March 17, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Eight members of Congress wrote to SEC chair Gary Gensler about the SEC’s treatment of crypto firms, accusing the regulator of being “inconsistent with the Commission’s standards for initiating investigations.”

-

Aave is set to launch Aave V3 on Ethereum, Polygon, Fantom, Avalanche, Arbitrum, Optimism, and Harmony.

-

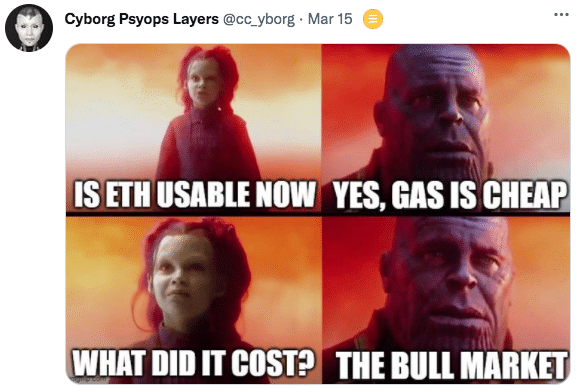

Ethereum successfully merged on Kiln – the final public testnet before the official mainnet merge.

-

Elliptic has identified several hundred thousand crypto addresses linked to Russian-based sanction actors.

-

A new proposal on MakerDAO’s forum is seeking to shake up MKR tokenomics.

-

Utrust, a Portuguese crypto payments firm, received a license from Portugal to operate as a virtual asset service provider.

-

Argentina is set to include cryptocurrency firms in an upcoming change to its AML regulations.

-

Canada’s central bank is partnering with MIT for CBDC research.

-

Juno blockchain decided to change a user’s JUNO token balance via a governance vote.

-

0xSifu is now selling a Sifu coin 👀

Today in Crypto Adoption…

-

Ukrainian President Volodymyr Zelenskyy legalized crypto in Ukraine yesterday.

- London-based bank HSBC purchased a parcel of land in The Sandbox.

The $$$ Corner…

-

Institutional crypto custodian Hex Trust raised $88 million in a Series B funding round.

What Do You Meme?

What’s Poppin’?

Bored Ape Yacht Club Is Launching a Token That Will Be Aped

ApeCoin, a token linked to the NFT collections Bored Ape Yacht Club, Mutant Ape Yacht Club, and Bored Ape Kennel Cub, was announced yesterday.

ApeCoin’s use case is governance-based, but also includes benefits like access to exclusive games, merch, and events. Per the website, the supply is fixed at 1 billion coins. 15% of tokens are allocated to Bored Ape Yacht Club and Mutant Ape Yacht Club NFT holders. 47% is being used to fund the ApeCoin DAO treasury. 37% of tokens are set aside for Yuga Labs, BAYC founders, and launch contributors. 1% will go to the Jane Goodall Legacy Foundation.

Coinbase, Gemini, FTX, and Kraken have already announced their support for the token, which will start to unlock today.

Interestingly, Yuga Labs, the developers behind the various Yacht Club communities, is not taking charge of the token drop. Instead, Yuga Labs is delegating the drop and ownership of ApeCoin to an entity called ApeCoin DAO, which is “a decentralized organization where each token holder gets to vote on governance and use of the Ecosystem Fund.” On top of that, ApeCoin DAO is “supported” by Ape Foundation. Board members for the Ape Foundation include Reddit co-founder Alexis Ohanian and Amy Wu, head of ventures and gaming at FTX, among others.

While ApeCoin is not officially being launched by Bored Ape Yacht Club, the project did point out that it would be utilizing the token in some way. “We’re adopting ApeCoin as the official currency of the BAYC Ecosystem,” explained the team on Twitter.

Holders of CryptoPunks and Meebits, for which Yuga Labs just purchased the IP rights, will not be receiving any ApeCoin tokens at launch. Data from CryptoSlam shows that the announcement immediately increased demand for Bored Ape Yacht Club and Mutant Ape Yacht Club NFTs, which saw a 457% and 361% increase in volume day-over-day (as of 1:30 am ET).

While much of the response to ApeCoin was positive on Twitter, Loot creator Dom Hoffman appeared unimpressed with ApeCoin’s utility:

Recommended Reads

-

Ansem on the market outlook for Q2 2022:

-

dYdX on the best structure for DAOs operating outside of the US:

-

Fred Wilson on the benefits of venture capital in web3:

On The Pod…

What Is It Like to Only Work for DAOs? Chase Chapman Tells All

Jack of all metaverse-trades Chase Chapman discusses her experience working for DAOs, how DAO tooling and governance can improve, and drops a hot take about Discord. Chase brings a unique perspective to Unchained as a co-founder and advisor at Decentology, host of On the Other Side podcast, and active DAO contributor at Orca, Index Coop, and Rabbit Hole. Show topics:

-

how Chase got into crypto

-

new avenues for bringing more women into crypto

-

how DAOs change the nature of work

-

how Chase gets paid – and why her accountants might start ducking her calls

-

why Chase is passionate about DAOs having a core set of values

-

why Chase thinks terms like “permissionless” and “decentralized” should not be used to describe DAOs

-

what DAOs can learn from corporate structures

-

why Chase is coming around to the idea that DAOs might not need a single HR department

-

how DAOs are dealing with inactive whale token holders versus DAO contributors (who own smaller amounts of token)

-

what suggestions Chase has for some of the recent big DAO controversies involving Ethereum Name Service and SushiSwap

-

the role of anonymity in DAOs

-

which DAO tools Chase is impressed with and what SnapShot has in common with Wikipedia

-

why Discord is not that bad for DAO management

- how Chase envisions DAOs and NFTs intersecting in the future

- what DAO trends Chase is looking forward to in the coming months

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians