July 27, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Digital asset funds saw a net outflow of $28M last week, according to data from CoinShares.

-

Aave plans to launch its institutional platform within the next few weeks.

-

Binance has begun limiting new user leverage to 20x.

-

Amazon denied a report saying it will accept BTC as payment.

-

Tesla took a $23M impairment in Q2 thanks to its BTC investment.

- Shopify now allows businesses to sell NFTs directly through their own storefront.

- Goldman Sachs has filed with the SEC for a “DeFi” and blockchain ETF.

What Do You Meme?

What’s Poppin’?

The US Department of Justice (DOJ) is investigating whether Tether executives committed bank fraud, according to a report from Bloomberg. The charges may focus on Tether’s early days, when they allegedly lied about being a crypto company when opening initial bank accounts.

Per Bloomberg, three unnamed sources “with direct knowledge of the matter” claim that federal prosecutors are examining “whether Tether concealed from banks that transactions were linked to cryptocurrency.”

As of now, no criminal charges have been filed against Tether concerning the concealment of cryptocurrency transactions. However, Bloomberg reports that federal prosecutors have sent letters to individuals at Tether, alerting them of an investigation. Such notices signal that senior DOJ officials could be making a decision soon on whether charges are warranted.

In response to the Bloomberg article, Tether published a statement which did not entirely deny the report but certainly indicated it was wrong:

“This article follows a pattern of repackaging stale claims as “news.” The continued efforts to discredit Tether will not change our determination to remain leaders in the community. Tether routinely has open dialogue with law enforcement agencies, including the U.S. Department of Justice, as part of our commitment to cooperation, transparency, and accountability.”

At this point, regulatory scrutiny and USDT go hand in hand. The stablecoin recently came under fire after releasing the composition of its reserves. After years of maintaining that USDT was backed 1:1 with US dollars, the company recently reported that cash only makes up 3.87% of its reserves.

Furthermore, Tether is just months removed from a settlement with the New York Attorney General’s office over an investigation into Tether’s relationship with Bitfinex and the alleged cover-up of losing $850M in customer funds. Tether settled for $18.5M, admitted no wrongdoing, and agreed to the aforementioned quarterly reports on the composition of Tether’s reserves.

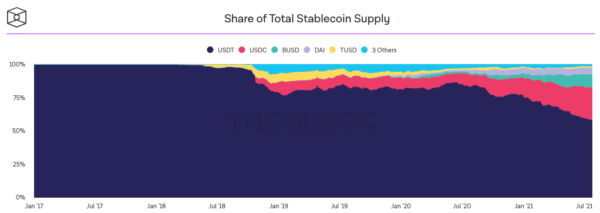

USDT is currently the third-largest cryptocurrency. At a $60B+ market capitalization, USDT makes up 57% of all stablecoins in circulation, towering over second-place USDC ($27B) by more than two times.

Bonus Rec. Read

CoinDesk’s David Z. Morris on why Tether’s collapse may be good for crypto in the long term:

Recommended Reads

- Arca’s Jeff Dorman with a mid-year review of the firm’s 2021 digital asset predictions:

- Alex Gladstein on Bitcoin and Palestine:

- Andre Cronje, founder Yearn.finance, on fair launches in crypto:

On The Pod…

Why ShapeShift’s Erik Voorhees Thinks Toxic Bitcoin Maximalism Is Bullshit

ShapeShift recently announced an intent to decentralize — a move that would transition the one-time centralized exchange to a full-on DAO. Erik Voorhees, founder and CEO of ShapeShift, comes onto the show to talk about decentralizing the exchange, along with his thoughts on Bitcoin maximalism and crypto regulation. Show highlights:

- why ShapeShift is decentralizing the company

- how ShapeShift used to work

- what needs to happen for ShapeShift to decentralize

- why user experience should not change during the transition

- how the FOX token works

- what parts of a company cannot be decentralized yet

- how ShapeShift’s forthcoming foundation will function

- how ShapeShift decided upon the allocations for the FOX token airdrop

- why ShapeShift employee and shareholder FOX tokens are locked up for three years

- what Erik’s role will be going forward

- how ShapeShift plans to attract devs

- why Erik believes FOX is not a security

- how Erik wants the SEC to handle crypto

- why he believes THORChain is one of the most critical projects in crypto

- why he is opposed to Bitcoin maximalism

- Erik’s thoughts on BitMEX’s and Binance’s regulatory issues

- what he thinks about stablecoin regulation

- Why Erik believes ShapeShift and Uniswap are not competitors

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians