July 13, 2021 / Unchained Daily / Laura Shin

Daily Bits ✍️✍️✍️

- American Express is offering NFTs as a credit card perk.

- Grayscale’s Digital Large Cap Fund is now an SEC reporting company.

- Fidelity plans to hire as many as 100 employees to bolster various cryptocurrency projects.

- NFT platform Nifty’s raised $10M in a seed round.

- Clear Junction, one of Binance’s payment partners in Europe, will no longer facilitate payments for the exchange.

- Compute North, a US-based mining facility operator, intends to aggressively scale its mining capacity in the next 12 months.

- Goldman Sachs labels COIN a buy.

What Do You Meme?

What’s Poppin’?

Here are five stats that could be worth keeping an eye on:

1. Bitcoin’s Lightning Network capacity now sits above 1,700 BTC, a 67% increase YTD. Since July 1, the network has grown by over 100 BTC in just 11 days.

Source: Bitcoin Visuals

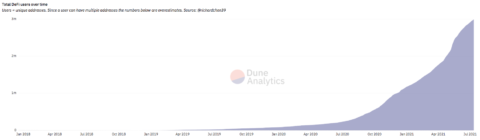

2. Data from Dune Analytics shows that nearly 3,000,000 unique addresses have interacted with DeFi protocols. On July 13th of last year, that number stood at 258,000.

Source: Dune Analytics + Richard Chen

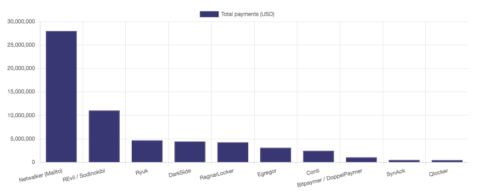

3. Ransomwhere, a crowd-sourced ransomware payment tracker, estimates that over $30M in Bitcoin has been paid to hackers in 2021.

Source: Ransomwhere

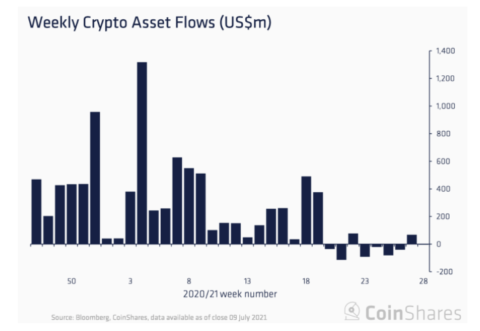

4. Digital asset investment products saw an outflow of $4M last week. Interestingly, trading volume fell to $1.58B — the lowest since Oct. 2020:

Source: CoinShares

5. Dion Guillaume, a writer at Bitcoin Magazine, pointed out that while BTC is still nearly 50% below its ATH, the asset has been profitable for 96% of its existence.

Source: Bitcoin Magazine

Recommended Reads

- Arthur Hayes on why the threat of Tether instability could be overstated:

- Tom Schmidt on a few different ways to handle the MEV crisis:

- 22 assets that could benefit from EIP 1559:

On The Pod…

Aaron Wright, co-founder of OpenLaw and Professor at Cardozo Law, and Ross Campbell, SushiSwap core developer and LexDAO contributor, discuss the latest breakthroughs and legal implications in the burgeoning world of DAOs. Show highlights:

- how Aaron and Ross fell down the crypto rabbit hole

- whether a DAO, like Curve, could sue to protect its IP

- when a governance token might be considered a security

- who owns the copyright to a DAO

- how SushiSwap handles its open-source licenses

- why Ross views Uniswap’s business license as a good thing

- what a DAO is and how the idea stems from Bitcoin

- how Wyoming’s DAO law works

- what makes a Wyoming DAO different from a DAO registered as a Delaware LLC

- how an algorithmically managed DAO might work in the future

- why Aaron thinks a DAO should not be allowed to be manager-managed

- why wrapping a DAO into an LLC could be advantageous

- the difference between private and public ordering

Book Update

My book, The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze, is now available for pre-order now.

The book, which is all about Ethereum and the 2017 ICO mania, comes out Nov. 2nd. Pre-order it today!

You can purchase it here: http://bit.ly/cryptopians