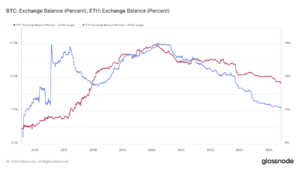

The percent supply of bitcoin (BTC) and ether (ETH) held on exchanges dropped to multi-year lows on Monday.

Just over 11.5% of BTC’s supply is currently held in wallet addresses belonging to exchanges, a roughly 8% decrease since the start of the year before the U.S. Securities and Exchange Commission approved several spot bitcoin ETFs, according to data from blockchain analytics firm Glassnode.

For ETH, exchanges hold about 10.6% of the cryptocurrency’s supply in their wallet addresses, about a 10.6% decline in 2024, as those in the crypto space and traditional finance are gearing up for the launch of several spot ether ETFs. (And no, the repeated numbers are not a mistake — ETH held on exchanges started the year at 11.8% and has now dropped 10.6% to 10.6%.)

The last time exchanges held a comparable record low percentage of the BTC supply was in Dec. 2017, and for ETH, Oct. 2015, the same year Ethereum had its first transaction.

A drop in the amount of BTC and ETH held in exchanges is typically a sign of investors adopting a longer-term strategy of holding since tokens off exchanges and into direct custody are less accessible for selling.

Read More: Ethereum ETFs Likely Protect Ether From the SEC. But What About Staked ETH?

The amount of BTC held across all exchanges stands at over 2.28 million BTC, valued at around $154 billion, per Glassnode, and for ETH, exchanges hold nearly 12.66 million ETH, about $48 billion.

The decrease in BTC and ETH’s percent supply on exchanges comes as centralized exchange Kraken witnessed its largest outflows of bitcoin and ether in roughly seven years. On May 29, Kraken saw a daily outflow of BTC and ETH worth over $4.45 billion at current market prices, the largest daily outflows for the two since 2017 for both cryptocurrencies, according to onchain data firm CryptoQuant.

Despite the substantial outflow, Kraken has an onchain portfolio of $20.5 billion at the time of writing, per crypto research company Arkham Intelligence.