As user demand and interest in both bitcoin (BTC) and ether (ETH) surges—on the back of the approval of spot bitcoin ETFs in the US and the potential approval of spot ether ETFs — gas prices on Ethereum are spiraling out of control.

At peak times, users are reporting paying over $100 in transaction fees for swaps, which is the exchange of one crypto token for another on the network. The average gas fee for a swap transaction is currently around $79, according to data from Etherscan.

Gas prices for swaps back above $100 lmao

— 🐧 Pentoshi (@Pentosh1) February 28, 2024

The “top gas guzzlers” are decentralized exchange Uniswap and Blast, an Ethereum layer 2 network that launched on mainnet yesterday. Respectively, they’ve earned $2.5 million and $1.4 million in fees within the last 24 hours, per Etherscan data.

400 fucking dollars to migrate .1 ETH to Blast mainnet.

It's so over.

Pack it up. Ethereum is unusable today. pic.twitter.com/hZRrwRAMlz

— Pop Punk (@PopPunkOnChain) February 29, 2024

The high transaction fees once again draw attention to Ethereum’s scaling challenges and how difficult it can be to onboard new users to the network during times of increased interest.

Ethereum is not blind to these issues, which continue to reoccur in bull market cycles. Ethereum has an ambitious multi-year roadmap to reduce transaction fees, increase security, and future proof the network.

Read more:

“Ethereum is trying to learn from this mistake of pricing away marginal users to other, cheaper chains,” said Luke Nolan, Ethereum research associate at digital asset investment manager CoinShares. “The proposed and implemented solution is to scale through layer 2 solutions, mostly rollups.”

Two key upgrades from the roadmap have already been implemented including “The Merge,” which was Ethereum’s transition to the proof-of-stake consensus mechanism, and the “Shapella” upgrade, which enabled the release of staked ether withdrawals. The next major upgrade is Dencun, which is scheduled for March 13.

Read more:

One of the key introductions in the Dencun upgrade is a new transaction type called “blobs.” Ethereum layer 2 rollups currently post data to Ethereum using calldata. This is costly and makes up around 90% of the gas fees that rollups pay to post bundled transactions to the network. After Dencun, layer 2s will post the data to blobs, which are highly optimized and are much cheaper than calldata.

“Overall, yes fees will reduce on Ethereum, but only for layer 2s,” Nolan said. “The general hope here is that layer 2s will become sophisticated enough over time, with seamless UX, high speed and low transaction costs … In this end state, Ethereum can compete with any new fast chain that comes out of the box because layer 1 continues to be the secure settlement layer, and layer 2 becomes the data availability layer that allows it all to scale to new heights.”

Under the upgrade, transaction fees on layer 2s will decrease between 10 to 100 times depending on the chain, said Nolan, adding that it could get very close to “Solana-esque transaction fees.”

Solana’s Surge

This fee reduction couldn’t come soon enough for many users. Many Ethereum users, particularly those who trade NFTs, are talking about moving to Solana, which is a layer 1 blockchain that offers much cheaper transaction fees.

It costs 52 dollars to purchase a standard ERC-721 off Blur right now.

It costs another 20-30 dollars per marketplace you want to list that NFT on.

and that's with gwei relatively low (70) by bull market standards

ETH does not make sense for the majority of NFT collections.

— root 🔺 (@rootslashbin) February 27, 2024

The average transaction costs for NFTs on Ethereum is around $140, per Etherscan, which is sometimes more than the cost of the actual NFT being traded. While on Solana, the average cost of a transaction is 0.000036 SOL, which is $0.0047, according to data from Solscan.

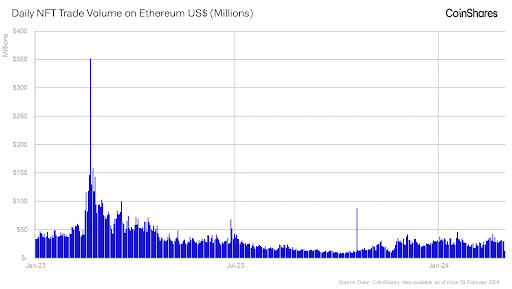

“As of the last few months, a lot of attention has shifted to Solana NFTs, which has certainly taken some of Ethereum’s market share,” said Nolan, adding that Ethereum NFT trading is not back to the same transaction volume levels as last year.

Most activity on Ethereum is centering around collections with high floor prices such as Bored Ape Yacht Club and Moonbirds, Nolan said. They have floor prices of $75,000 and $4,000 respectively. In these scenarios, a trader is unlikely to be phased by a $100 transaction fee.

Daily NFT trade volume on Ethereum in millions (CoinShares)

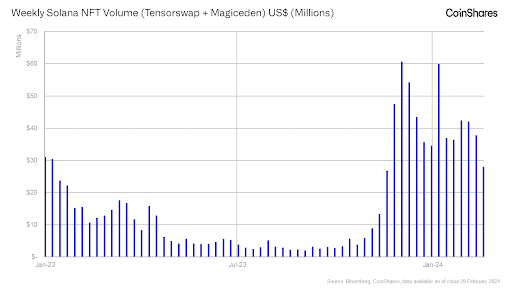

“Whilst on Solana I would venture to say that the activity for smaller collections (as well as big ones) has been picking up because transaction fees are 100x smaller on average and so the smaller value accounts have logically flocked over there,” Nolan said. “It has made for a much more enjoyable speculative playground for participants.”

Weekly NFT volume on Solana in millions (CoinShares)

This is echoed by Anastasia Melachrinos, a DeFi product manager at crypto data firm Kaiko, who notes that new users are generally entering the blockchain ecosystem through centralized exchanges or directly via Solana.

“It is without a doubt that high throughput upgradeable chains like Aptos or Solana will receive most of the non crypto native traffic, which is most of the world in the case mass adoption does take place,” said Sharvin Baindur, chief of staff at investment firm Saison Capital, who focuses on investing and supporting high performance and low cost blockchains.

Even if gas fees on layer 2s are reduced to Solana levels, Nolan notes that Ethereum layer 2s still face challenges around fragmentation and poor user experiences, which can act as a barrier to capturing those smaller value transactions. On the flip side, Ethereum and layer 2s have a strong reputation and a very complete ecosystem, so once the execution cost is fixed the barriers to entry to those chains will be lowered, Melachrinos said.