April 5, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bitcoin 2022 is kicking off on April 6th.

-

SEC Chair Gary Gensler called for more regulation on the crypto industry during a speech at the University of Pennsylvania yesterday and revealed that the SEC is exploring a shared role with the CFTC in regulating crypto platforms.

-

Elon Musk bought 9.2% of Twitter (which isn’t a crypto headline, but it’s not ~not~ a crypto headline).

-

The Ronin hacker sent $7 million in stolen funds through the privacy mixer Tornado Cash.

-

BitMEX laid off 75 employees after an attempt at purchasing a German bank fell through.

-

Intel released its second-generation BTC mining chip.

-

Digital asset investment vehicles saw their second straight week of inflows last week.

- Digihost is the first publicly traded miner to offershareholders a BTC dividend.

Today in Crypto Adoption…

-

The Japan Exchange Group says it will launch a digital securities market by 2025.

- The UK will issue an NFT this summer in a bid to position the UK as crypto-friendly.

The $$$ Corner…

-

Moneybox raised a $45.9 million Series D funding round to help build out crypto offerings.

-

Chorus One announced a $30 million venture fund to invest in other crypto projects.

- NFT meme marketplace Dank Bank raised $4.2 million in a seed funding round.

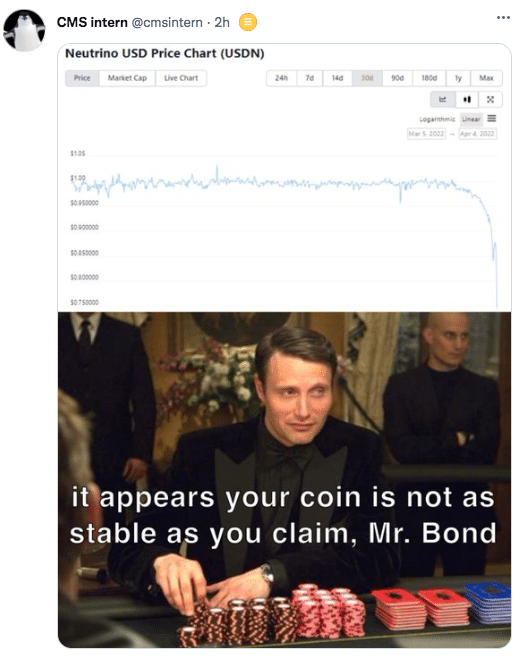

What Do You Meme?

What’s Poppin’?

Market Manipulation Charges Cause USDN to De-Peg

Neutrino dollar (USDN), an algorithmic stablecoin built on the smart contract platform Waves, lost its peg on Monday morning, sliding to a low of $.68.

The de-pegging of USDN coincides with a flurry of accusations being thrown around regarding the alleged price manipulation of Waves, which has seen its token price more than 6x in 2022.

@0xhamz started the conversation on Twitter by claiming that the Waves team has been using leverage to prop up the price of its own token. “WAVES is the biggest Ponzi in crypto. It [the team] has recklessly engineered price spikes by borrowing USDC at 35% to buy its own token. Continuous WAVES market cap growth is needed to keep the system stable. WAVES will eventually crash and USDN will break with it.”

For context, Waves is very similar to Terra in that its native token, WAVES, is used to maintain the USDN’s peg to the dollar, just like Terra utilizes LUNA to keep UST at a 1:1 ratio with the dollar. Waves is very dependent on the success of USDN. For example, Neutrino, a DeFi protocol enabling the creation of stablecoins like USDN, accounts for 50% of the total value locked into Waves.

“If WAVES prices drop enough – WAVES mkt cap could be less than USDN outstanding. This would mean USDN is insolvent and would depeg,” explained 0xHamz. “I call the platform ponzi because it is being propped up by borrowed money. There is no organic activity.”

In response, Waves CEO Sasha Ivanov took to Twitter to debunk the allegations. However, instead of just denying the thread by 0xhamz, Ivanov pointed a finger at Alameda Research, one of the largest market makers in crypto, claiming that “@AlamedaResearch manipulates $waves price and organizes FUD campaigns to trigger panic selling.” Ivanov cited the activity of an address tied to Alameda Research’s email as proof.

FTX CEO Sam Bankman-Fried, the founder of Alameda, promptly denied the accusations, calling it “bullshit.”

Regardless, Ivanov is now supporting a new governance proposal on Vires, the Waves equivalent of Aave, that would essentially force Alameda Research out of its short WAVES position. “In order to prevent price manipulation and protect the ecosystem I propose to temporary [sic] reduce the liquidation threshold for Waves and USDN borrowing to 0.1%. Also I propose to limit the maximum borrow APR to be 40%,” the proposal reads.

However, based on comments found on the governance forum, the proposal is not being taken seriously. “This is a terrible proposal. Just because we don’t like that a party took a big short position doesn’t mean we should change the protocol to target them back,” wrote Mortax. “So we’re trying to pass a proposal that would instantly liquidate users on a whim? Who would ever use Vires again after this?” added lvxvre.

As of press time (6:30 pm ET), USDN is trading at $.78 and has a market capitalization of $827 million. WAVES is trading at $34.68, marking a 25% decrease in a twenty-four hour span.

Recommended Reads

-

Mario Gabriele on finding the next Solana (from the perspective of Multicoin):

-

@accel_capital compiled a fantastic reading list spanning topics like NFTs, DAOs, GameFI, and more:

-

@CryptoHarry_ on the relationship between 4pool, UST, and FRAX:

On The Pod…

Why TBD’s Mike Brock Is Skeptical That Decentralized Applications Will Become Popular

Mike Brock, general manager of TBD at Block, discusses how TBD’s yet-to-be-released DEX is structured, explains why he thinks decentralized solutions do not necessarily need blockchains, and tells the humorous story about how Jack Dorsey convinced him to start working on a Bitcoin project. Show highlights:

- what TBD is and what its relation to Block (formerly Square) is

- how TBD differs from Spiral, another Block-based Bitcoin firm

- how tbDEX works and why building on-ramps and off-ramps to crypto is so important

- who will be supplying the liquidity for tbDEX

- why Mike is passionate about creating digital identity infrastructure

- how tbDEX will incorporate digital identity tooling into its protocol

- what Mike thinks about Vitalik Buterin’s misgivings concerning tbDEX’s design

- why Mike fell down the rabbit hole (thanks Jack Dorsey)

- what lessons Mike learned at Cash App that he is using at TBD

- which stablecoin TBD will be working with

- why Mike is not a believer in DeFi

- why tbDEX (or, seemingly, other TBD products) will not utilize tokens

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians