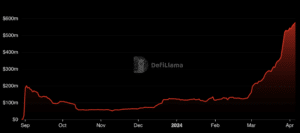

Decentralized exchange Aerodrome, which only launched seven months ago, reached an all-time high of $580 million in locked value in its smart contracts on Friday, growing more than 382% since Jan. 1 when its TVL sat at about $120 million, data from blockchain analytics firm DefiLlama shows.

The three largest trading pair pools by TVL — DOLA/USDbC, WETH/USDC, and USDC/AERO — collectively are worth over $244 million, representing roughly 42% of overall TVL on Aerodrome.

The Base-native DEX is already the sixth largest exchange across all blockchain networks by TVL, behind Uniswap, Curve, PancakeSwap, Balancer, and Raydium.

Aerodrome’s high in TVL comes 10 days after AERO, its native token that is distributed to liquidity providers, climbed to an all-time high of $2.00, before settling around at $1.37 at the time of publication, per CoinGecko. Despite the drop, the price of AERO has increased 81.2% in the past 14 days and 183.4% over the month, which has contributed to Aerodrome’s TVL growth. The USDC/AERO pool has $76 million in TVL, a Dune analytics dashboard shows.

Aerodrome also has added over $126 million in USDC liquidity through its boost program since Dec. 2023, a sign of the DEX’s commitment to increase usage of Circle’s stablecoin on Base. In a post on Warpcast earlier today, Aerodrome announced the extension of its boost program and its continued partnership with risk management firm Gauntlet to double its USDC match program, which means “each week Aerodrome will be distributing $25,000 in USDC voting incentive boosts per week pro-rata to protocol incentivizers.”

“The native USDC adoption push on [Base] has been so successful thanks to [Aerodrome] and the liquidity partners, it’s doubling down,” wrote Adam Atkins, the co-founder of crypto advisory firm Four Moons, on X on Friday. “Huge for Aerodrome’s TVL and a big win for traders.

Over the past seven days, Aerodrome has generated between $35 million and $50 million in daily trading volume, a substantial increase in activity since the first week of 2024 when it averaged just $3.2 million in daily trading volume. Despite this growth, Aerodrome lags far behind the fifth largest DEX by TVL – Raydium – which did over $556 million in trading volume yesterday, per DefiLlama.

Aerodrome’s ascent shows how Base is becoming more liquid, a move that helps with overall adoption of the layer 2 network.

Read more: Coinbase to Store More Customer, Corporate Balances on Base

How It Started

Aerodrome was rolled out in August 2023 as a fork of Velodrome Finance, the largest decentralized exchange on layer 2 network Optimism. However, Aerodrome has since surpassed its predecessor Velodrome’s TVL figure of $170 million.

At presstime, Aerodrome’s TVL makes up 46% of the entire TVL on Base, which has seen sharp increases in memecoin activity and transactions. The daily number of transactions on Base has increased from 372,400 at the start of the year to around 2.9 million as of yesterday, according to onchain intelligence firm Artemis.

In a few weeks, Aerodrome will unveil Slipstream, new concentrated liquidity pools aimed to provide “low slippage onchain swaps,” according to a Velodrome blog post. Even though Slipstream has been rolled out on Velodrome, the concentrated liquidity pools have yet to make their way to Aerodromease-native exchange.

Slippage refers to the difference between a trader’s expected price of an asset and the actual price at which the transaction is executed.