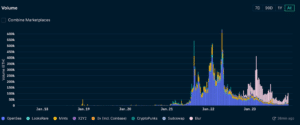

Non-fungible tokens (NFTs) on the Ethereum blockchain are resurging, hitting their highest trading activity across all marketplaces in six months, following a recent two-year low.

Total NFT trading volume for the week ending on Monday, Dec. 4 exceeded 105,000 ETH, a more than 250% increase since the week ending on Oct. 9, Nansen data shows. A local trough in early October saw the lowest recorded level since July 2021, right before the first explosion in NFT trading.

These trends may be indicating an end to NFT winter.

The boom since October suggests that the “market basically agrees that NFTs bottomed,” blockchain analytics firm Parsec CEO Will Sheehan wrote to Unchained on Telegram. “The Punks rally was equivalent to a BTC rally for the NFT market. Now you see pockets of net buying in NFTs, Pudgies the most notable, but in general liquidity and attention in NFTs has inflected,” said Sheehan.

The surge in NFT trading coincides with ETH rising to around $2,200, a price point that hasn’t been seen since May 2022. “Much of the spike in NFT trading volume has to do with the price movement of ETH,” wrote Cameron Thompson, community manager and editor for NFT gallery Tonic, in an email to Unchained. “ETH’s 20% increase in the past month has not only driven the buying and selling of NFTs, but has also reinforced positive sentiments around tokenized collectibles — sentiments that have not been felt among the Web3 community in many months.”

The majority of NFT trading volume these days takes place on Blur, the leading marketplace tailored for high-frequency traders, which launched in October 2022, with former market leader OpenSea coming in second.

Renewed Interest and General Appeal Outside the Crypto Ecosystem

Carlos Mercado, a data scientist at blockchain analytics firm Flipside Crypto, expressed two noteworthy reasons for the increased trading volumes for NFTs. The first is renewed interest in “meme” NFTs, like Pixelmon and Milady. “These often serve as proxies for leveraged ETH, so as ETH rises the store of value narrative rises,” Mercado wrote to Unchained via Telegram. In the past 30 days, the floor prices of Pixelmon and Milady have increased 210% and 48%, respectively, per CoinGecko.

The second, wrote Mercado, is the “noticeable success (led by Nouns & Pudgy Penguins) in breaking out of crypto into the broader culture.” In September, Pudgy Penguins debuted its toy collection across 2,000 Walmart stores in the United States. OpenSea’s Pudgy Penguins page showed that in the past 30 days, volume increased 114% to 15,770 ETH, while its number of sales jumped 58% to 2,267 and floor price grew 83% to 9.7 ETH.

Data from blockchain analytics firm Nansen shows that Blur’s lending smart contract holds the most Pudgy Penguins, with 477 NFTs, a roughly 9% increase in the past 24 hours. The second biggest holder of Pudgy Penguins is a smart contract associated with Flooring Protocol, which fractionalizes NFTs to lower barriers to entry for new participants.

Pseudonymous Blur co-founder Pacman did not return a request for comment as of press time.