May 26, 2022 / Unchained Daily / Laura Shin

Daily Bits✍️✍️✍️

- Mastercard CEO Michael Miebach said SWIFT may not exist in 5 years.

- CryptoPunks floor price fell below $100,000.

- 29 Moonbird NFTs, valued at a total of 750 ETH, were stolen from their owner.

- Wormhole bridge will integrate with the Cosmos ecosystem.

- YGG responded to Merit Circle’s proposal to revoke their tokens.

Today in Crypto Adoption…

- Andreessen Horowitz raised a $4.5 billion crypto fund.

- StarkWare, an Ethereum scaling project, raised $100 million.

- Crypto firm Babel Finance raised $80 million.

- ZenLedger, a crypto tax startup, raised $15 million.

The $$$ Corner…

- Flowcarbon, a blockchain startup cofounded by WeWork founder Adam Neumann, raised $70 million.

- Common, a DeFi-focused startup, raised $20 million.

- Bud, a gaming platform, raised $36.8 million led by Sequoia Capital India.

- VC firm Standard Crypto raised $500 million for a new fund to invest in crypto and equities.

What Do You Meme?

What’s Poppin’?

Do Kwon’s Plan to Rebirth Terra Gets Approved

After the collapse of the Terra ecosystem, Do Kwon’s plan to revive the Terra blockchain was approved yesterday. After being put up for an on-chain vote last Wednesday, 65.5% of the total votes approved the plan, 21% abstained, and only 13.5% rejected it.

Do Kwon’s proposal consists of forking Terra into a new chain without UST – basically, a typical smart contract chain. The current chain and native token will be renamed “Terra Classic” and LUNC (Luna Classic), respectively. The new chain will be called Terra, with the native token LUNA, and will have 1 billion LUNA tokens. The tokens will be airdropped, with 30% of the distribution going to a community pool, 35% to pre-attack LUNA holders, 10% to pre-attack aUST holders, 10% to post-attack LUNA holders, and 15% to post-attack UST holders.

“The proposal allocates a large portion of the token distribution to provide runway for existing Terra dApp developers and to align the interest of developers with the long-term success of the ecosystem,” said Terra’s official Twitter account.

In addition, the Terraform Labs (TFL) and the Luna Foundation Guard (LFG) were removed from the airdrop whitelist to “make Terra a fully community-owned chain”.

On this note, a crypto account named Terra Watcher highlighted that due to the distribution design of the new chain, VCs and whales will have to wait one year until they receive their tokens. This means that only “only 12% of the total LUNA supply will be circulating for the first 6 months. And much of that will remain staked, not sold. Dumping will be relatively minimal for the first 6 months, giving the chain a chance to prove itself before the cliffs hit.”

Based on the proposal, the new blockchain will be launched this Friday 27th. At this moment, the tokens will be airdropped to the corresponding wallets and a new era for Terra will begin.

Recommended Reads

- Korpi on the ETH unlocked after the Merge.

2. Pastry on Soulbound tokens (SBTs).

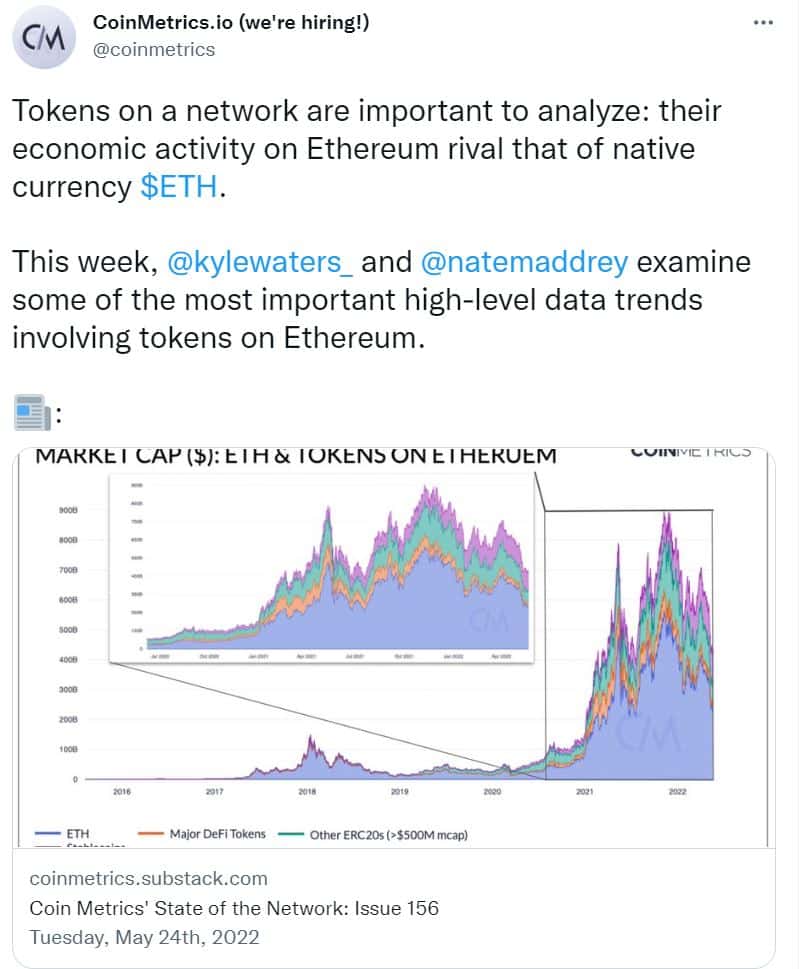

3. CoinMetrics on the importance of tokens on a network.

On The Pod…

Cobie and Chris Burniske on How to Navigate a Crypto Bear Market

Cobie, co-founder of Lido and UpOnlyTv, and Chris Burniske, partner at Placeholder Ventures, talk about surviving a crypto bear market, the Terra collapse, lessons they’ve learned from their mistakes, and much more. Show highlights:

- whether Chris and Cobie think crypto is in a bear market

- why Chris says these are the times to buy

- what effect the Terra debacle will have on the crypto industry

- why Chris was expecting UST to blow up

- why Chris thinks there is going to be another massive liquidation event

- whether an algo stablecoin could work

- why bear markets are sometimes a good thing

- how USDT was stress tested and proved its resilience

- how macro is affecting the crypto space and what the role of the Fed is

- when will we see the bottom of this bear market

- how meme coins are the symptoms of a broken system

- why this crypto cycle is different

- whether regulations are helping VCs rather than the retail investors

- why risky assets are the ones that could increase 10,000x

- whether the future of crypto is multichain or not

- how developers signal what ecosystem is going to win in the next expansion cycle

- whether Cobie thinks staking is dying

- how Chris judges market bottoms and tops

- what lessons Cobie and Chris have learned from their mistakes

- what innovations will catalyze the next bull cycle

- what needs to happen in the future for crypto to succeed

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, which is all about Ethereum and the 2017 ICO mania, is now available!

You can purchase it here: http://bit.ly/cryptopians