Banks ❤️ Bitcoin

After years of skepticism, JPMorgan sent out its rationale for why Bitcoin could double or triple in a research note sent out to its investors. It also has been reaching out to crypto-native firms in the hopes of enlisting sub-custodians to offer crypto custody. And Michael Del Castillo of Forbes published a thorough look at what may be the real purpose of Binance’s U.S. arm, Binance.US.

There’s tons of bank-related news this week, including a crypto-friendly bank that reported strong earnings in the third quarter, with much of the success credited to digital currency activity. In other news, on-chain metrics are pointing to what may be the most significant Bitcoin breakout yet. And yet another DeFi project has fallen prey to a manipulative attacker. Also, Coinbase has announced plans to launch a Visa debit card in the U.S. next year, and we’ve got some hilarious suggestions from my Twitter followers on ways to celebrate the 12th anniversary of the Bitcoin white paper.

On Unchained, acting comptroller of the currency Brian Brooks discusses the future of crypto banks, private blockchain-based transactions and how regulators like the OCC might approach DeFi. And on Unconfirmed, Matt Hougan of Bitwise explains how institutional investors in crypto have changed since 2017 and why the JPMorgan research note on Bitcoin is so significant.

This Week’s Crypto News…

JPMorgan Is Finally Bullish For Bitcoin

After years of skepticism, JPMorgan is now projecting Bitcoin’s price could see a “doubling or tripling,” assuming current trends hold. A research note published by the bank says the cryptocurrency is a valid alternative to gold among millennials while still cautioning that Bitcoin is overbought in the near term. In addition to demographic trends, the company cites positive developments for Bitcoin such as the recent announcement by PayPal to offer Bitcoin to customers as well as companies such as Square adding the asset to their balance sheets.

JPMorgan also had other crypto-related news this week. The Block reports that the bank has been in talks with crypto-native firms as it explores how it can offer cryptocurrency custody. The plan would likely be for JPMorgan to enlist sub-custodians to provide services, and it has reportedly reached out to Fidelity Digital Assets and Paxos, among others. Amidst all of this JPMorgan blockchain news, the firm’s digital currency, JPM Coin, is being used commercially for the first time this week to send payments worldwide. It also rebranded its banking network to the name Liink and invited its 500-plus financial institutions to start building on the platform. The head of that product, Christine Moy, called it “the foundation of an enterprise mainnet.” All these blockchain and digital currency efforts have now been housed under a new business called Onyx, which currently has more than 100 staffers.

Was Binance.US Set Up as a Decoy for US Regulators?

Michael Del Castillo at Forbes did a thorough look into Binance’s approach to US regulation — and in particular its reason for establishing the regulatorily compliant Binance.US. Michael obtained a 2018 document that detailed its plans for the launch of the entity that would eventually become Binance.US but was at the time called ‘the Tai Chi entity,” which Michael says is, “an allusion to the Chinese martial art whose approach is built around the principle of ‘yield and overcome,’ or using an opponent’s own weight against him.” He says, “While the then-unnamed entity set up operations in the United States to distract regulators with feigned interest in compliance, measures would be put in place to move revenue in the form of licensing fees and more to the parent company, Binance.”

Some of the more startling revelations from the document are a bold bullet point that says, “Key Binance Personnel continue to operate from non-U.S. locations to avoid enforcement risks.” The document then also says, “License and service fees paid by the US Service company to Binance are functionally US-sourced trading fees.” Then Michael writes, “But unlike an actual subsidiary whose parent company could be held accountable for regulatory violations, the Tai Chi entity would have little more than a contractual relationship, further ‘insulat[ing] Binance from U.S. enforcement,’ according to the document.” Michael writes, “Essentially, it would be a decoy.”

This article is perhaps the most thorough look into how Binance is playing regulatory arbitrage, in particular with US regulators. It’s definitely worth a read and certainly offers arguments to people who believe Binance is playing fast and loose when it comes to US regulations, as well as those who believe US regulations regarding crypto are too stringent.

Crypto-Friendly Bank Silvergate Reports Strong Earnings

After the OCC’s letter this summer giving banks the authority to custody crypto assets, there’s a lot of positive crypto news from banks, including those who have long been involved in the industry. For instance, Silvergate Bank, which has long been friendly to crypto companies, revealed a strong third quarter with much success related to digital currency activity. CEO Alan Lane remains bullish on the bank’s payment platform, the Silvergate Exchange Network, after seeing $36 billion in transfers during the last quarter, which surpassed the amount transferred in all of 2019. The number of digital asset customers has also risen by 23% to over 900. Lane also says the entry of JPMorgan, which also banks Silvergate customer Gemini, into the arena hasn’t resulted in any loss of business.

Avanti Granted Bank Charter

A Wyoming state regulator has voted unanimously to grant Avanti Bank & Trust a bank charter, which gives the firm the same powers as national banks in its approved business lines. Avanti is authorized to offer several products and services, most notably a tokenized U.S. dollar called Avit. Calling this token a “stablecoin disruptor,” Avanti says it is designed to solve problems in legacy payment systems that have long plagued traders, investors, and corporate treasurers. “Avanti’s mission is to provide a compliant bridge between the traditional and digital asset financial systems, with the strictest level of institutional custody standards,” said Caitlin Long, Avanti’s founder and chief executive officer.

On-Chain Metrics Point to Bitcoin Breakout

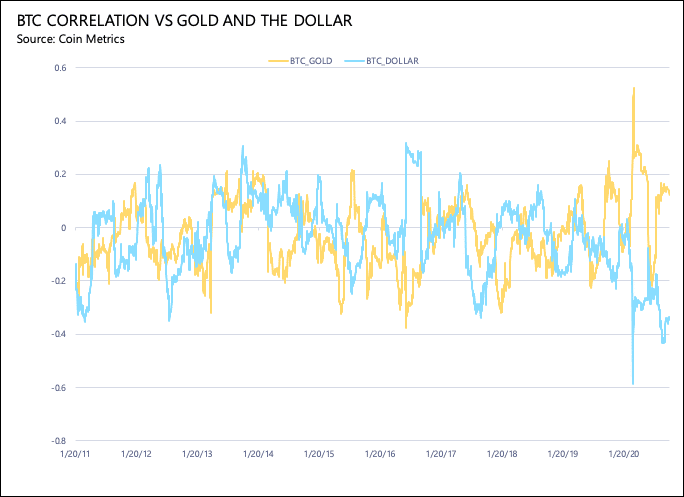

The Bitcoin price has been growing steadily since the March crypto crash, and, according to Coin Metrics, the data suggests BTC could be preparing for its most significant breakout yet. Bitcoin’s correlation with gold has been at near all-time highs since March, while its correlation with the dollar has been at all-time lows, further supporting the thesis that Bitcoin serves as a digital version of gold.

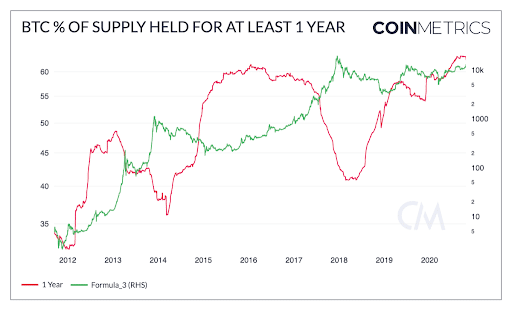

In addition to these correlations, on-chain holding is increasing. As of October 25th, close to 62.5% of all BTC has been held for at least a year — near all-time highs.

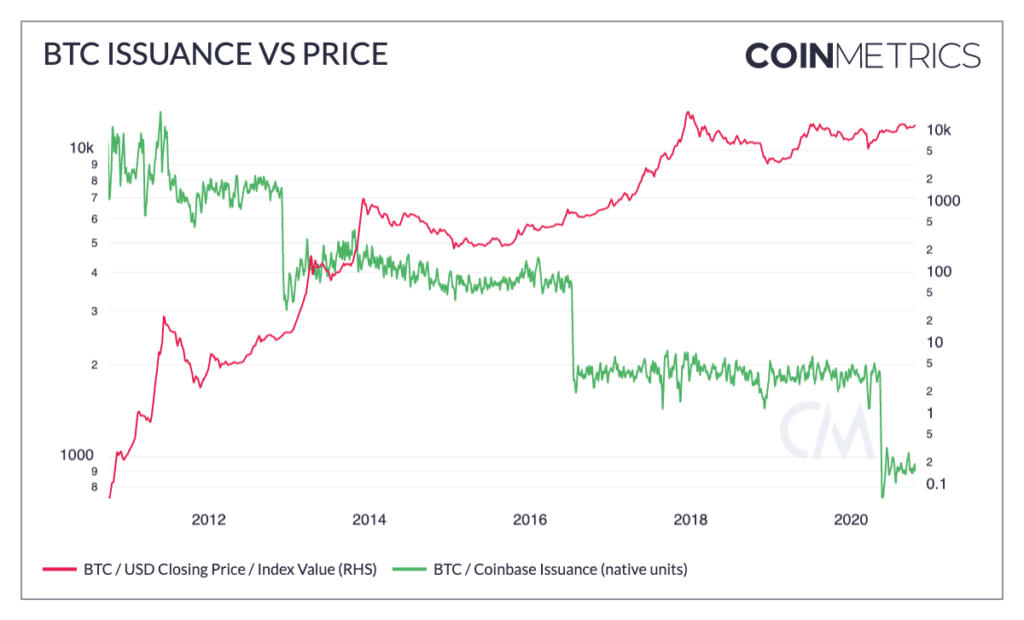

As holders increase, velocity is at all-time lows, furthering Bitcoin’s trend towards a store of value rather than a medium of exchange. Bitcoin is also being moved off of centralized exchanges in increasing numbers, suggesting more Bitcoin owners want full control of their keys. As the number of holders continues to grow, the Bitcoin supply inflation decreases with each halving, continuing to drive the price upward.

$33.8 Million Drained From Harvest Finance During Attack

An arbitrage trade exploited weak points in the Harvest Finance DeFi protocol on Monday, allowing an attacker to make off with $33.8 million. The exploit sent Harvest’s native FARM token tumbling 65% in less than an hour, and the total value locked in the protocol plummeted as a result. The attacker returned $2.5 million, for unknown reasons, soon after the attack.

Using a flash loan, the attacker was able to take on massive leverage with zero downside in order to manipulate the USDC:USDT ratios in the Y pool of Curve, which allowed them to generate a profit.

Promising to implement UX changes to prevent such incidents in the future, Harvest claimed to know the attacker’s identity, saying they are “well known in the crypto community.” Harvest then provided the bitcoin addresses of the attacker containing what they called “a significant amount of personally identifiable information” and they put up a $100,000 bounty for the first person or team to get the attacker to return the funds to the deployer address.Although the attack is devastating, people have stopped short of calling it a hack. A twitter thread by crypto lawyer Gabriel Shapiro makes a case as to why this should be viewed, at most, as “a manipulative device, scheme or artifice to defraud” or even as “commodities spot market manipulation.”

The Harvest incident isn’t the only recent attack that can’t be viewed as a traditional hack. On Monday, someone used a flash loan of MKR to pass a governance vote on MakerDAO, prompting the stablecoin project to issue a warning. The event also highlighted the impact flash loans can have on DeFi, in this case, being utilized by an outside party that wanted its proposal passed.

In related news, OpenZeppelin has launched OpenZeppelin Defender, a platform for building on Ethereum with security best practices built in. Hopefully, with more products like this, we’ll see fewer and fewer of these DeFi exploits.

Coinbase Launching Crypto Debit Card

Coinbase plans to launch a Visa debit card in the U.S. next year that will offer 1% back in Bitcoin or 4% back in Stellar. (Disclosure: Stellar has been a sponsor of my podcasts.) The company, which plans to start distributing the cards in the first half of next year and has opened a waitlist for U.S. customers, sees the card’s launch as a “significant milestone” to crypto’s mainstream adoption.

A Week’s Crypto News in 46 Seconds

Girl Gone Crypto, who I admittedly discovered just before writing this, published a hilarious vlog of a week in crypto, which begins, “$13k — that’s it, that’s the video,” and touches on the PayPal news, pokes fun at CBDCs, Filecoin and Ethereum 2.0, and also drinks to Microstrategy CEO Michael Saylor. Definitely worth checking out — especially for shots of her vacation in what looks like Southern California!

https://twitter.com/girlgone_crypto/status/1320108909097406464

Happy 12th Birthday, Bitcoin White Paper!

If you’re looking for fun pandemic-friendly ideas to celebrate the 12th birthday of the Bitcoin white paper being published, I already solicited some for you from my Twitter followers. My favorite says, “I’m going to have a #bitcoin cocktail. Something with orange, no melting ice cubes, and limited supply.”

And my NSFW, but since we’re all working from home anyway, runner-up favorite answer to the question, “What are you doing to celebrate the 12th anniversary of the publication of the Bitcoin white paper?” was this by @crypto_rand: “Coke.”

Coke

— Crypto Rand (@crypto_rand) October 29, 2020