PLUS: Everything you want to know about COIN

Happy Coinbase direct listing week! If you still need more Coinbase content, I would recommend clicking here, here, and here — or just check out this week’s Unconfirmed episode featuring Gil Luria, director of research at D.A. Davidson!

While Coinbase took center stage this week, crypto continued to cycle through headlines at a rapid pace. As bitcoin and ether hit all-time highs, the United States created a gamut of headlines that could affect crypto for years to come: Gary Gensler was confirmed as the new chairman of the SEC, Biden’s administration expressed concern over China’s head start in digital currencies, and SEC Commissioner Hester Peirce unveiled a proposal to better regulate token offerings.

In other news…

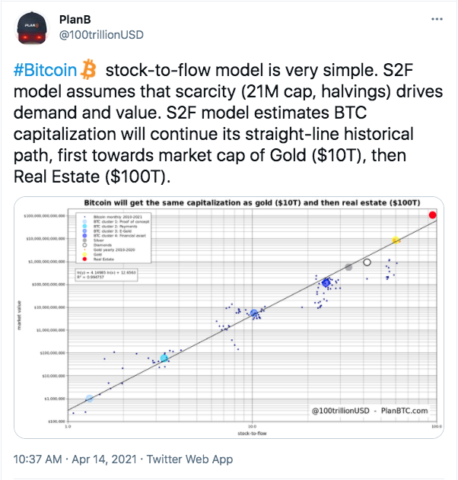

- PlanB’s stock-to-flow model predicts Bitcoin’s market cap surpassing gold at $10 trillion (and more)

- Binance now allows certain customers to trade tokenized shares of Tesla… along with one other stock that might surprise you

- Ethereum’s Berlin fork went live on Thursday, causing a major exchange to temporarily suspend ETH withdrawals

- Michael Saylor was interviewed by a three-year-old, and it is a must watch (scroll all the way down for the link)

On Unchained, Peter L. Brandt, veteran trader and publisher of the Factor Report, alongside Willy Woo, prominent on-chain Bitcoin analyst and author of the “The Bitcoin Forecast,” talk about all things Bitcoin, including Peter’s observation that the only time in history he’s seen charts that look like Bitcoin’s rise against the dollar was when the value of the German mark was collapsing, to the point where one USD equaled 4.4 billion marks. On Unconfirmed, Gil Luria breaks down Coinbase’s performance in its first couple of days as a public company, plus gives us his take on its future prospects.

Listen to the Latest Episode of Unchained

Why Bitcoin’s December Price Target Is Now ‘Above $300,000’

In an interview I moderated at Real Vision’s “Crypto Gathering,” Peter L Brandt, veteran trader and publisher of the Factor Report, and Willy Woo, prominent on-chain Bitcoin analyst and author of the “The Bitcoin Forecast,” a market intelligence newsletter, discuss Bitcoin charts, trading, and how Bitcoin is evolving as an asset.

Listen to the Latest Episode of Unconfirmed

Gil Luria, director of research at D.A. Davidson, talks about Coinbase’s performance on its first day as a public company.

Thank you to our sponsors!

Download the Crypto.com app and get $25 with the code “Laura”:

Check out InterPop, a superteam redefining the future of NTFs and fandom!

This Week’s Crypto News…

BTC Hits Another All-Time High Like Clockwork

Bitcoin surged to a record high of $64,899 on early Wednesday morning. Amidst the current bull run fueled by institutional investment, NFTs, and Coinbase’s direct listing, it seems a new Bitcoin peak is barely even meme-worthy on Twitter anymore.

What is noteworthy, however, is that one crypto investment firm projected, a year ago, that the price of Bitcoin would break $62k this month. In its April 2020 investor newsletter, at a time when bitcoin traded at roughly 10% of its current price, Pantera Capital correctly projected Bitcoin would cross $62k this month.

Pantera used projections based on a stock-to-flow model — which assumes that Bitcoin’s scarcity drives demand and value. Pantera CEO Dan Morehead noted, “This Bitcoin rally is EXACTLY like previous halvings. [Bitcoin is] Likely to reach $115k by August.” Pantera also correctly called when Bitcoin would break $30k, $40k, and $50k in previous months.

In a tweet, PlanB, a prominent stock-to-flow bitcoin analyst, estimated “BTC capitalization will continue its straight-line historical path, first towards market cap of Gold ($10T), then Real Estate ($100T).”

If S2F models are not convincing enough for you, Michael del Castillo, someone I consider a Forbes colleague even though we didn’t overlap there, reported that 24% of Forbes’ Blockchain 50 Symposium attendees said their companies will buy bitcoin this year; a trend that could provide the institutional capital necessary to continue bitcoin’s path toward a $115,000 price in August and, further down the line, gold’s $10T market cap as predicted by Pantera and PlanB respectively.

Gary Gensler Named SEC Chair

The U.S. Senate officially confirmed Gary Gensler as chairman of the Securities and Exchange Commission. Previously, he was the former chairman of the Commodity Futures Trading Commission and served on MIT’s faculty, where he taught classes on blockchain.

As SEC chair, Gensler’s opinion on crypto will likely affect the SEC’s lawsuit against Ripple and the viability of a bitcoin ETF in the U.S.

Two other regulatory stories stood out this week:

- IRS commissioner Charles Rettig admitted that standard crypto reporting rules would “absolutely” help close the tax gap — which is the amount of U.S. taxes owed that have yet to be paid.

- Blockchain forensics firm CipherTrace, which, disclosure is a previous sponsor of my shows, released software to help DeFi protocols comply with the U.S. Treasury’s Office of Foreign Assets Control. CipherTrace’s new tool blocks OFAC-sanctioned blockchain addresses that might be associated with terrorist funding. Very curious to hear what opinion DeFi protocol builders have of this software.

Fears Over Losing Ground to China Spark Bitcoin Conversation in the U.S.

- According to a Bloomberg report, the Biden administration is troubled by the long-term effects the digital yuan may have on the strength of the dollar. China has already created and distributed its digital currency — a first for a major economy. (If this topic interests you, be sure not to miss my interview last summer with historian Niall Ferguson and CoinDesk’s Michael Casey, which touched on this issue.)

- As reported by Forbes, Michael Morell, a former CIA director who spent 33 years at the agency, published an independent study which concluded: 1) worries about bitcoin as a tool for illicit finance are overstated 2) blockchain analysis is a highly effective tool to mitigate crime. His conclusions may catch the attention of Treasury Secretary Janet Yellen, whose recent remarks have focused on how crypto could be used for money laundering or terrorist financing. He told Forbes, “we need to make sure that the conventional wisdom that is wrong about the illicit use of Bitcoin doesn’t hold us back from pushing forward the technological changes that are going to allow us to keep pace with China.”

- On CNBC, when asked about Secretary Yellen and Fed Chair Jerome Powell’s approach to Bitcoin, Congressman Kevin McCarthy had some powerful words: “They tried to ignore it to make it go away…. Those who regulate, those who are in government that make policy better start understanding what it means for the future because other countries are moving forward, especially China. I do not want America to fall behind.”

Binance Launches Tokenized Stock Trading

Certain Binance users can now purchase tokenized shares of Tesla. Customers may buy as little as 1/100th of a share with zero commission fees — although trading will be limited to regular trading hours. Notably, the tokens are not shares; they only give exposure to the asset, including dividends and stock splits. As of now, residents of the U.S., mainland China, Turkey, and other restricted jurisdictions are barred from buying stock tokens on Binance.

In an act of goodwill, Binance announced it would also list COIN as a stock token even though Coinbase does not offer BNB, Binance’s native token, on its exchange. However, on early Thursday morning, Binance released a statement that its tokenized COIN offering would be postponed “due to market volatility.”

In related news, WallStreetBets opened up its infamous Reddit thread to crypto, allowing for discussion on bitcoin, ether, and doge.

Hester Peirce Releases Safe Harbor 2.0

SEC commissioner Hester Peirce unveiled an updated version of her Safe Harbor proposal on Wednesday. Peirce has been working to give blockchain developers more freedom to build in DeFi without worrying about the ramifications, unintentionally or otherwise, of creating a token that runs afoul of U.S. securities law. Her proposal would give projects three years to determine whether a token should be deemed a security or not. This would allow developers to create a token offering very similar in nature to a security and gradually evolve the project into a more decentralized entity, rather than launching with everything already buttoned up.

Besides additional reporting requirements, including an exit report and outside counsel, Safe Harbor 2.0 remains similar to the initial proposal presented in February 2020. In a nod to the open-source ethos of crypto, Peirce posted the Safe Harbor Proposal 2.0 on Github, where anyone can provide feedback via pull request.

Ethereum’s Berlin Hard Fork Is Live

Ethereum’s Berlin hard fork went live on Thursday, incorporating four Ethereum Improvement Proposals (EIP) to reduce gas fees and increase users’ transaction capabilities. The Berlin launch takes Ethereum one step closer to this summer’s London hard fork and EIP-1559, the controversial proposal that would likely have a deflationary effect on ETH.

Fifty blocks after the fork, Ethereum’s network experienced a syncing error, disrupting major services. In response, Coinbase disabled ETH and ERC-20 withdrawals, while Ledger admitted its users’ ETH prices might not update.

Syncing issue aside, the Berlin upgrade seems to have been met with approval, as ether reached a new high of $2,500 on the day the fork launched.

Along with the network upgrade and new all-time high, two other headlines point towards a continued bull-run for Ethereum:

1) CoinDesk reports the total value locked on Ethereum 2.0 surpassed $8 billion earlier this month, making Ethereum 2 the fifth-largest proof of stake network by staked value.

2) On Tuesday, Ethereum-focused venture studio ConsenSys raised $65 million from JPMorgan, Mastercard, and UBS to bridge the TradFi and DeFi gap.

Coinbase Pays Homage to Satoshi

Satoshi famously coded a message into the Bitcoin Genesis block. It reads,

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

Bringing the origins of crypto full circle, Coinbase embedded a similar message on the Bitcoin blockchain to commemorate its listing day. It reads,

“TNYTimes 10/Mar/2021 House Gives Final Approval to Biden’s $1.9T Pandemic Relief Bill”

NYSE Mints an NFT… and Nobody Cares?

In a week where Coinbase listed at $50 billion+ while bitcoin and ether hit all-time highs, the New York Stock Exchange, somewhat ironically, released a collection of NFTs commemorating a company’s first trade, saying: “Innovation is what we do at the NYSE.”

Hayden Adams, the founder of Uniswap, put that “innovation” – air quotes – in context, tweeting:

Lily, 3-Year-Old Reporter Extraordinaire, Interviews Michael Saylor

If you haven’t seen the video of the 3-year-old Lily interviewing MicroStrategy CEO Michael Saylor, I think you should check it out. As a journalist, one question I was especially impressed by, and, remember, this is a 3-year old girl, was when she asked Michael:

“My next question is… investing $2 billion [in Bitcoin] is a ballsy move, what’s next for you?”