September 23, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Helium community members voted in favor of moving the project to the Solana blockchain.

- Congressman Warren Davidson said there’s an “outside chance” for stablecoin regulation happening this year.

- Bitcoin mining hosting company Compute North filed for Chapter 11 bankruptcy protection.

- The CFTC imposed a $250k fine on bZeroX and charged Ooki DAO for “offering illegal, off-exchange digital-asset trading, registration violations, and failing to comply with [the] Bank Secrecy Act.

- The Uniswap Foundation announced $1.8 million in grants for 14 recipients.

- Wintermute, which has hacked for $160 million, is warning the attacker to give back the funds.

- Binance set up a new advisory board and hired Barack Obama’s former political guru David Plouffe.

- A new bill in the UK would make it easier for law enforcement to seize, freeze and recover cryptocurrencies.

Today in Crypto Adoption…

- Coinbase obtained regulatory approval to operate in the Netherlands.

- Russia’s finance ministry and central bank have reportedly agreed on a bill to allow cross-border settlements in crypto.

- Crypto firm Chain signed a four-year sponsorship deal with the New England Patriots.

- NFT Marketplace TravelX launched tokenized flight tickets in partnership with low-cost Argentinian airline Flybondi.

The $$$ Corner…

- FTX wants to raise up to $1 billion for additional deal-making at a valuation of $32 billion.

- Crypto automated trading bot platform 3Commas garnered $37 million in a Series B funding round.

- Chiru Labs, creator of the Azuki NFT collection, is closing in on a $30 million Series A round.

- Immunefi, a Web3 bug bounty platform, closed a $24 million Series A funding led by Framework Ventures.

- Web3 fund Variant led an $18.5 million round for developer platform Hyperlane.

- Lit Protocol, an open source utility, raised $13 million led by crypto fund 1kx.

- MEV infrastructure firm Skip raised $6.5 million led by Bain Crypto.

- Block Green, a lending protocol for miners, announced a $3.7 million seed round led by Peter Thiel’s Founders Fund.

- Crypto tax reporting app Binocs closed $4 million in a seed round.

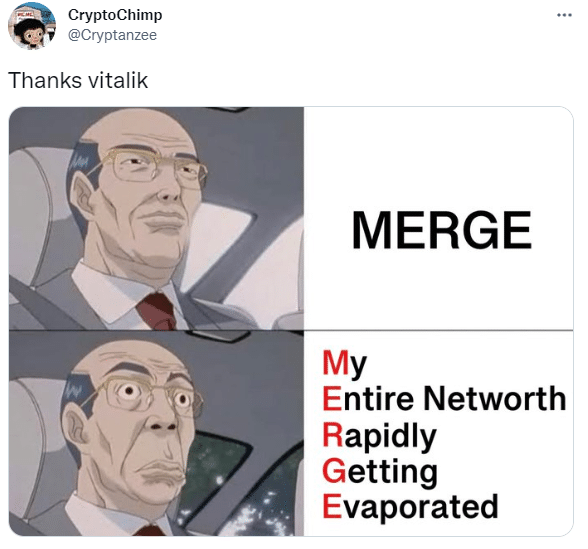

What Do You Meme?

What’s Poppin’?

WSJ: Coinbase Engaged in Proprietary Trading

Coinbase, the world’s third-largest cryptocurrency exchange by daily volume, engaged in proprietary trading last year, according to the Wall Street Journal.

Proprietary trading, which is also known as “prop trading,” occurs when a trading desk at a financial institution, brokerage firm, investment bank, hedge fund or other liquidity source uses the firm’s capital and balance sheet to conduct self-promoting financial transactions.The news comes despite the fact that Coinbase executives testified before Congress and stated that the company was not running a proprietary trading business. Nevertheless, the WSJ reports that Coinbase hired at least four senior Wall Street traders to create a new business unit called Coinbase Risk Solutions (CRS).

According to the Journal, the business unit completed a $100 million transaction as a test. Coinbase’s goal with CRS reportedly was to find additional revenue streams, but the effort was dissolved within months of its creation.

Coinbase denied the accusations from the WSJ by saying the report confused “client-driven activities” with proprietary trading. “Unlike many of our competitors, Coinbase does not operate a proprietary trading business or act as a market maker,” the company said in a blog post.

“Coinbase does, from time to time, purchase cryptocurrency as principal, including for our corporate treasury and operational purposes. We do not view this as proprietary trading because its purpose is not for Coinbase to benefit from short-term increases in value of the cryptocurrency being traded,” Coinbase wrote.

Recommended Reads

- Ishan B on stablecoins

- Alt Street Journal on institutional adoption

- Arthur Hayes on the crypto markets

On The Pod…

Pat Toomey, U.S. Senator for Pennsylvania, talks about legislation in the crypto industry, how to determine if something is a security, the future of CBDCs, and much more. Show highlights:

- the structural differences between crypto tokens and securities

- why Sen. Toomey is demanding crypto legislation

- why “regulation by enforcement” does not provide clarity

- how to determine if a token is decentralized

- whether proof of stake consensus turns tokens into securities

- Sen. Toomey’s take on the new framework for stablecoin regulation

- whether it is appropriate to ban algorithmic stablecoins

- the importance of making disclosures so that regular users understand the risks of crypto

- how the collapse of Terra and other crypto companies like Voyager and Celsius affected lawmakers’ perception of crypto

- whether the US Treasury made a mistake with the Tornado Cash sanctions

- what the government should take into account in regards to a central bank digital currency (CBDC)

- why he believes the White House reports on crypto are not helpful and whether entrepreneurial talent is migrating to other countries

- the likelihood of any of the crypto bills passing soon

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians