Polymarket, a prediction market venue built on crypto infrastructure, has been rising in popularity, becoming cited regularly by the mainstream media due to the US presidential election. It also set a record high in monthly trading volume in July of more than $387 million, a threefold increase from June’s $111.56 million figure, per a Dune Analytics dashboard by Richard Chen. At presstime, Polymarket’s total volume stands above $1 billion.

While the race has helped Polymarket’s adoption, the November election is not the only driver of the prediction market platform’s rising prominence, according to early-stage investment firm ParaFi Capital, which is also Polymarket’s single largest investor.

In a thread on X, ParaFi also attributed Polymarket’s rising success, which includes over 32 million web traffic page views over the past year, to multiple reasons, such as a spike in volume of non-election-related markets, among other statistical metrics.

ParaFi said in a tweet that 58% of the roughly 70,000 addresses that have used Polymarket started their journey in non-election markets.

Read More: Polymarket Hits Record Highs in Monthly Users and Trading Volume Due to Presidential Election

Of the remaining 42% of wallet addresses that first traded in an election-related market on Polymarket, the majority of these participated in non-election markets in their following trades. “Essentially, almost half of all users who first traded in an election-related market moved on to markets covering topics such as the economy, sports, and crypto,” said ParaFi.

One popular market revolved around when the US Securities and Exchange Commission would approve a spot ETH exchange-traded fund, which saw a cumulative volume of over $13 million.

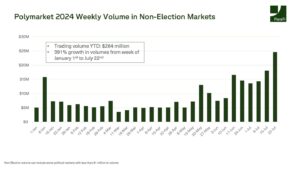

Total trading volume for non-election-related markets currently stands at $264 million year-to-date compared to $497.1 million for election-related markets, and on a weekly basis, trading volume has grown 391% since the first week of the year when the figure was around $5 million to nearly $25 million for the week of July 22.

ParaFi also noted how Polymarket has not seen a “sharp deterioration in the retention rate as quarters progress,” a sign of how sticky the platform is for users wanting to participate in prediction markets.

US Election Still Top Draw

Even though non-election-related markets have helped with Polymarket’s growth, the US election still dominates the platform. The top markets by volume and liquidity are based on the presidential contest, such as who will be the 2024 presidential election winner which has seen $474.4 million in bets, and who will be the 2024 Democratic nominee which has seen $299.9 million in wagers.

The largest non-election-related market by liquidity is about what team will be the Super Bowl Champions in 2025. This market has a trading volume of $2.7 million, ahead of which country will have the most gold medals in the 2024 Paris Olympics.

“70%+ of daily trading volume in dollar terms has been tied to election-related markets in recent weeks,” ParaFi wrote, though “this is not surprising given the proximity and volatility of events surrounding the election.”

Polymarket’s total value locked, made of total deposits and the platform’s open interest, has reached an all-time high of $89.4 million, a more than 109% increase from $42.7 million last month, data from Token Terminal shows.