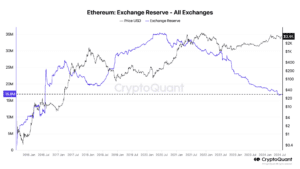

The amount of ETH held in reserve by crypto exchanges has dipped to its lowest level since July 2016, likely driven by the fact that spot ether exchange-traded funds are finally set to begin trading on Tuesday.

Exchanges around the world collectively hold 16.9 million ETH worth roughly $58.3 billion, a decrease of more than 10% since the start of the year when exchanges had 18.8 million ETH worth about $65.0 billion, according to data from blockchain analytics firm CryptoQuant.

The last time exchanges held as small an amount of ETH as now was in July 2016 when ETH traded at around $11. At the time of writing, a single ETH token was trading at almost $3,500.

Suki Yang, a data scientist at Electric Capital, told Unchained that the main reason for the drop in ETH exchange reserves was likely the fact that spot ether ETFs are set to begin trading on Tuesday.

“The biggest thing that happened with Ethereum this year has been the ETF,” said Yang. “What happens with the ETH ETFs means institutions are holding more Ethereum that’s in the liquid circulating supply.”

Yang noted that “if you ask the question fundamentally how do institutions buy ETH, it’s through [over-the-counter], definitely not through the open market on exchanges. So the reserve of Ethereum on these exchanges dropping means that a lot of the institutions are coming in and they’re moving Ethereum off of those exchanges.”

The exchange account wallets of institutions are connected to the internet and therefore more susceptible to online exploits. So these accounts are where institutions move money around and conduct trading, according to Yang. The decrease in ETH in exchanges stems from institutions wanting to hold ETH in custodial wallets or cold storage, away from exchanges and the market.

Read more:

Coinbase and Binance had the largest negative changes in their ETH reserves. According to onchain intelligence platform Nansen, the two exchanges saw their ETH holdings decrease by about $1.2 billion over the last seven days.

Coinbase Prime, which is aimed at institutions, was responsible for the vast majority of the reduction that occurred this past week, with the group’s token balance of ETH shrinking by $747.9 million.