August 30, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Sam Bankman-Fried said FTX is not planning to acquire crypto exchange Huobi.

- The Monetary Authority of Singapore makes it harder for retail investors to trade crypto.

- FedNow, the instant payments service developed by the Fed, could launch next year.

- Texas’s grid operator, the Electric Reliability Council of Texas, has slowed the issuance of new permits for bitcoin miners to connect to the grid.

Today in Crypto Adoption…

- Users will now be able to post NFTs on Facebook.

- Snoop Dogg and Eminem performed as Bored Apes at the MTV awards.

- Argentina’s province Mendoza will accept cryptocurrencies for tax payments.

- In order to circumvent sanctions, companies in Iran are now allowed to use crypto to pay for imports.

The $$$ Corner…

- Limit Break, a web3 gaming startup, raised $200 million over two rounds of funding.

- GammaX, a crypto derivatives exchange, closed a $4 million seed round.

- Lightnet Group secured a $50 million investment from LDA Capital to boost Web3 and cross border payments.

- IOG, a Cardano blockchain builder, funded a $4.5 million research hub at Stanford University.

What Do You Meme?

What’s Poppin’?

Accusations Against Ava Labs Roil Crypto Twitter, But Token Rebounds

On Sunday night, Crypto Leaks, an outlet that claims to expose corruption in crypto, accused Ava Labs of using the law firm Roche Freedman to initiate lawsuits against competitors like Solana and gain a strategic advantage.

On Monday Emin Gün Sirer, the CEO and founder of Ava Labs (disclosure: a sponsor of Unchained), categorically denied the accusations.

Ava Labs is the company building layer 1 blockchain Avalanche, which has a market capitalization of $5.5 billion and $1.8 billion in total value locked.

“The allegations on this site are categorically false. Ava Labs believes in transparency and facing the world head-on, not through behind-the-scenes dealing or activity,” said Sirer in a statement.

Kyle Roche, the owner of Roche Freedman, also put out a blog post denying the claims. “In all of my dealings with Emin Gün Sirer and the rest of the Ava Labs team, they have always acted with the highest integrity.”

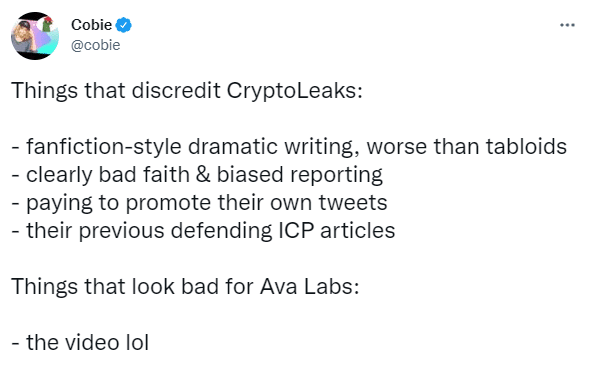

Some noted what looks like ties between Crypto Leaks and ICP, a company that is going through a fraud lawsuit brought by Roche Freedman. (The only other investigations by Crypto Leaks were about “attacks” on ICP.)

Drama sparked all over crypto Twitter, with many different opinions on whether the accusations were true or not, and whether this would be the end of the blockchain.

- “It’s just some noise and cheap shots that try to find the conclusion the publisher created,” said CoinDesk reporter Griffin McShane.

- “I assume this is accurate and that it’s as bad as it looks. Fits with everything I’ve seen previously from both Sirer and Roche,” said Ari Paul, CIO of BlockTower Capital.

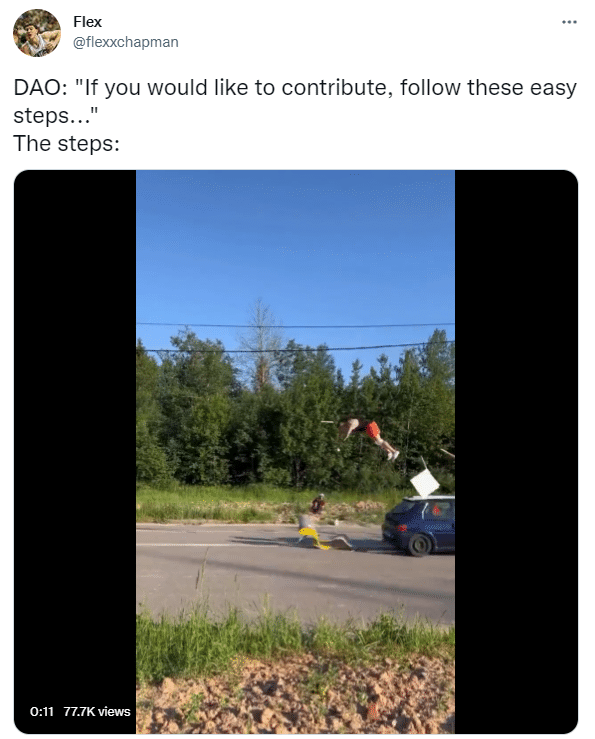

Eric Wall took the news a bit more lightly:

The native token of the Avalanche network AVAX initially plummeted 11% from just under $20, hitting a low of $17.56, according to CoinMarketCap. However, by press time, AVAX had almost fully rebounded and was trading at $19.50.

Recommended Reads

- Nic Carter on social slashing

- Ignas on Compound III

- The DeFi Investor on protocols with real yields

On The Pod…

Andrew Hinkes, partner at K&L Gates and adjunct professor at NYU, and Martin Koeppelman, cofounder of Gnosis, talk about the sanctions on Tornado Cash, how they will impact Ethereum on the base layer, and the likelihood of having two chains. Show highlights:

- the legal meaning of the OFAC sanctions on Tornado Cash and why it is causing complications

- how legislation is built for the fiat world, and how in DeFi and crypto there’s no clarity

- whether a proof of work chain or a proof of stake chain would be more censorship resistant

- whether laws apply to validators in a PoS chain

- the different entities involved in Proof of Stake

- how a user-activated soft fork works and the conditions in which a fork could happen

- whether social slashing is enforceable considering it is not in the protocol

- the likelihood of Ethereum becoming a permissioned system

- the role of Flashbots’ relay code and what it means for Ethereum’s censorship resistance

- how DeFi’s exposure to US-based institutions can affect the likelihood of the chain complying with sanctions

- why US-based companies will choose a conservative path, considering the lack of guidance

- the importance of educating the regulators

- how cash and crypto are the only remaining private payment methods

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians