On-chain data suggests that NFT marketplaces like Blur are compromising on long-term profitability to compete for a small pool of traders.

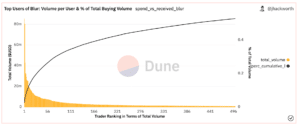

Analysts compiling recent data from the NFT space have come up with some concerning results over the last week, particularly with respect to the popular new marketplace Blur. A Dune analytics dashboard created by J. Hackworth found that just 500 traders made up 50% of its trading volume.

Even more concerningly, his analysis shows that 50 traders made up 25% of Blur’s total volume. To put this into perspective, the top wallet trading on Blur contributed to $75 million worth of volume.

Comparatively, rival NFT marketplace OpenSea’s top 250 traders only made up 11% of its total volume.

The reward for top traders from the Blur airdrop was particularly lucrative, compared to platforms like OpenSea. J. Hackworth’s data shows that the top 500 traders saw an average 2200% increase in their profit and loss flow from the airdrop. However, it was the heavy trading activity, rather than the authenticity of trades, that led to these massive airdrop rewards.

Blur only seems to be continuing this incentivization strategy, announcing on Tuesday a 300 million BLUR token distribution to its community in “Season 2.” The platform said that users with 100% loyalty stand the highest chance to earn Mythical Care Packages, worth 100 times more than the Uncommon Care Packages.

Some users have taken issue with this model, which they believe will damage creator relationships and profits in the long run.

Bad decisions:

Killing profits – 0 fees

Killing creator relationships – Cutting royalties

Compromising long term growth – royalties value prop is important for attracting new creators and their fans to the NFT space so we can hit mass adoption

Sounds short sighted to me 🤷♂️

— Kofi (@0xKofi) February 21, 2023

https://twitter.com/jumpmanft/status/1627510231961051136

Earlier this week, OpenSea shifted to a zero-fee marketplace model and made creator royalties 0.5% for all collections without on-chain enforcement.

“if this becomes the new reality it may drive OS [OpenSea] to think differently about strategy, specifically whether it makes sense to continue fighting over the pro traders or instead accept a dual-marketplace world and shift energy toward a delightful UX/UI for the long-tail,” said NFT analyst “jumpman” on Twitter.

Tune in to this week’s edition of The Chopping Block where Pacman, founder of Blur, talks about the company’s origins, competition with OpenSea, the ‘death’ of royalties, and more.