PLUS: Could EIP 1559 Cause a Fork?

NFTs continued to catch the crypto industry’s imagination this week, as headlined by Beeple’s “Everydays” sale at Christie’s Auction House in New York. The cliche goes that a picture is worth a thousand words, although, with the latest sale of the “Everydays” NFT, we may have to readjust our math now that we know 5,000 images are actually worth $69 million. Taco Bell, Jack Dorsey, Bansky, and one very expensive CryptoPunk also contributed to another wild week in the world of non-fungible tokens.

Crypto-adjacent investing was a trend this week. JPMorgan will be providing indirect crypto exposure for clients through a basket of stocks that will include Microstrategy, Square, and NVIDIA Corporation. Similarly, the Simplify U.S. Equity PLUS bitcoin ETF plans to offer indirect investing opportunities through a 15% fund allocation to the Grayscale Bitcoin Trust. Other notable institutional news includes new funding rounds for NYDIG and BlockFi, Grayscale posting job listings for ETF positions, and PayPal confirming its Curv acquisition.

U.S. legislation came out with a slew of crypto announcements this week. Wyoming is working on a bill to recognize DAOs as companies. Congress is working to clarify the jurisdiction of the SEC and the CFTC regarding when and if a token is a security or a commodity. The Token Taxonomy Act was reintroduced for the third time.

In Ethereum news, EIP 1559 was approved, much to the chagrin of Ethereum miners. A hacker minted his exploit as an NFT, and OpenSea promptly shut down the auction. OpenZeppelin released a new piece of software to help mitigate flash loan attack damage.

On Unchained, dYdX and StarkWare make the case for how their new platform could become a decentralized BitMEX. We’ll see when the full waitlist is released to trade. And on Unconfirmed, Brendan McGill, of Offsetra and Carbon.FYI, unpacks the ArtStation controversy around the environmental impact — and given how steeped he is in the environmental world, you might be surprised by his take.

A Note on Taxes for NFT Investors

When we did the show last month all about crypto taxes for 2020, I asked about taxes on NFTs — but only for creators. I neglected to ask about taxes on NFTs for investors. I reached back out to our guest, Shehan Chandrasekera of CoinTracker, who graciously wrote up a quick explanation of how NFTs get taxed for NFT investors.

To briefly recap how NFT creators get taxed, he writes, “creators get taxed at the time they sell NFTs. Say Sam created an NFT artwork and sold it for 2 ETH valued at $2,000. He would report $2,000 as ordinary income. If he is in the business of creating NFTs, he can also deduct business-related expenses to reduce the tax bill.”

As for NFT investors, this is what Shehan says about how they will be taxed:

Investors are individuals who buy and sell NFTs for speculative purposes. Most people fall into this category.

For investors, taxes work very similar to crypto trading. There’s a taxable event whenever you sell a NFT into cash or another cryptocurrency. Profits are subject to capital gains tax rules.

Say, David purchased a NFT for 2 ETH($4,000) in January 2021. If he were to sell this NFT for $10,000 in March 2021 (with a holding period less than 12 months), he would have a short-term capital gain of $6,000 ($10,000 – $4,000). This $6,000 will be subject to his ordinary income tax rate.

If he were to sell this NFT for $10,000 after holding it for more than 12 months, say in March 2022, the profit of $6,000 will be subject to more favorable long-term capital gains tax rates.

One interesting item to note is that some NFTs could fall under the definition of “collectibles” under the IRS rules (Sec. 408(m)(2)). The maximum long-term capital gains tax rate for collectibles is 28%. The maximum long-term capital gains for crypto/non-collectible NFTs is 20%.

Listen to the Latest Episode of Unchained

Can dYdX Become a Decentralized BitMEX? How It Is Scaling With StarkWareAntonio Juliano, founder of the decentralized exchange dYdX, and Eli Ben-Sasson, cofounder of StarkWare, discuss the recent launch of dYdX on Ethereum layer 2 using StarkWare’s scaling technology.

Listen to the Latest Episode of Unconfirmed

Don’t Blame Crypto’s Environmental Impact on NFTsBe sure not to miss Unchained with Brendan McGill, co-founder of Offsetra and Carbon.fyi, a company focused on reducing carbon emissions, where talks about the environmental impact of NFTs.

Thank you to our sponsors!

Download the Crypto.com app and get $25 with the code “Laura”:

https://crypto.onelink.me/J9Lg/unchainedcardearnfeb2021

Square: https://square.com/go/unchained

This Week’s Crypto News…

Christie’s Auction House Sells an NFT for $69 Million

On Thursday, a digital artwork representing the first 5,000 days of digital art created by artist Mike Winkelmann, aka Beeple, was sold for $60.25 million at Christie’s in New York. With the buyer’s premium for purchasing in ETH, the total comes out to $69 million. (In case you missed it, be sure to check out the Unconfirmed interview with Mike when he first made $3.5 million from a sale last fall.) Crypto Twitter was aghast when it first thought that Justin Sun, the founder of Tron, was the buyer. Blockchain consultant Maya Zehavi tweeted, “Why did it have to be Justin Sun? It’s way too predictable & in the worst way possible.”

However, the story took a turn later, when CoinDesk reported that Justin Sun was actually not the winning bidder. When I tweeted about this, Olie Chan tweeted back at me, “Craig Wright has entered the chat.” Another good guess was from a Twitter user Mike with the handle @4KTV, who suggested billionaire Chamath Palihapitiya was the buyer. I guess we will find out.

The bidding for “Everydays: the First 5,000 Days,” a mosaic of every image Winkelmann has made since 2013, opened at $100 on Feb. 25 and was pushed to $1 million in under 20 minutes, with only three of the bidders previously known to Christie’s. An hour before the sale closed, the online bids were sitting at around $14 million … until they jumped from $22 million to $35 million before closing at a startling $60.25 million in a sale that is nearly unprecedented in modern auction history.

“Everydays” is now the third-most expensive artwork sold by a living artist in auction… thanks in large part to a group of bidders using magic internet money 🙂

More NFT Mania

- Jack Dorsey is auctioning off his genesis tweet, “just setting up my twttr” from March 21, 2006, via the Ethereum platform Valuables. The latest bid sits at $2.5 million. Dorsey announced that he will convert all proceeds to bitcoin and promptly donate to GiveDirectly as part of its Africa Response program.

- CryptoPunk #7804 sold for 4,200 ETH ($7.56 million) this week, blowing the previous highest amount paid for a CryptoPunk out of the water at a mere 800 ETH.

- Last week, one Banksy piece was purchased, burned on a live stream, and then digitally resurrected as an NFT. This week, that artwork, titled “Morons,” sold for 229 ETH ($382,000).

- Taco Bell dropped 5 “taco-llectibles” on Rarible this week and sold out in minutes.

- a16z crypto is investing $20 million in NFT marketplace OpenSea.

Investors Continue to Pour Money Into Crypto Firms

Crypto lender BlockFi announced a Series D funding round of $350 million, valuing the firm at $3 billion. With $10 billion in outstanding loans and profitable operations, Zac Prince, BlockFi’s chief executive officer, said, “we are interested in becoming a public company.” The latest round of funding means that BlockFi has raised more than $450 million in venture capital.

NYDIG, the Bitcoin subsidiary of Stone Ridge known for getting insurance company MassMutual to allocate capital to Bitcoin, announced a $200 million growth round led by Morgan Stanley, Soros Fund Management, MassMutual, and New York Life, amongst others. NYDIG will be working with its investors to explore bitcoin-centric initiatives and expects “an explosion of innovation in bitcoin products and services,” Robert Gutmann, NYDIG CEO, said in a press release Monday.In other news, PayPal confirmed the purchase of Curv, a provider of cloud-based infrastructure, as the payment company’s first acquisition in the crypto industry. Curv will join the newly formed crypto-focused business unit PayPal recently created.

More Ways to Get Exposure to Bitcoin in the Capital Markets

JPMorgan is looking to offer clients a way to invest in crypto through structured notes linked to cryptocurrency-focused companies. The J.P. Morgan Cryptocurrency Exposure Basket will hold 11 stocks, including a 20% stake in MicroStrategy, an 18% weighting for Square, and a 15% allocation for both Riot Blockchain and chipmaker NVIDIA. The basket, curiously, does not include Tesla stock and will also not contain crypto-assets directly.

In a similar move, the Simplify U.S. Equity PLUS Bitcoin ETF is looking to provide a workaround to the SEC’s reluctance to approve a straightforward bitcoin ETF. According to the SEC filing, the new fund would indirectly invest up to 15% of its overall holdings into cryptocurrency via the Grayscale Bitcoin Trust. If approved, the ETF would trade under the ticker “SPBC” and be administered by BNY Mellon.

Grayscale, the world’s largest digital asset management firm, posted nine new job openings this week, strongly suggesting the trust company is positioning itself to launch an ETF. The vacant listings consistently reference an “ETF business” but do not specify which assets the ETF will include. The ETF-related job openings come during a period where both the Grayscale Bitcoin Trust and Ethereum Trust are trading at a discount to the price of the underlying assets. Grayscale has roughly ~$36 billion in AUM.

On Thursday, crypto investment company CoinShares began trading on the Nasdaq First North Growth Market, an alternative stock exchange for smaller companies in Europe, under the ticker “CS.” The IPO was oversubscribed by 400%, totaling $80 million in raised funds and bringing aboard 2,280 new shareholders.

Norwegian oil and gas company Aker announced a new unit dedicated to investing in bitcoin and bitcoin-related projects. The new company, Seetee, plans to keep its liquid assets in bitcoin, establish mining operations to better utilize stranded wind, solar, and hydropower, and invest in projects within the bitcoin ecosystem. Seetee will partner with Blockstream to accelerate the use of renewable energy used in bitcoin mining.

In a tweet thread highlighting some choice quotes from the Aker letter, Alex Gladstein, chief strategy officer at the Human Rights Foundation, said he thinks the Aker announcement is a “major step towards more Scandinavian Bitcoin + adoption.”

Ethereum Improvement Proposal 1559 to Be Implemented in July

Ethereum Improvement Proposal (EIP) 1559, which could turn ether into a deflationary asset, has been accepted in an Ethereum network upgrade and will go live in conjunction with the London hard fork this coming July or August. The proposal will change blockchain transactions on Ethereum so that a portion of the gas fee is burned in each transaction, potentially reducing the total supply of ETH.

While EIP 1559 may sound exciting for ETH holders and application builders, a majority of Ethereum miners, reportedly over 60% of the network’s hash power, oppose EIP 1559, as it effectively reduces miner revenue. Miners, however, have few options to stop EIP 1559 outside of a hostile 51% attack, which is a highly unlikely attack vector given the lack of economic incentives, now that the proposal is approved. The reduction in miner compensation may lead to a rise in the implementation of miner extractable value software, which takes advantage of a miner’s ability to front-run trades in the block it is currently securing.

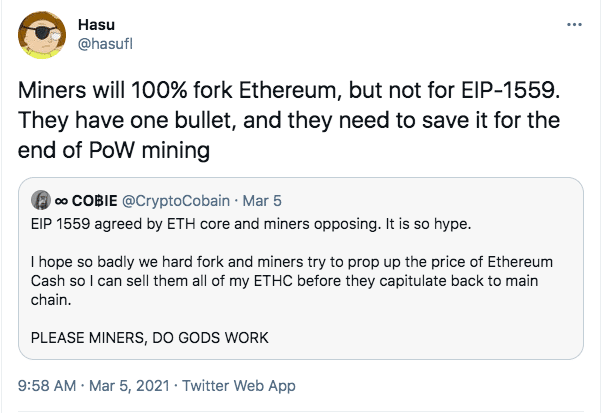

Given miners’ opposition, it will be interesting to see how the Ethereum community handles the contentious proposal, though Deribit crypto researcher Hasu thinks that EIP 1559 will not be the issue that forces miners to fork the network. He tweeted: “Miners will 100% fork Ethereum, but not for EIP-1559. They have one bullet, and they need to save it for the end of PoW mining.”

New Crypto Bills Could Give DAOs and Tokens New Life

On Tuesday, the Wyoming State Senate approved legislation that would recognize decentralized autonomous organizations (DAOs) as companies. It will become law if passed by the Wyoming House of Representatives. The bill would allow DAOs to set up in Wyoming and further bolster the state’s reputation as a blockchain-friendly jurisdiction. Aaron Wright, a professor at Cardozo Law in New York, believes the bill is a huge step forward, tweeting, “Setting up a legally recognized DAO could cost hundreds of dollars instead of tens of thousands of dollars” and this “should let millions (if not billions) of DAOs bloom.”

Preston Byrne, a partner at Anderson Kill Law, strongly disagreed, stating “the Wyoming DAO bill is slack-jawed stupidity” and that “our laws already have concepts that cover algorithmically-driven DAOs and their members: unincorporated associations and partnerships.” Gabriel Shapiro, a partner at BSV Law, seconded Byrne’s opinion, tweeting that the bill “is a material step backward for LLC-based DAOs [because] it imposes additional regulations on them that never existed before.”The CFTC and SEC are working with Congress to clarify jurisdiction on different types of cryptocurrencies/tokens. A bipartisan piece of legislation, called the “Eliminate Barriers to Innovation Act of 2021,” introduced Tuesday seeks to define the parameters for digital asset securities, in which case the SEC would have jurisdiction, and digital asset commodities, in which case the CFTC would have jurisdiction. The bill would create a working group, composed of SEC and CFTC representatives, that would look at issues such as how the current regulations impact the U.S.’s competitive position, as well as issues around custody, private key management, fraud, and investor protection.

The Token Taxonomy Act was reintroduced by Representative Warren Davidson on Wednesday, aiming to exempt certain digital assets from federal securities law by amending the Securities Exchange Act of 1934. The Token Taxonomy Act is making its third pass through Congress after first being introduced in 2018 and again in 2019. Rep. Davidson, who says he believes the U.S.’s opportunity to be a global leader in blockchain tech is closing, sees the Token Taxonomy Act as a way to mend the patchwork of laws and regulations that currently create confusion and sometimes hostility for various blockchain businesses.

Hacker Token Auction Gets Shut Down

On Monday, Matthew Hickey of Hacker House released a piece of “highly collectible hacker artwork” as an NFT. The token contains data that would allow the purchaser to exploit code that would cause a denial-of-service error in the 28 games that use the free game software called ioquake3. Hickey describes this idea as “a proof-of-concept exploit” redeemable as an NFT.

In a particularly interesting decision for an application housed on a decentralized network, OpenSea promptly took the listing down after it was posted. The hacker token, however, still exists in Hickey’s wallet.

Speaking of hacks, OpenZeppelin, a cryptocurrency software and security firm, released a software suite called “Defender” that will give DeFi teams real-time alerts and automated scripts in response to flash loan attacks. Flash loans have been one of the most common tools for hacking DeFi applications, resulting in $150 million in losses since 2020. The key to Defender is a set of automated responses that allows the smart contract to be paused or upgraded quickly. Defender cannot prevent flash loan attacks from occurring, but it can be used to stop the exploit before the hacker can make off with a large number of coins.

Grants for Rollups

The Ethereum Foundation is sponsoring a wave of rollup community grants, due April 16th, to help kickstart development on layer 2 scaling solutions. Anyone is free to participate; all the application requires is an idea and a passion for building (along with a high-level understanding of optimistic rollups). Some items on the Ethereum Foundation’s wishlist:

- making it easier for devs to deploy dApps on rollups

- enabling interactions between rollups

- establishing rollup standards

Again, the deadline is April 16, for any developers interested in submitting a proposal.

Crypto on Tim Ferriss

Popular author and podcast host Tim Ferriss has recently published two crypto-related shows. This week he had on Vitalik Buterin and Naval Ravikant to discuss Ethereum, scaling plans, NFTs, and more. One of the most interesting moments of the show was when Vitalik said he thought there was some chance that some members of the Ethereum community, such as miners, and perhaps people who don’t want to take the risks of moving over to proof of stake, stay on Ethereum 1 instead of moving over to Ethereum 2.

In February, Tim also interviewed Kathryn Haun, general partner at a16z crypto, about her time prosecuting crimes involving the Dark Web and some rogue federal agents, plus she discussed NFTs in a way highly accessible to a mainstream audience. I highly recommend both shows — I think that Tim is doing a great job introducing crypto to his mainstream audience.