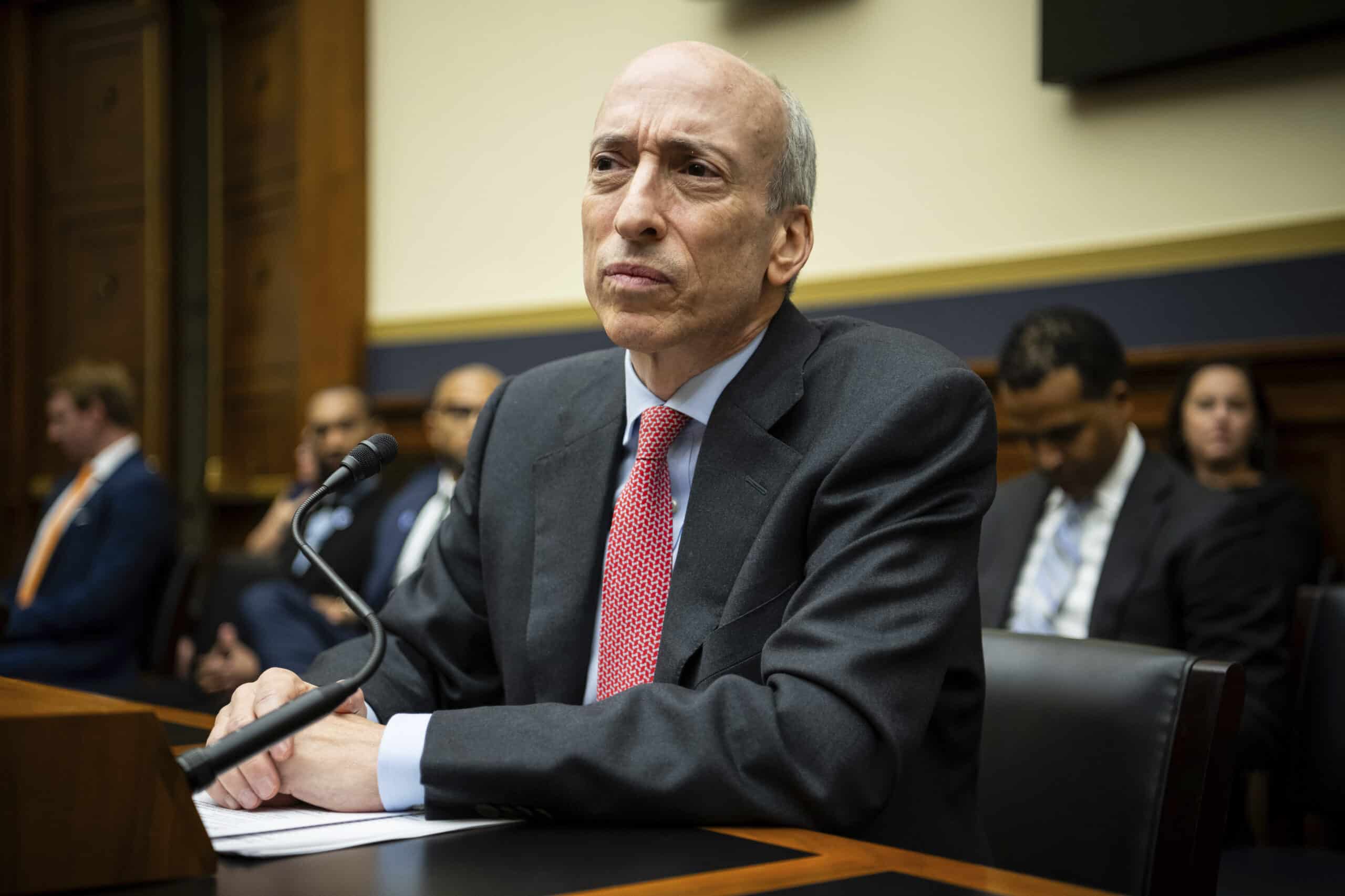

House Financial Services Committee Chair Patrick McHenry (R-NC) and other Republican members of Congress upbraided SEC chairman Gary Gensler for how his agency has regulated the crypto industry at an SEC oversight hearing on Tuesday. Meanwhile, most of the Democratic members of the Committee praised Gensler for the work he was doing in regulating crypto.

“Under Chair Gensler, the SEC has become a rogue agency,” McHenry said at the hearing’s opening. He then cited several instances of the SEC ineffectively regulating the crypto industry by enforcement, before noting how the voting on FIT21, a market structure bill for digital assets sponsored by McHenry, demonstrated that more than two thirds of the House opposed Gensler’s approach to digital assets. “True to form, Chair Gensler has doubled down on regulation by enforcement. Without the regulatory clarity and consumer protections in FIT21, the United States will continue to fall behind Europe in technological innovation and adoption. This is unheard of in modern history,” said McHenry.

Read more: Can Gary Gensler Be ‘Fired’ If Trump Becomes President Again?

Arguing Over Terms

In addition to questioning Gensler, Republican Members of Congress also looked to the two pro-crypto Republican SEC Commissioners, Hester Peirce and Mark Uyeda, for guidance and support. McHenry asked Gensler about the confusing way that the SEC has used multiple terms to refer to digital assets, such as “crypto asset securities” and “crypto security tokens,” Gensler responded by saying “it’s less about the terms and more about the economics.” Gensler then noted that the crucial criteria for determining whether a token is a security or not are ”whether an investment contract is being offered and sold to the public and the public is looking to others in a common enterprise anticipating profit.” These are the requirements known as the Howey Test, which came out of a 1946 Supreme Court ruling.

McHenry then turned to Commissioner Peirce to ask whether using multiple descriptions and words to describe crypto tokens was problematic. “Yes, that’s absolutely true,” Peirce responded. “We have taken a legally imprecise view to mask the regulatory lack of clarity.”

Peirce then lamented how the SEC had failed to properly regulate the digital asset industry by being clearer. As an example, Peirce brought up a much-criticized footnote that was part of the SEC’s recently amended complaint against Binance. In the footnote, the SEC acknowledged that it had used the term “crypto asset security” as shorthand and didn’t mean to imply that any crypto asset itself was a security. “[The SEC has] fallen down on our duty as a regulator not to be precise,” said Peirce.

Congressman Wiley Nickel (D-NC) and Congressman Mike Flood (R-NE) also questioned Gensler about SAB 121, a much-criticized SEC rule that requires entities seeking to custody crypto to list the assets on their balance sheet and create a corresponding liability equal to the worth of the crypto. Nickel and Flood authored a joint resolution to overturn SAB 121 that passed the House and Senate but was ultimately vetoed by President Biden.

Gensler said he would not act to rescind SAB 121 and when Nickel asked why, Gensler responded that the rule was nothing out of the ordinary and sought to protect customers when the company that was custodying their crypto went bankrupt, a situation that has occurred numerous times in recent years.

Waters Proposes a ‘Grand Bargain’ on Stablecoins

In an unusual display of bipartisanship, Rep. Maxine Waters (D-CA), the highest ranking Democrat on the committee, used some of her opening time at the hearing to publicly ask McHenry for a bipartisan approach to passing a stablecoin bill.

“Before the end of this year, I want us to strike a grand bargain on stablecoins and other long overdue bills,” said Waters. “I strongly believe we can reach a deal that prioritizes strong protections for our nation’s consumers and strong federal oversight.”

McHenry had previously introduced the Clarity for Payment Stablecoins Act of 2023 into the House; however, during a review of the bill in July of 2023, Waters led a walkout of all Democrats on the Committee to protest the lack of a bipartisan agreement over how stablecoins should be regulated. This led to a stall in negotiations that had been reportedly occurring between McHenry and Waters for some time.

Waters described many paths to the oversight of stablecoins, but highlighted that in other countries, there is a role for central banks and thus, that the U.S. should make sure the Federal Reserve has a prominent position in the oversight of stablecoins. Waters also commented on the composition of stablecoin reserves, saying that “stablecoins can only be truly stable if they are backed by safe and liquid reserves like short-term Treasury bills.”

In response, McHenry said he welcomed further discussions on a potential stablecoin bill, but also hinted it would be important to provide clarity for digital assets in general, a likely reference to his FIT21 bill.