which of them will have staying power but for miners to succeed they need more activity and fee generation onchain,” wrote Quinn Thompson, chief investment officer at crypto hedge fund Lekker Capital, in a private message to Unchained.

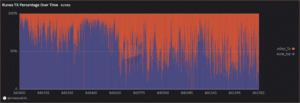

At block height number 840,003 — three blocks after the Bitcoin halving — Runes accounted for 97.3% of all transactions, dominating Bitcoin and increasing miner revenue in the process.

While the percentage of Runes transactions on Bitcoin has fluctuated, the onchain activity of Runes has decreased in the most recent blocks.

“The problem is the spikes in activity typically signal local peaks because it’s for peak speculative activities, not fundamental real use cases,” Thompson said. “This is a problem and why I question how legitimate these things are.”

Still, Runes, at times, makes up the majority of transactions in a single block. For example, at block 841,547, Runes was responsible for 87.4% of all activity.

“Time will tell but it’s unclear there’s enough staying power in BTC activity at the moment to support the required revenues for miners,” Thompson said.