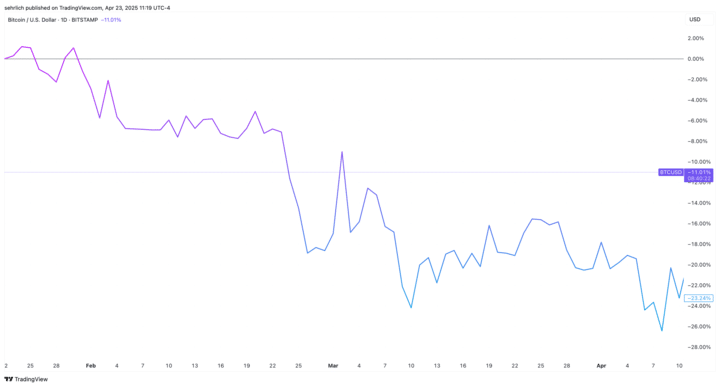

Bitcoin started 2025 riding high on the back of President Trump’s inauguration and his plan to make America a “bitcoin superpower.” However, it mostly went downhill for the asset since reaching a high of $108,786 on Jan. 20, the day that Trump retook the White House.

In the ensuing months it ultimately dropped over 26% as it got caught up in Trump’s trade wars and tariff threats.

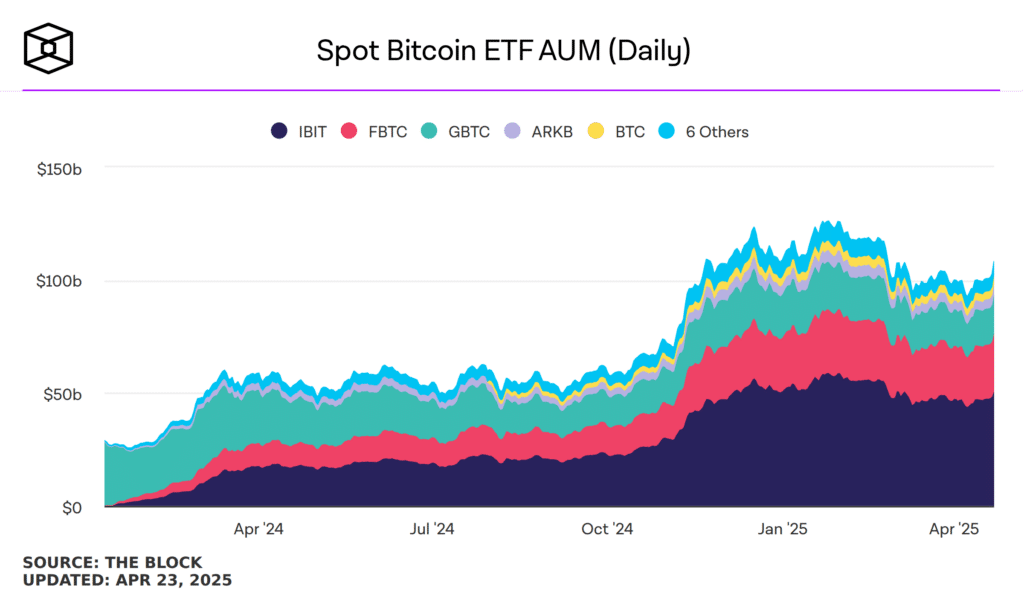

Spot bitcoin ETF flows, which experienced the first sustained bearish period in their history, were not immune. From Jan. 20 through April 8, the day before Trump issued a 90-day pause on his “reciprocal” tariff policy, these products lost $27.5 billion. Going back to the beginning of the year, where the assets held $109.07 billion, the loss was $16.62 billion. And now, the spot Bitcoin ETFs are finally about to reverse all their losses, with their AUM as of Tuesday standing at $108.16 billion, according to The Block.

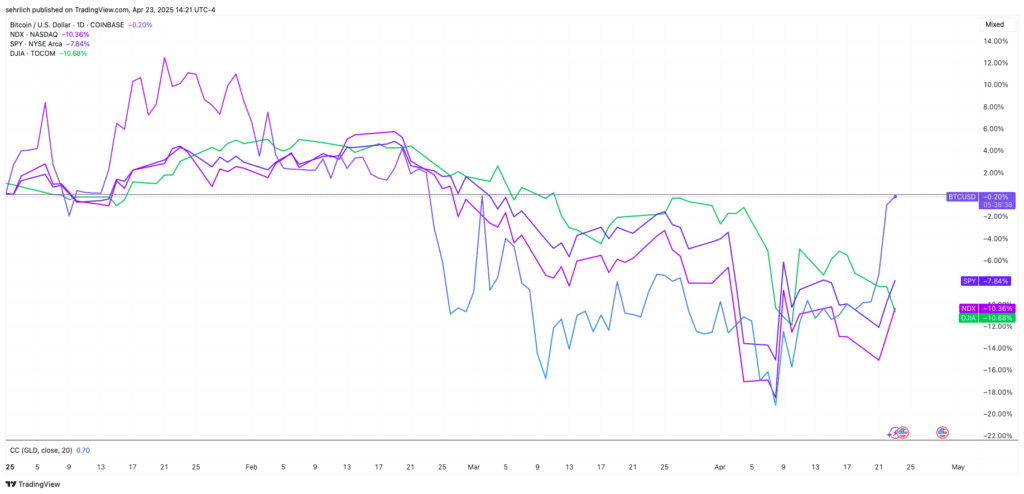

Recovering this lost ground is an important moment for these funds, and for bitcoin overall, which is now down just 0.27% year to date. By comparison, prominent equities indices such as the Nasdaq 100, S&P 500, and Dow Jones Industrial Average are each still down considerably this year.

A Faint Unwind and a Furious Comeback

The sell-off in Bitcoin ETFs earlier this year was not nearly as widespread as expected. “The initial drop-off in February was largely the basis trade unwind,” said James Seyffart, analyst at Bloomberg Intelligence, referring to a common trade that exploits price differences between the spot and futures markets for a given commodity or security. “Basis trades went from double-digit yields from late December into early February to now single digits, and billions of dollars came out of these products after that. What’s interesting to me is the fact that for the most part, investors are stuck in there.”

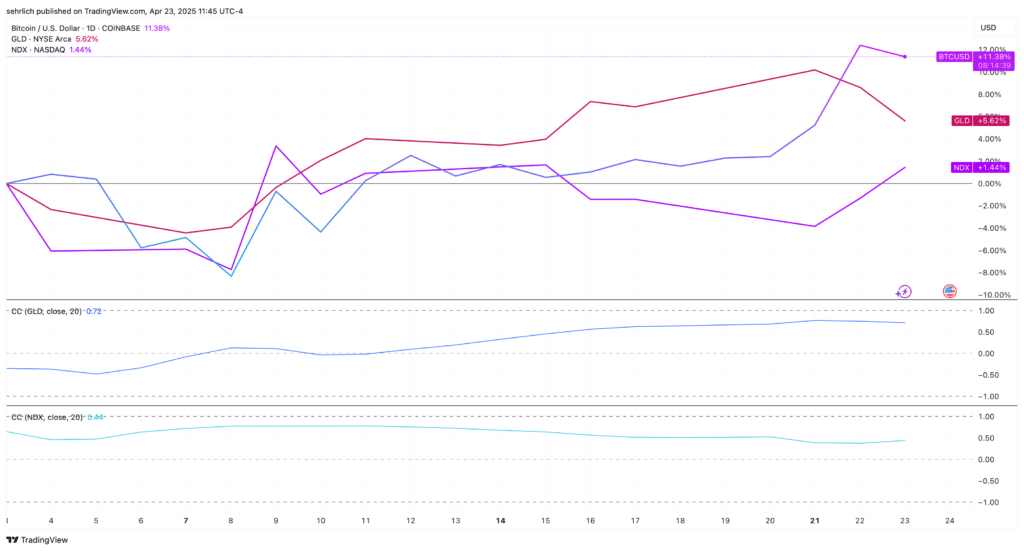

With this solid foundation in the face of widespread market panic earlier this year, these assets are staging a furious recovery as bitcoin increasingly decouples from broad equities indices and is increasingly correlated with gold. Since April 9, when Trump paused his tariffs, spot bitcoin ETFs have gained $15.66 billion in assets, virtually bringing them back to even on the year.

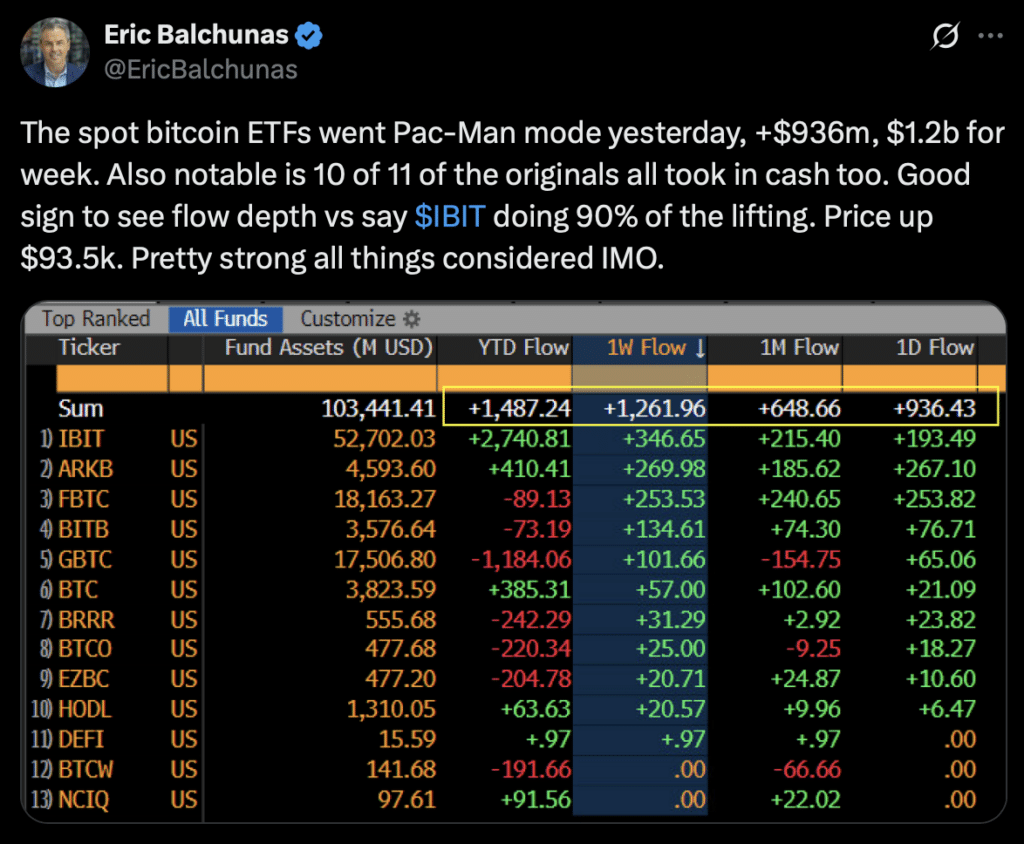

The capstone for this surge came on April 22, when nearly $1 billion in assets came in that very day. According to data from Bloomberg Intelligence, more than $1.6 billion came in over the single week. $936 million came in on April 22, with high inflows the day before as well.

Read more: Why Trump-Induced Stagflation Could Finally Make Bitcoin a Safe Haven

One Mountain Left to Climb

But even if these products become even on the year, they still have a long way to go to regain their all-time high of $126.1 billion on Jan. 25. Specifically, they need to add another $17.94 billion, which is the difference between their current tally of $108.16 billion and the all-time high.

What will it take to get there? For starters, more good news similar to Trump’s statement Tuesday that he will not try to fire Federal Reserve Chairman Jerome Powell, progress on the multitude of trade deals, and a ratcheting down of pressure between the trade war with China.

Don’t Miss This Week’s Episode of Bits+Bips!