Plus ERC-20 > ETH?

The big news this week was the mass hacking of prominent Twitter accounts, ostensibly to perpetrate a Bitcoin scam. Coinbase announces an upcoming Investor day even as it faces flak from the crypto community for selling blockchain analytics software to government agencies. Plus, Grayscale sees record inflows, PayPal confirms its crypto plans and Abra settles with the SEC and CFTC.

On the Unchained podcast, the “˜Why Bitcoin Now’ series continues with authors Michael Casey and Niall Ferguson speaking about how Bitcoin fits in the history of money, how Bitcoin behaves like an option on digital gold, and when it will behave like digital gold and more. And on Unconfirmed, we look at the rise of stablecoins since Black Thursday.

This Week’s Crypto News…

Twitter Hack Breaches VIP User Accounts to Perpetrate a Bitcoin Scam

A coordinated attack hacked numerous high-profile Twitter accounts, such as those of Elon Musk, Bill Gates, Kanye West, Jeff Bezos, Joe Biden and Barack Obama, to run a Bitcoin scam. The corporate accounts of Apple and Uber were compromised, as were those of a host of influential players in the crypto space – Binance, Gemini, Coinbase, CoinDesk, Charlie Lee and others.

Larry Cermak, Director of research at The Block, compiled all the high-profile Twitter hacks in a chronological order.

He says, “The takeaway is that the hacker started with large crypto accounts and stuck to only a few formats and addresses. The hacker then moved to non-crypto celebrities two hours after the first hack. They only used three BTC addresses … it’s totally unacceptable that it took Twitter to act as long as it did. At 4:17 PM ET it was absolutely clear to anyone that was paying attention that Twitter is compromised. It took Twitter 2 hours (at 6:05 PM ET) to start acting”

Initially, these hacked accounts promoted a Bitcoin giveaway scam associated with an organization dubbed “Crypto For Health.” Later, the hackers posted tweets with a Bitcoin address along with messages such as – “I am giving back to the community. All Bitcoin sent to the address below will be sent back doubled. If you send $1000, I will send back $2000. Only doing this for 30 minutes. Enjoy”

While Twitter reacted quickly to remove many of the messages, similar tweets were sent again from the same accounts, indicating that the hackers had completely overwhelmed Twitter’s security infrastructure. The popular social media platform had to eventually disable some of its services temporarily to prevent the scam from spreading further. On Thursday, the Federal Bureau of Investigation said it had opened an investigation into the hours-long hack.

According to reports, the Bitcoin wallets promoted in the tweets received over 300 transactions and Bitcoin worth over $100,000 indicating that some Twitter users fell prey to the scam. A Twitter investigation revealed that the hackers had compromised employee accounts in a “coordinated social engineering attack”.

Security experts have suggested that the blame for the incident squarely rests with Twitter due to security flaws in its service. However, a new report by VICE even suggests that hackers may have convinced a Twitter employee to help coordinate these takeovers.Following these hacks, the social media platform is now restricting posts containing crypto addresses. It has disabled the ability to share strings of numbers and letters on its site, typically used in crypto addresses. According to tests conducted by The Block Research, Litecoin, XRP, Monero, Bitcoin and Ethereum addresses could not be shared through tweets.

Grayscale records largest quarterly inflows in Q2, 2020

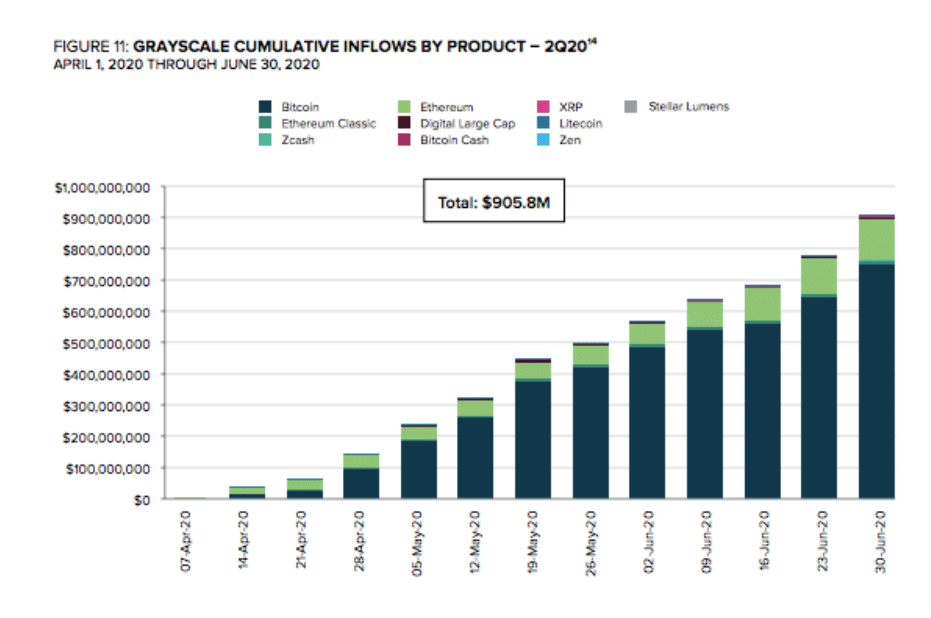

Digital asset manager Grayscale has recorded its largest quarterly inflows ever in Q2 2020. The company raised $905.8 million in that quarter, a nearly 100% jump from its previous highs of $503.7 million in Q1, 2020.

The company said in a report, “For the first time, inflows into Grayscale’s products over a 6-month period crossed the $1 billion threshold, demonstrating sustained demand for digital asset exposure despite a backdrop characterized by economic uncertainty.” Following a successful quarter, cumulative investment across Grayscale’s digital asset products has now reached $2.6 billion. Its products – Grayscale Bitcoin Trust and Grayscale Ethereum Trust – both experienced record quarterly inflows of $751.1 million and $135.2 million, respectively.

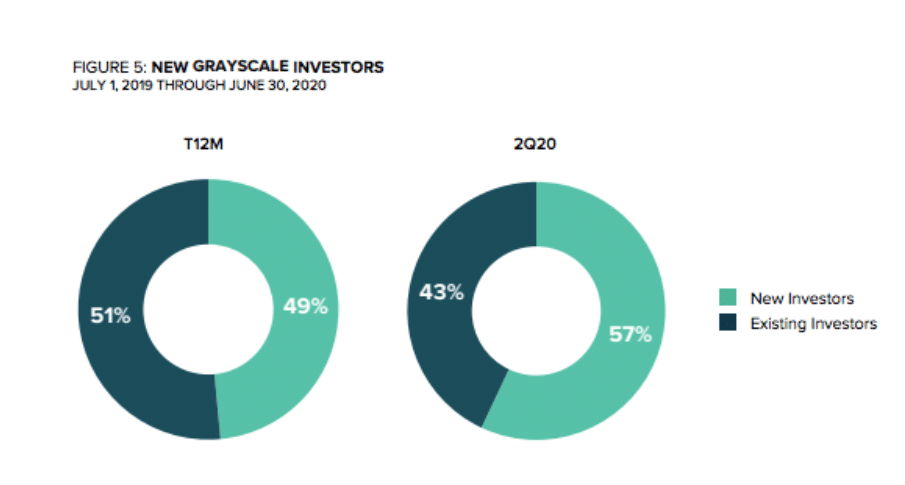

Grayscale’s products also saw interest from new investors who accounted for 57% of the investor base in Q2, 2020. In the same period, 81% of the existing institutional investors allocated their investments towards multiple products.

Grayscale’s total AUM now stands at $4 billion.

While you are at it, listen to Barry Silbert, founder and CEO of Digital Currency Group – the parent company of Grayscale, talk about his company and more, on the Unchained podcast.

ERC-20 tokens market cap surpasses Ethereum

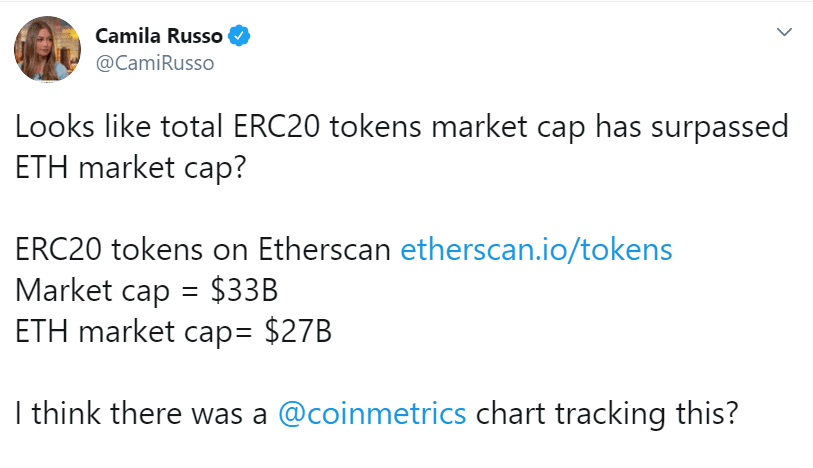

As Ethereum inches closer to ETH 2.0, the ERC-20 ecosystem seems to be having its own big moment. According to data compiled by Camila Russo, founder at crypto media publication The Defiant, the ERC-20 tokens running on the Ethereum network had a cumulative market cap of $33 billion while its native token ETH was at a market cap of $27 billion.

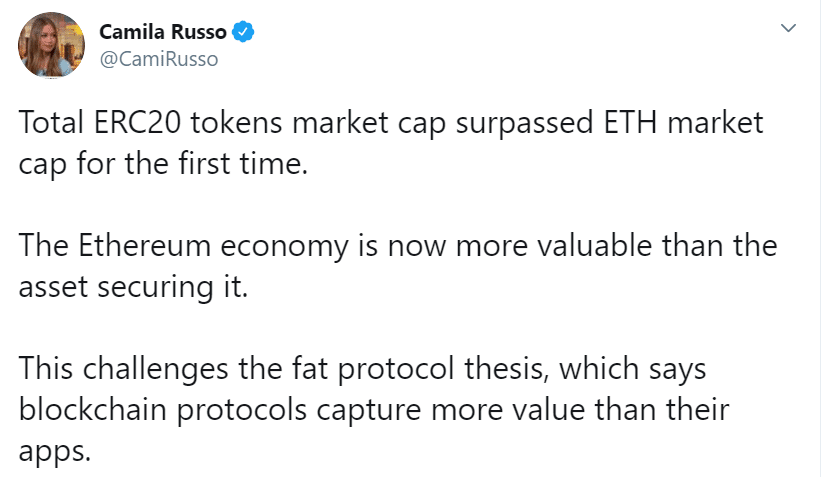

Many of the popular ERC-20 tokens are used in DeFi, and according to Decrypt, DeFi tokens are growing at a faster rate compared to Bitcoin. Interestingly, Camila tweeted, “The Ethereum economy is now more valuable than the asset securing it. This challenges the fat protocol thesis, which says blockchain protocols capture more value than their apps.”

Coinbase plans first ever investor day

Coinbase has planned its first-ever investor day on August 14th, fuelling rumors that the exchange is exploring options to go public. A Coinbase spokesperson said that the upcoming meeting is meant to “to facilitate a wider understanding of cryptocurrencies and blockchain technology.”

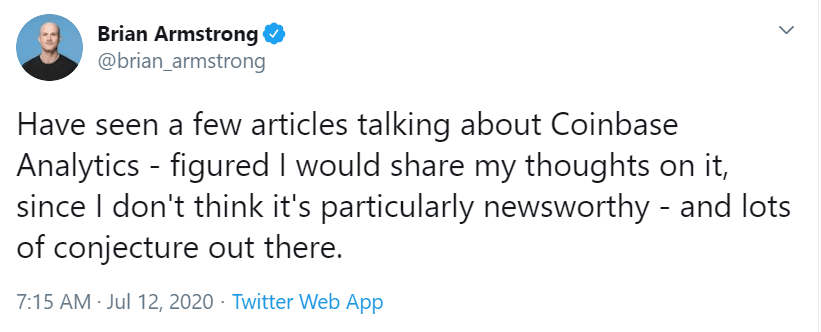

Last week, there were reports that the exchange may be planning a stock market listing later this year. The announcement of the investor day comes at a time when Coinbase is facing flak from the crypto community for providing its blockchain analytics software to the US Secret Service. Coinbase CEO Brian Armstrong wrote a tweet thread to defend his company’s decision of licensing analytics software to government agencies. He argued that blockchain analytics software has been around for a long time and people still had the option of using privacy coins if they wanted ‘true privacy’.

However, on Twitter, Larry Cermak of The Block pointed out the various inconsistencies in Brian’s tweets, saying, “What’s still not clear is whether Coinbase is giving government agencies access to the full cluster of all of their addresses. Coinbase has always had a notoriously difficult set of addresses to cluster. That data is only ever probabilistic unless you are Coinbase. … Remember that in 2018, Coinbase served client data of 13,000 users to the IRS. When you combine client data exports with perfect knowledge of the cluster, it creates a new (dangerous) dynamic.”.

PayPal confirms it is developing crypto capabilities

PayPal has confirmed that it is monitoring the crypto space closely and developing crypto capabilities. The payments giant had written a letter to the European Commission in March where it said, “PayPal is continuously monitoring and evaluating global developments in the crypto and blockchain/distributed ledger space,” and said it is taking “unilateral and tangible steps to further develop its capabilities in this area,” confirming earlier reports it will offer buying and selling of crypto.

Abra hit with $300k in Penalties by SEC, CFTC over ‘Illegal’ Swaps

The SEC and CFTC filed and settled charges against crypto app Abra (disclosure, a previous sponsor of my shows) for a product that enabled people to “get synthetic price exposure to the price movements of stocks and exchange-traded fund (“ETF”) shares that trade in the United States.” The SEC charged Abra and its Philippines-based partner company Plutus Technologies for “offering and selling security-based swaps to retail investors without registration and for failing to transact those swaps on a registered national exchange.” On the other hand, the CFTC charged both firms for “entering into illegal off-exchange swaps in digital assets and foreign currency with U.S. and overseas customers and registration violations.” Even though the Abra products were technically not securities, the SEC said that these swaps were nonetheless subject to US securities laws.

Will this open a can of worms for other DeFi products? Blockchain consultant Maya Zehavi certainly thinks so. She tweeted, “me thinks the SEC & CFTC are starting to signal they don’t like DeFi. … the legal construct Abra used in these swap contracts is essentially the same as those underlying most DeFi products. hence, they can potentially face the same exact charges”:

Meet Amiti Uttarwar – the First Confirmed Female Bitcoin Core Developer

Forbes ran a feature on Amiti Uttarwar, the first confirmed woman developer of Bitcoin Core. She’s an ex-Coinbase employee and Chaincode Labs alumna, and her talk titled “Attacking Bitcoin Core” is one the most comprehensive presentations on the Bitcoin network. Her work focuses on two main areas of the network — privacy and test coverage. Definitely check out this profile!