Even though BTC has been flowing to exchanges en masse from addresses identified as connected to the German governmentt, the number of bitcoins sitting on exchanges has reached a multi-year record low.

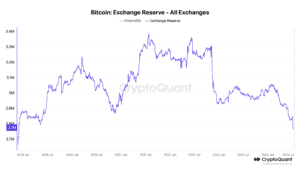

According to data from blockchain analytics firm CryptoQuant, exchanges around the world hold about 2.76 million bitcoins, worth roughly $156.6 billion at current prices. That’s the lowest number of BTC tokens held by exchanges since Nov. 2018 when BTC was trading near $3,800. As of Monday, a single BTC coin is worth $56,164.

In July alone, exchanges saw their BTC reserves decrease by 65,750 coins, representing a $3.7 billion reduction. The drop in BTC exchange reserves comes despite the German government offloading a substantial amount of BTC.

Per onchain data provider Arkham Intelligence, the German government has transferred roughly 16,000 BTC in the past 24 hours to market makers such as Flow Traders and Cumberland DRW as well as several exchanges, such as Coinbase, Kraken, and Bitstamp. Market makers typically place assets on exchanges, whether to provide liquidity or to sell assets. BTC has relatively few active DeFi tools at present, so most of those flows could be expected to go to off-chain exchanges.

Read More: Short-term Holders Underwater Amid Bitcoin Sell-off, Glassnode

Zooming out, the German government had over $3.55 billion in BTC tokens in April, and its balance has slid to $1.33 billion at presstime, an over 62% decrease in roughly two months. In January, the German government announced seizing nearly 50,000 bitcoins from piracy website Movie2k.

Few Reasons for Low BTC Supply on Exchanges

The multi-year low of BTC on exchanges, while the German government sends BTC to exchanges, presumably to sell, means a few things, according to Suki Yang, a data scientist at venture firm Electric Capital.

While the German government sales are adding to selling pressure that pushed BTC down to a local low of around $54,000, the amount of BTC on exchanges suggests that people are not selling, but rather self-custodying their BTC, Yang argued.

On the other hand, CryptoQuant’s head of research Julio Moreno said to Unchained over Telegram that “Part of these lower balances on exchanges could be explained by bitcoin moving to some other custodial entities. In the past, we have seen bitcoin flowing out from exchanges into custodial services as large investors buy.”

Read More: What Will Allocations Look Like in Combined Bitcoin and Ethereum ETFs?

The low supply of bitcoin on exchanges “doesn’t necessarily mean prices are going up 100%, but it does mean there’s less liquidity for people to buy BTC on the market.” wrote Yang, who is also the founder of meme tokenization platform LMAO, to Unchained over Telegram.

“There’s a lot of OTC happening with institutions coming into the space, and people are not actively selling in this part of the cycle… I believe the real bull market is starting in a couple of months after the current selloff,” Yang added.

Data from CoinGecko shows that the entire market cap for the cryptocurrency industry has dropped over $221 billion in the past seven days, from $2.4 trillion to $2.2 trillion at the time of writing. The “Fear and Greed Index,” by Alternative.me, which looks at several factors including volatility, volume, and search engine trends to capture current market sentiment, shows that the crypto space is in a period of “Fear.”