August 19, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- Chase Bank shut down Compass Mining’s bank accounts, according to Compass Mining CEO Whit Gibbs.

- Facebook’s financial lead, David Marcus, argues for crypto wallet, Novi, to be allowed to go to market.

- The operator behind Helix, a bitcoin mixing service, pleaded guilty to laundering $300M+.

- Binance hired Greg Monahan, a former IRS official, to head its global money laundering team; it will also apply for registration with the central bank of the Netherlands after being issued a warning for operating illegally.

- Coinbase is holding $4.4B in cash in case of a “crypto winter.”

- MobileCoin, a privacy-based cryptocurrency project, raised $66M in a Series B.

- During last month’s Federal Open Market Committee meeting, regulators cited “various potential risks to financial stability including the risks associated with expanded use of cryptocurrencies.”

- United Wholesale Mortgage, the second-largest US mortgage lender, plans to accept crypto as payment by EOY 2021.

- Iris Energy, a BTC mining company, submitted a proposal to the SEC to go public via Nasdaq.

- Avalanche launched a liquidity mining incentive program to lure DeFi applications to its platform.

- Spinesmith Holdings, a small biotech company, is converting its balance to BTC

What Do You Meme?

What’s Poppin’?

Crypto trading on Robinhood is poppin’.

The investment app just completed its first quarter as a publicly-traded company. According to Robinhood’s earnings report, it appears that crypto trading had an outsized impact on the company’s bottom line, as evidenced by the fact that 60% of Robinhood users traded in crypto in Q2.

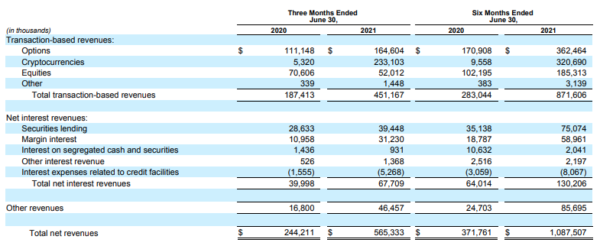

At $565M, revenue more than doubled since Q4 2021. The majority of Robinhood’s revenue, roughly 80%, is tied to transaction fees extracted from traders buying/selling options, cryptocurrencies, equities, and other investment products.

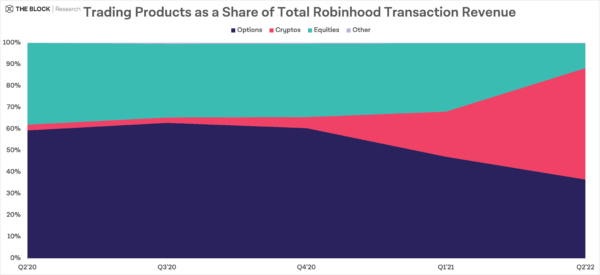

As you can see in the chart above, of that 80% brought in via transaction revenue, cryptocurrency trading accounted for more than half of that income — meaning that 41% of Robinhood’s total revenue is the direct result of crypto trading. The company’s filing also mentioned that Dogecoin trading was the crypto of choice for customers, noting, “62% of our cryptocurrency transaction-based revenue was attributable to transactions in Dogecoin.”

Robinhood’s reliance on crypto trading seems to be growing. In Q4 2020, crypto trading only accounted for 2% of the company’s revenue. In Q1 2021, only 17% of the investment app’s total revenue was derived from crypto trading. To put that in perspective, crypto trading revenue on Robinhood grew over 4,000% since Q4 2020.

Source: The Block

At publishing time, $HOOD is trading at $45.43, down 9% on the week.

Recommended Reads

- CoinShares on DeFi:

- Sam Sun, a research partner at Paradigm, on how he found and helped patch a vulnerability that put over 109k ETH (~$350M) at risk.

- Chainalysis on crypto adoption (up 880% in the last year):

On The Pod…

On-Chain Analytics Show ETH Accumulation Is Greater Than That of BTC

NFTs are the talk of the metaverse, EIP 1559 just went live, and DeFi stats are rebounding. On Unchained, Fredrik Haga, cofounder and CEO at Dune Analytics, along with Richard Chen, general partner at 1confirmation, discuss the booming Ethereum ecosystem through the lens of on-chain data, diving into NFTs, DeFi, ETH, and their favorite layer 2s. Show highlights:

- why Ethereum is on such a pronounced upswing

- why on-chain metrics lead to superior information reporting

- mind-blowing OpenSea statistics

- why NFTs are so hot at the moment

- how Richard explains NFTs to normies

- whether the NFT market is sustainable

- what makes an NFT drop pop and why profile pics (PFPs) matter

- how Polygon NFTs compare to Ethereum NFTs

- the main driving force behind DeFi usage

- how Richard measures the total amount of DeFi users

- what brings new users into DeFi

- what DEX trends Fredrik is keeping his eye on

- why structured products are crucial to DeFi’s continued success

- how Ethereum is doing since the London hard fork

- why NFT drops are like 2017 ICOs

- what metric shows ETH adoption outpacing BTC adoption among institutions

- which layer 2 solutions are Fredrik and Richard excited about

- why Richard considers Binance Smart Chain a centralized blockchain

- why Fredrik likes what Solana is building

- Richard and Fredrik’s predictions for the NFTs, DeFi, and ETH going forward

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Jan. 18. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians