February 4, 2022 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Jump Crypto replaced the 120,000 ETH on Wormhole’s ETH contract so that wETH was once again fully-backed on Solana.

-

Kraken’s proof-of-reserves audit showed $19 billion worth of BTC and ETH.

-

The Federal Reserve of Boston and Massachusetts Institute of Technology’s Digital Currency Initiative published their joint CBDC research.

-

Paxos is adding support for Aave, Uniswap, Chainlink, and Polygon to its wallets.

-

Galaxy Digital says it uses an 80% sustainable power mix across its mining operations.

-

Miami received $5.25 million from CityCoins.

- An $11.7 million gold cube in Central Park is affiliated with $CAST, a cryptocurrency.

Today in Crypto Adoption…

-

During a conversation at MicroStrategy’s Bitcoin for Corporation’s conference, Christine Sandler, head of sales and marketing at Fidelity Digital Assets, revealed that the company started mining cryptocurrency and accumulating Bitcoin in 2014.

-

GameStop unveiled a partnership with the Ethereum layer 2 solution Immutable X to launch its own NFT marketplace.

-

Personalized video app Cameo is launching an NFT pass.

-

Gaming developer Ubisoft has entered into an agreementwith HBAR Foundation to run a node on Hedera Hashgraph.

The $$$ Corner…

-

Yuga Labs, the developers behind Bored Ape Yacht Club, is looking to raise money at a $5 billion valuation from a16z.

-

Trust Machines raised $150 million to unlock Bitcoin’s web3 potential.

- Tribal Credit, which recently unveiled a cross-border payment system with the Stellar Development Foundation, raised $60 million in a Series B.

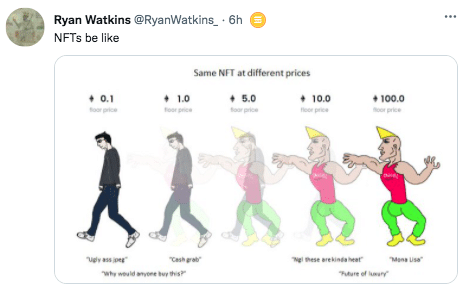

What Do You Meme?

What’s Poppin’?

Crypto Taxes Are the Talk of the Town

A decision by the IRS to issue a tax refund to Joshua and Jessica Jarrett could have long-lasting implications for how staking rewards are taxed.

Last year, Joshua and Jessica sued the IRS, arguing that they had incorrectly paid taxes on Tezos staking rewards as if it were income rather than property. The couple believe that staking rewards should only be taxed once sold.

This week, the IRS issued the Jarrett’s a refund. However, the regulator did not explain the reasoning behind the refund (and, therefore, is not setting a precedent).

In response, Joshua says he is not taking the refund and will instead wait for an official ruling (and, therefore, precedent). “I refused the offer, because I know that until my case receives an official ruling, I have no certainty they won’t try to tax me again,” he explained on Twitter.

Essentially, “Josh sued the IRS for clarity on taxation of new tokens created through staking. The IRS tried to pay him off to drop the suit. He turned down the money to continue the case & seek binding precedent for us all,” wrote the Blockchain Association’s Jake Chervinksy on Twitter. The future court case, however, would not be all-encompassing for crypto rewards. According to CoinTracker’s Shehan Chandrasekera, if the future court case is decided in favor of the Jarretts, it would only set a precedent for proof-of-stake staking income (and would not cover interest, mining, or airdrop income).

In related tax news…

-

A bipartisan group of US House representatives reintroduced the “Virtual Currency Tax Fairness Act” yesterday that would exempt crypto users from paying capital gains taxes on transactions less than $200.

-

Coinbase has teamed up with TurboTax to allow users to convert state and federal tax refunds directly to crypto via the exchange.

Recommended Reads

-

Arca CIO Jeff Dorman on how to figure out if the bottom is in:

-

Joel John on tokenizing NFT marketplace:

-

Forefront compiled 15 of the best articles on web3:

On The Pod…

Are Democrats Against Crypto? These Two Congressional Candidates Say No (Bonus Content: I wrote a summary of the episode on Medium, which can be found here.)

Shrina Kurani, a Democrat running for a House seat in California, and Morgan Harper, a Democratic candidate running to represent Ohio in the US Senate, explain why they are running pro-crypto campaigns. They discuss how crypto will affect the 2022 midterms, justify being both pro-crypto and pro-environment, and talk about the importance of educating regulators about Web3. On this episode of Unchained, they highlight:

-

how Morgan’s work at the American Economic Liberties Project and Consumer Financial Protection Bureau led her to run for Senate on a pro-crypto platform

-

why Shrina chose to mint NFTs on Solana to help fundraise for her campaign

-

what issues Morgan and Shrina have with the current financial system (and how they believe crypto could help solve such issues)

-

why both Shrina and Morgan stress that education is the key to making effective crypto policy in the US

-

what message Shrina and Morgan want to send to fellow Democrats about the crypto industry

-

why Morgan believes that single-issue voting for crypto candidates could be dangerous

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Feb. 22. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians