October 22, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

-

Bitcoin crashed to $8,200 on BinanceUS due to an algorithm bug.

-

Mt. Gox creditors are expected to recover over $9 billion worth of BTC.

-

The Financial Action Task Force, a global financial regulator, finalized its crypto guidance and will release it next week.

-

Polygon, a layer 2 solution for Ethereum, awarded a $2 million bounty to a white hat hacker — which could be the largest such bounty ever paid out.

-

The Associated Press (AP), a collective of 1,300 newspapers and broadcasters, is partnering with blockchain data provider Chainlink to provide news and data secured through crypto technology.

-

The ProShares’ bitcoin futures ETF (BITO) is likely to breach the limit on the number of futures contracts CME will permit it to hold.

-

Digital Currency Group authorized to purchase $1 billion worth of Grayscale’s Bitcoin Trust (GBTC).

-

The Sam Bankman-Fried led cryptocurrency exchange FTX announced a funding round valuing the company at $25 billion.

-

PayPal co-founder Peter Thiel wishes he had taken a larger position in Bitcoin.

-

PleasrDAO, a collective of NFT owners known for making splashy digital purchases, bought “Once Upon a Time in Shaolin,” a rare physical album by Wu-Tang Clan for $4 million.

-

Copper, a UK crypto firm, is set to raise up to $500 million in a round that would value the firm at $1 billion.

-

Walmart is now the home to Bitcoin ATMs.

What Do You Meme?

What’s Poppin’?

The ransomware group REvil was hacked and taken offline this week in a multi-country sting, reports Reuters, citing three private sector cyber experts working with the United States and one former official. “Happy Blog,” the Russian-based criminal gang’s website used to leak victim data and extort companies is no longer available.

“0_neday,” a leader of REvil’s operations admitted to the compromise on a cybercrime forum last weekend, as spotted by Recorded Future. “The server was compromised, and they were looking for me. Good luck, everyone; I’m off,” he wrote.

According to Reuters, law enforcement officials were able to deploy REvil’s signature hacking technique against them. Essentially, law enforcement agents hacked into REvil’s computer network and took over at least some of their servers, which led to REvil shutting down its site.

However, when another gang member restored those same websites from a backup, that person unknowingly restarted servers that were already controlled by law enforcement.

“The REvil ransomware gang restored the infrastructure from the backups under the assumption that they had not been compromised. Ironically, the gang’s own favorite tactic of compromising the backups was turned against them,” said Oleg Skulkin, deputy head of the forensics lab at the Russian-led security company Group-IB.

REvil is Russian-led criminal gang who pulled off a May cyber attack on Colonial Pipeline, forcing forced the company to shut down about 5,500 miles of pipeline, leading to substantial gas shortages on the East Coast. As part of the hack, attackers asked for and received a ransom payment worth $5 million in Bitcoin. Interestingly, the US government was able to recover$2.3 million in BTC of the initial ransom payment.

(For more information on REvil, be sure to check the Unchained episode covering ransomware.)

Recommended Reads

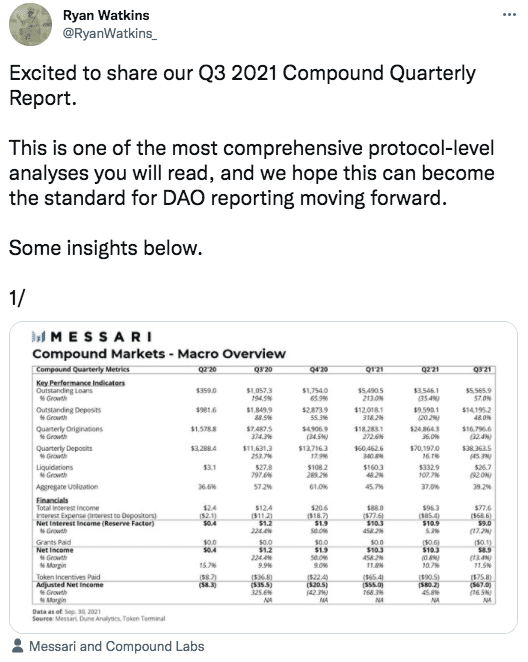

- Messari on Compound’s Q3:

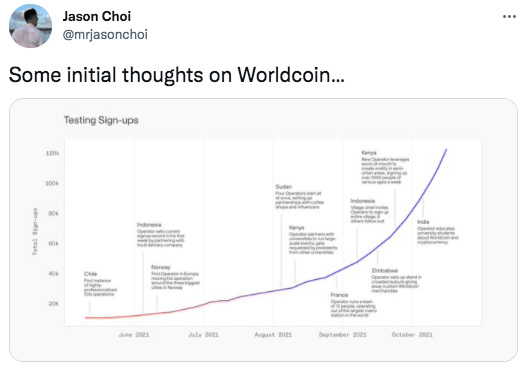

- Spartan Group’s Jason Choi on Worldcoin, which scans eyeballs in exchange for crypto:

- Arthur Hayes on, well, the “infectious gospel of our Lord Satoshi:”

On The Pod…

Bitcoin Projected to Reach $135,000 in December, According to PlanB

PlanB, a former institutional investor with 25 years of experience in financial markets turned anon Bitcoin analyst, discusses Bitcoin’s price action, from the macroeconomic drivers to what his models predict for the rest of 2021. Show highlights:

-

PlanB’s background and how he got into Bitcoin

-

what a stock-to-flow model is and how PlanB uses it to predict Bitcoin’s price

-

why PlanB called for a $1 trillion market cap when Bitcoin was priced at sub $4K

-

how the approval of a bitcoin futures ETF has affected Bitcoin’s price

-

why institutions are more comfortable with bitcoin futures, rather than the underlying asset

-

how to properly calculate gold’s stock-to-flow model

-

why he believes the stock-to-flow models works — even when detractors say it is flawed

-

how the pandemic has affected Bitcoin’s price

-

what PlanB thinks about China’s decision to effectively ban Bitcoin

-

the three charts PlanB uses to model Bitcoin

-

what the price floor for Bitcoin will be in October, November, and December

-

whether PlanB thinks we are in a supercycle

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians